VICI

I'm still long on Las Vegas

I’m back to talking about REITs again, specifically VICI Properties (VICI). If you don’t know what a REIT is, here is an overview:

I have written about REITs in the past, and overall, my sentiment has been that I completely love the idea of a REIT. In my mind, a REIT is one of the ideal types of investments; it’s simple and, overall, a category that doesn’t lend itself to wild speculation by investors. REITs are for grown-ups, not children. Many people express a desire to rent out property if they could afford to. I have relatives that are landlords, and the reality of it doesn’t interest me at all. I heard about a time where a tenant set a hot tea kettle directly onto the carpet, melting a giant circle into it. Another time, a tenant used quarter-inch nails to hang all of their pictures. There is a lot of bullshit that comes along with being a landlord. REITs have all the benefits of being a landlord without any of the bullshit.

One sticking point that gets in the way is that probably 98% of REITs have this obnoxious habit of constantly issuing new stock over and over again. Previously, I wrote this off as bad behavior, and it still isn’t something I’m fond of. But it has been bothering me that this has kept me out of REITs. Recently, I went looking for the rationale as to why someone would be thrilled that their ownership stake is constantly being diluted. As far as I can tell, the logic is that as long as the stock issuance is accretive and results in a higher dividend, investors find it acceptable. Sort of like, “I don’t care that my piece of the pie is smaller since it is more valuable.” The other part of the reasoning is that since REITs have to pay out so much of their earnings, it makes issuing stock all the more enticing. No loan payments need to be made, and it eliminates the strain on already narrow retained earnings.

Given this rational argument for a behavior that I otherwise despise, I have decided to give it a shot. Previously, I was invested in MGM. Given the recent decline in tourist traffic to Las Vegas and the fact that I gained 20% in MGM in a few short months, I thought I would switch my money to VICI, a more stable and less volatile investment in the exact same place.

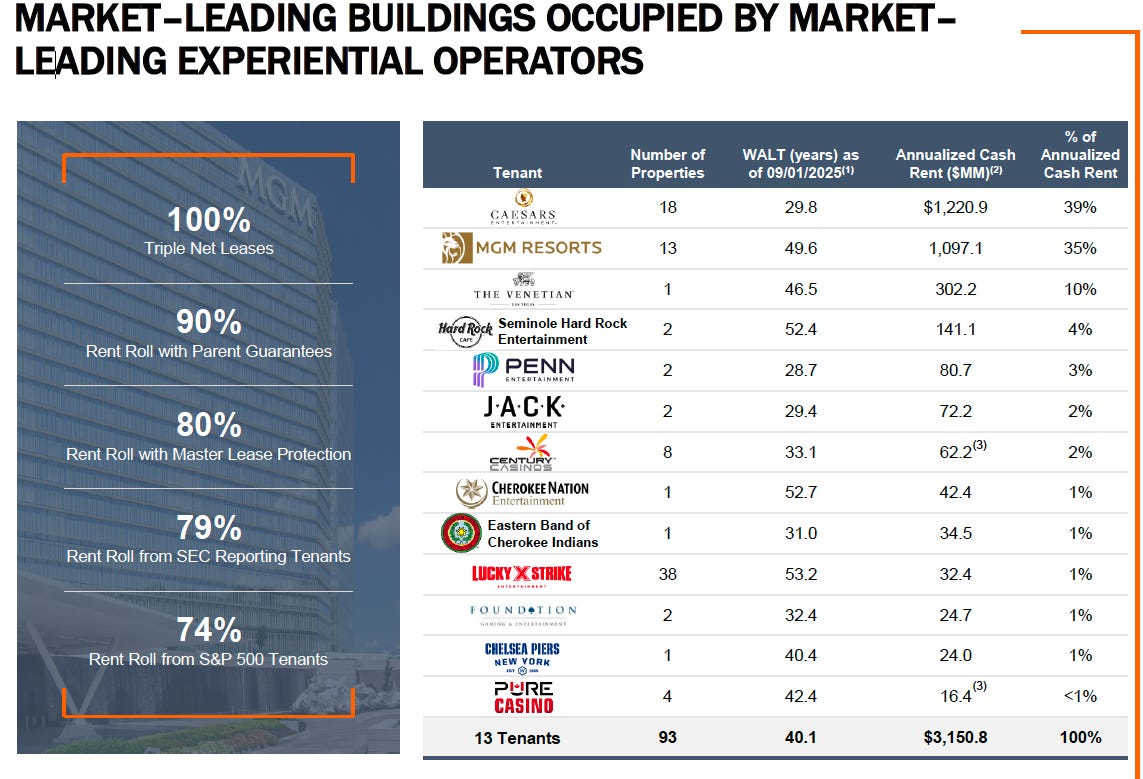

Let’s first get into who VICI is and what they do. VICI is an equity REIT, as described in the video above. More specifically, however, they are involved in the triple net lease of gaming, resort, and other entertainment properties. A triple net lease (NNN) is where the landlord doesn’t pay for anything. The landlord doesn’t pay property tax, maintenance of buildings, or utilities. Nothing. Literally, every single cost falls on the tenant. But on the flip side, the tenant can do essentially whatever they want with the property. In that sense, a triple net lease can be a win-win for both landlord and tenant. As an investor in VICI, it is quite nice because all VICI has to do is sit back and collect rent. VICI owns the properties of a large number of casinos. Is tourist traffic to Las Vegas decreasing? That’s a problem for Caesars and MGM, not VICI. The casino operators still have to pay their rent.

