It’s not every day a corporate CEO is downright assassinated. The murder of United Healthcare’s CEO has caused a dive in the share price. Since I don’t have any hot stock picks to talk about at the moment, I thought I would dig into United Healthcare’s financials. There is also a lot of bad blood on social media stemming from UNH having the highest claims denial rate in the country. So, how profitable is this corporation—so evil that its CEO must be murdered? Also, being a stone-cold capitalist, does the CEO’s murder and drop in share price create a great buying opportunity for the stock? It’s not often one can literally profit off a murder, after all. Did the shooter buy puts on UNH’s stock before the killing? Only time will tell…

By revenue, UNH is the largest health insurance company in the United States. It is also important to note that, under the Affordable Care Act, UNH would be required to pay out between 80% and 85% of its revenue in fulfilling patient claims and providing services to patients. I figure that’s a good starting point—if these dudes are diabolical, they’ll have their profit margin as close to the allowed amount as possible. There could also be other ways to make up for this restriction by having revenue sources other than insurance premiums. I will have to look into that as well.

At a glance, it doesn’t look great. As of this writing, UNH’s operating margin TTM is 7.04%. That isn’t a very great margin—Apple’s operating margin TTM is 31%. Normally, this is where people get all incensed and say comparing healthcare to smartphones isn’t exactly fair. One is a necessity, and the other is a luxury. I suppose there is a point there. Looking at Costco, we find an operating margin of 3.65%. Retail margins are notoriously razor-thin.

Anyhow, I think anyone who sees an operating margin double Costco’s and gets angry is probably someone who subscribes to the idea that profit as a concept is immoral. I wouldn’t expect them to be reading this anyway. I assume my audience consists of capitalists. I don’t see a 7% operating margin as unreasonable in any industry, no matter the product.

I also want to point out that I am using operating margin, not profit margin, which would be an even smaller number. Since I am trying to hone in on the margin UNH is making after it pays out claims—not after it pays taxes and other expenses—UNH’s actual profit margin for 2023 is 6%. This isn’t a level of greed that makes me think a man deserves to be murdered. But this isn’t a political Substack—you’re not here for that. I’ll get into more specifics on their margins later on.

Let’s continue to evaluate UNH as an investment and then get into the 10-K to take a closer look at income and cash flow to see if we can get a better idea. But now, to the charts!

Can we profit from this murder?

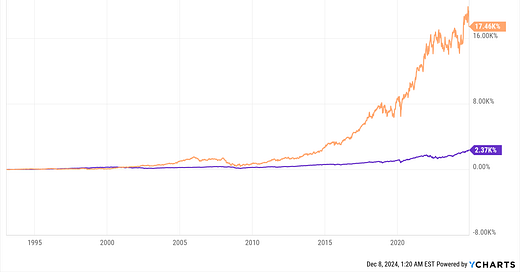

UNH vs. The S&P 500 as far back as I have data:

UNH vs. The S&P 500 in the last ten years:

UNH vs. The S&P 500 in the last five years:

UNH vs. The S&P 500 in the three years:

UNH vs. The S&P 500 over the last year:

Cash from Operations and Free Cash Flow:

Disappointingly share buybacks aren’t much of a thing:

Now, I can’t hold it against a company for failing to beat the S&P 500 over the last year. The S&P 500 gaining 34% in a year is insane and proof that we are in a bubble. Both Goldman Sachs and Bank of America are predicting very minimal growth of the S&P 500 index over the next decade due to how high valuations currently are. A lot of future growth is already priced in.

So far, UNH doesn’t look like a horrible investment. They have had a tremendous amount of earnings growth that has spurred their total return. The total lack of meaningful share buybacks is off-putting to me, however. Absent revenue growth, this stock will trade sideways. Also, we can clearly see how the CEO getting whacked has caused a huge drop in the share price.