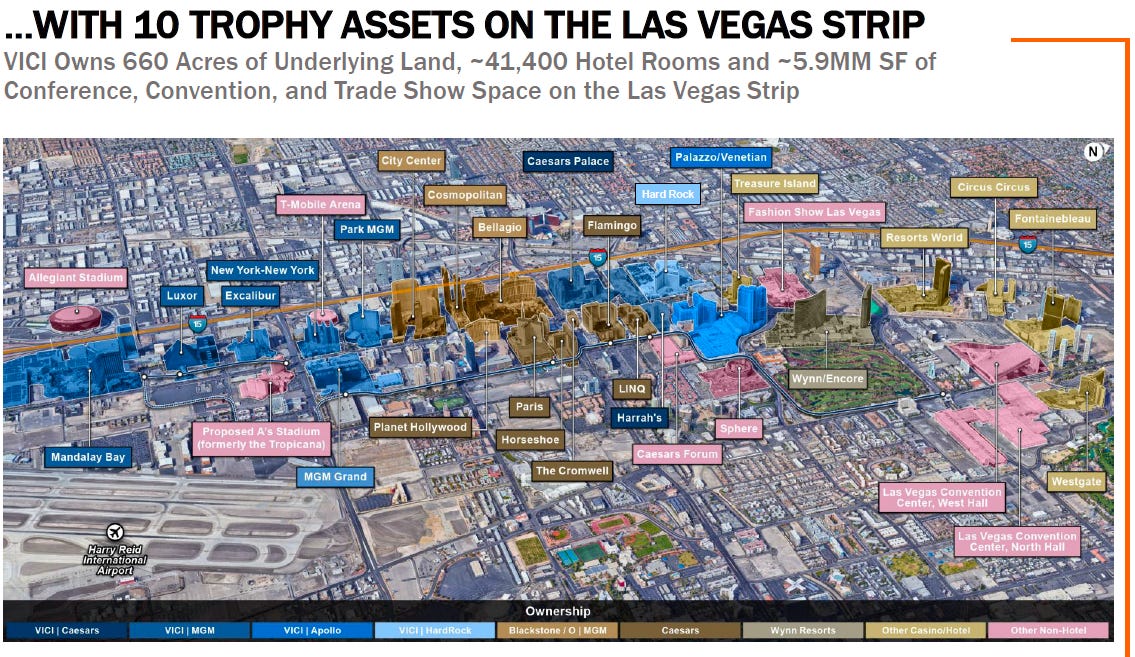

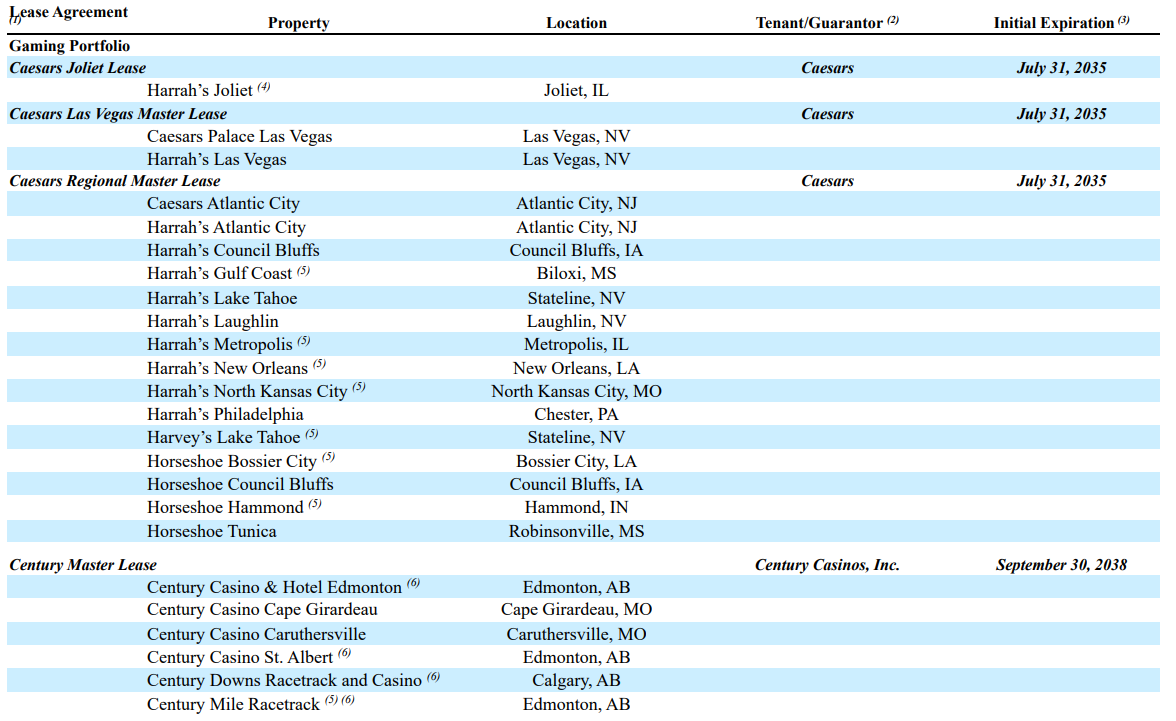

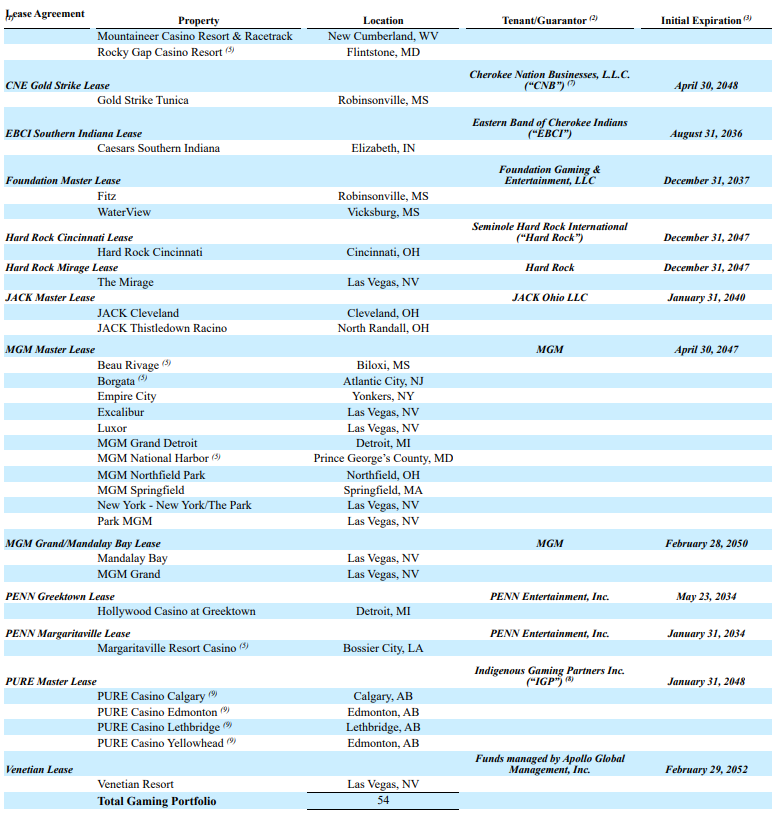

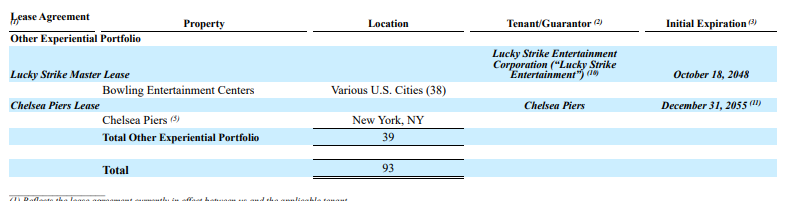

VICI investors presentation 9/4/25

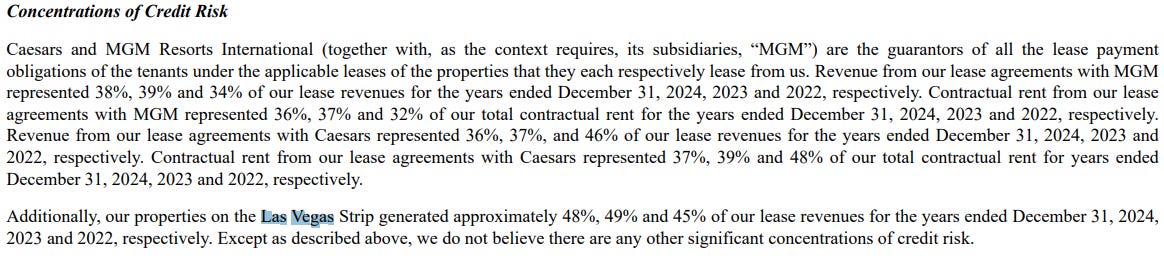

As you can see, VICI-owned properties appear in various shades of blue. They control a substantial amount of real estate on the Las Vegas Strip, and 74% of their revenue comes from MGM and Caesars properties. It is important to note that VICI has properties that extend beyond the Las Vegas Strip. They have NNN leases on 31 MGM and Caesars properties, many of which are not located on the Las Vegas Strip. I’m fine with this concentration for the same reason I was fine with investing in MGM.

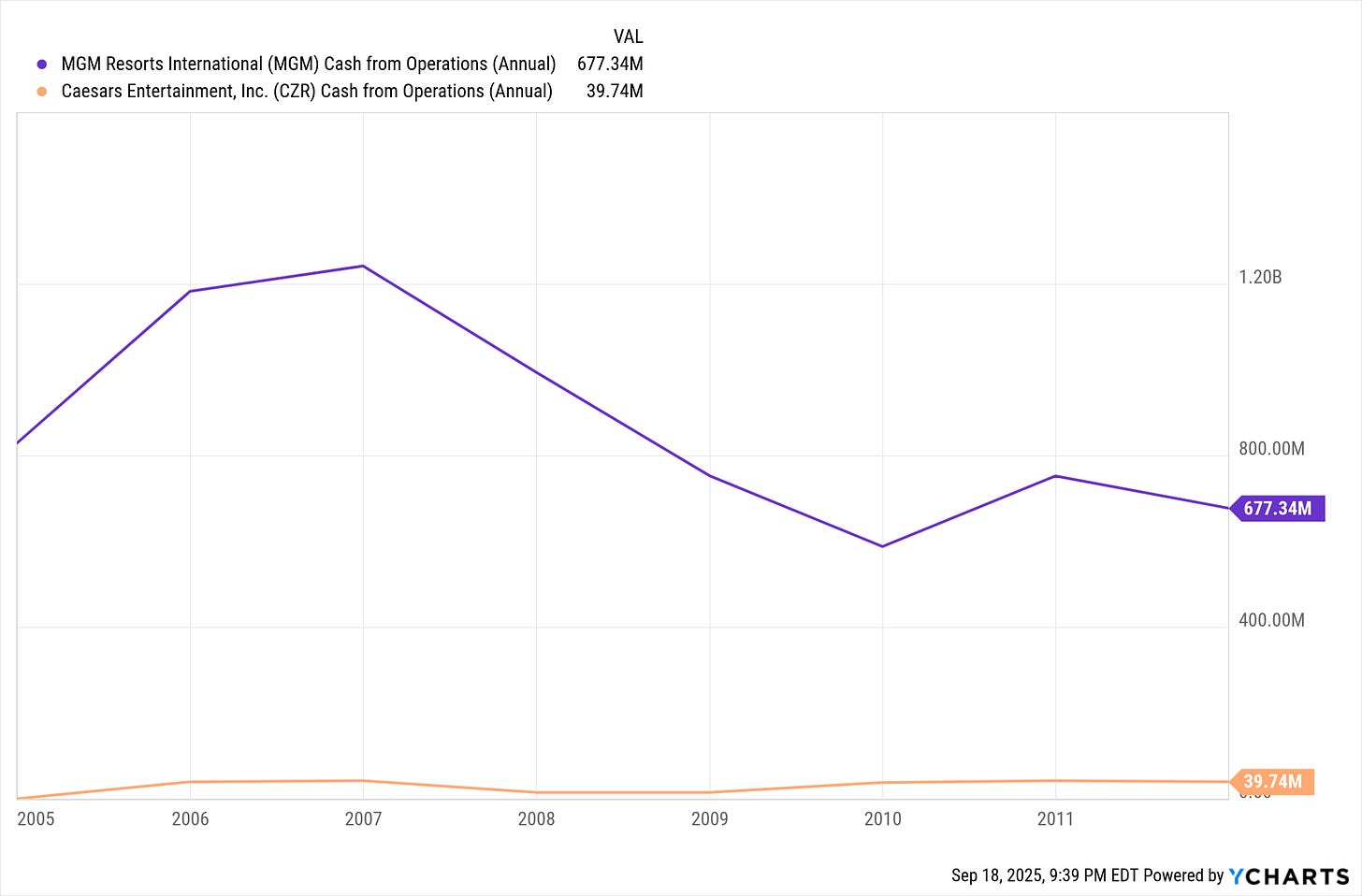

Cash from operations during the Global Financial Crisis:

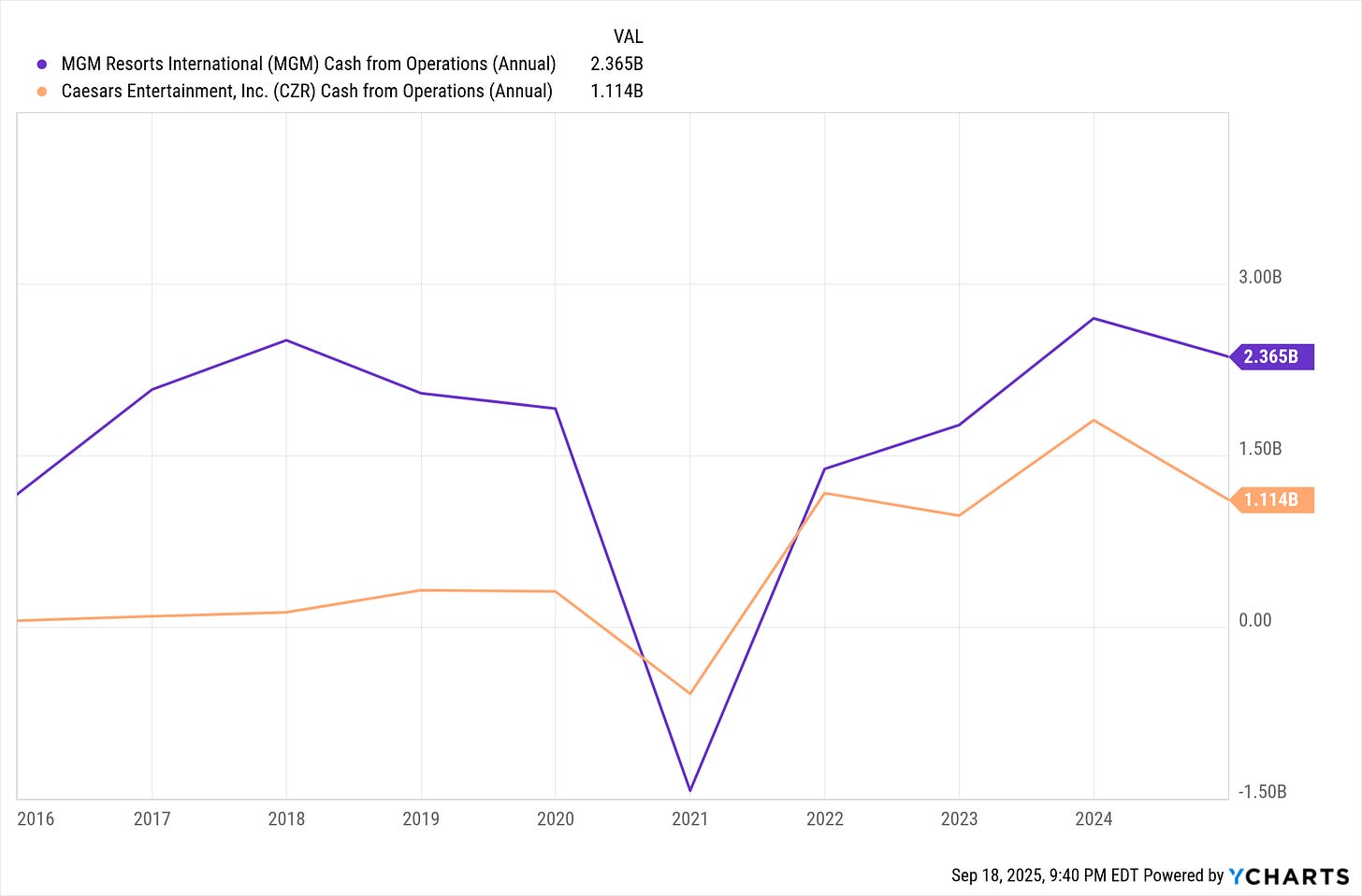

Cash from operations over the last ten years:

An atom bomb can detonate and people will keep gambling. The casinos might experience a blow, but they have always been able to pay their mortgages and rent, which is the extent of VICI’s risk exposure. The only serious danger came when the federal government forcibly closed large parts of the American economy because a flu was going around. It is also important to note that VICI has rent escalation clauses in their leases that increase rents at the pace of inflation.

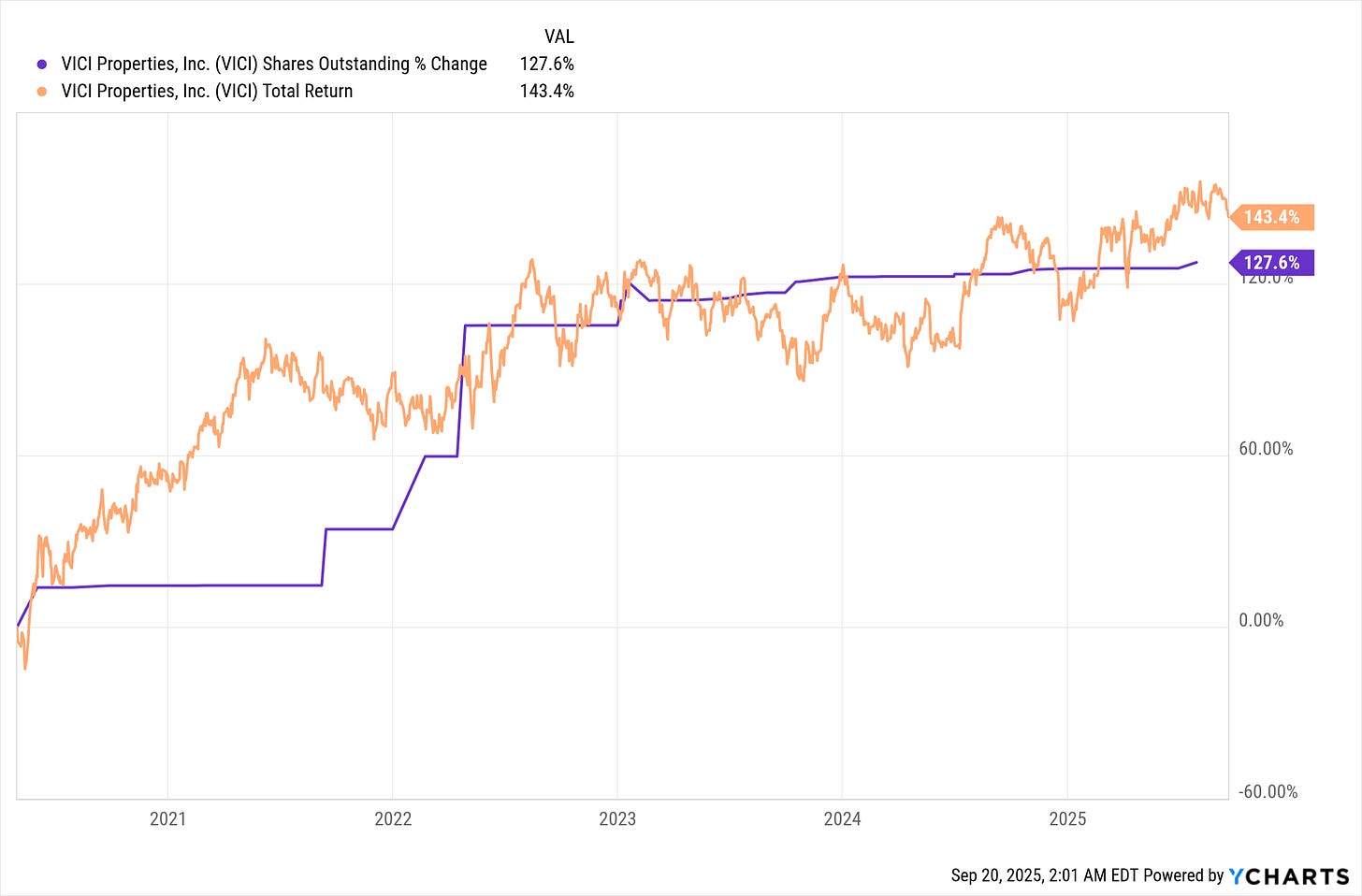

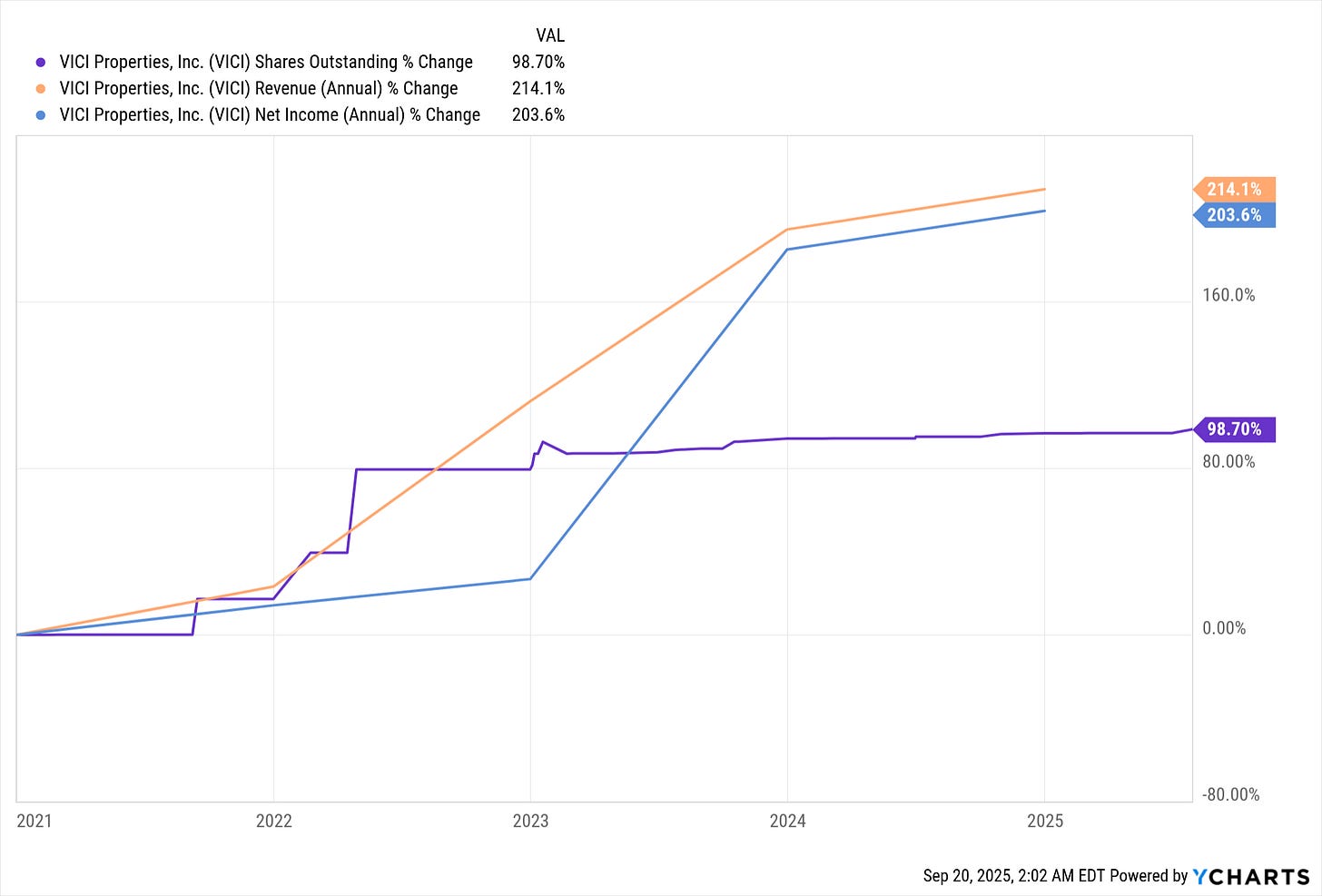

I’ve described what REITs are, what type of REIT VICI is, and their real estate portfolio. But now for the main question, was VICI’s issuance of new stock accretive for shareholders?

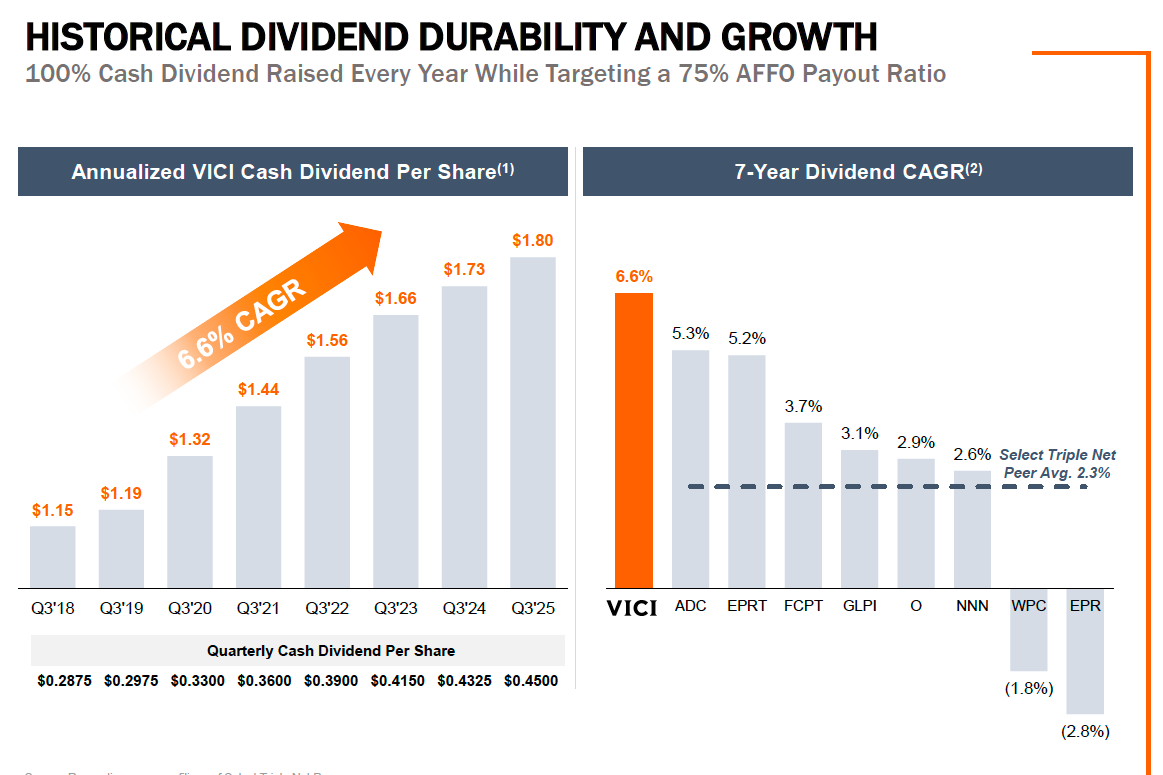

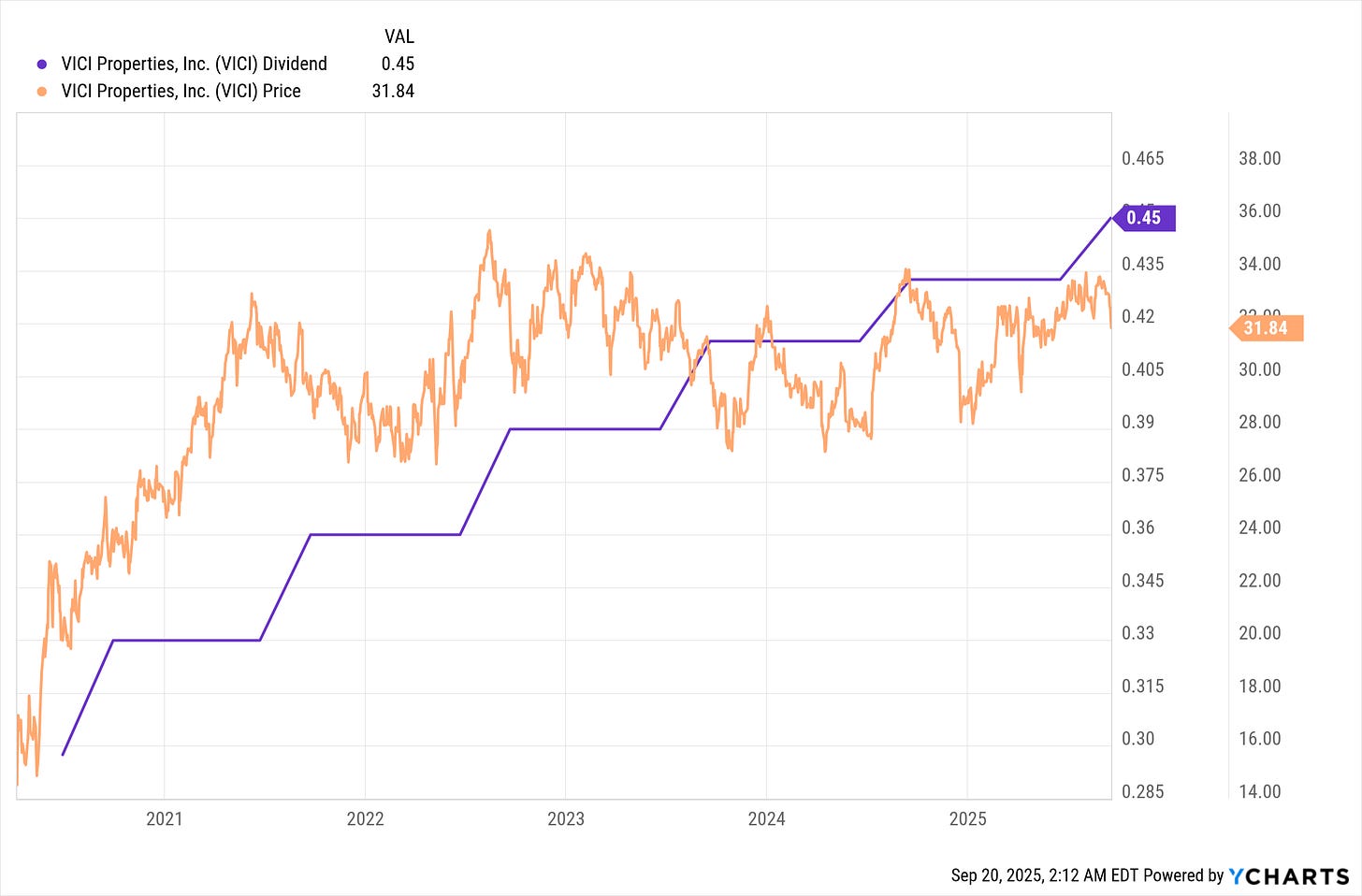

I think it is safe to say that VICI’s issuance of new stock has been a net positive for shareholders. Total return includes both share price increases and dividends issued, and it has been going up in tandem with shares issued. Increases in revenue and net income have vastly outpaced the increase in shares.

It is also important to note that dividend growth is the hero of this story, since VICI’s share price has been trading sideways since 2022.

Since we’re talking about a REIT, I thought it would be valuable to show precisely which pieces of real estate VICI owns, as well as to highlight the point that many MGM and Caesars properties that VICI owns are not located in Las Vegas.

That being said, nearly half of VICI’s lease revenue comes from Las Vegas. I didn’t find much that I would consider noteworthy in the 10-K. No smoking gun, just a lot of business as usual.

Currently, I’m beating the S&P 500 by 13% YTD, and I'm proud to say I've done it by being careful, not going all in on tech. I rotated out some of my investments: MGM became VICI, and SPG and MAS became OKE and PFBC. I’ve been busy lately, so it is going to take me some time to get around to writing about OKE and PFBC. To recap, I moved 65% of my money into bonds a couple of months before the market took a dive over tariff fears. Thus, I was able to buy in at the bottom of the market, having avoided much of the pain. My point is that my success came from being careful, and I intend to remain careful. In the case of MGM and VICI, I kept my exposure to gambling and leisure, particularly in Las Vegas, but I transitioned to a less volatile investment.

I have noticed reports and news stories coming around to the idea that the stock market isn’t just overheated but is in a bubble. This has been my opinion for the last couple of years. So, be careful.

Okay, bye bye now.

My Portfolio:

MITSY, META, ADBE, JPM, COF, VICI, OKE, PFBC

*I think it is worth stating that just because I hold a stock doesn’t mean I think it’s a good idea to buy it right now. Also, this only includes the stocks I own.

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.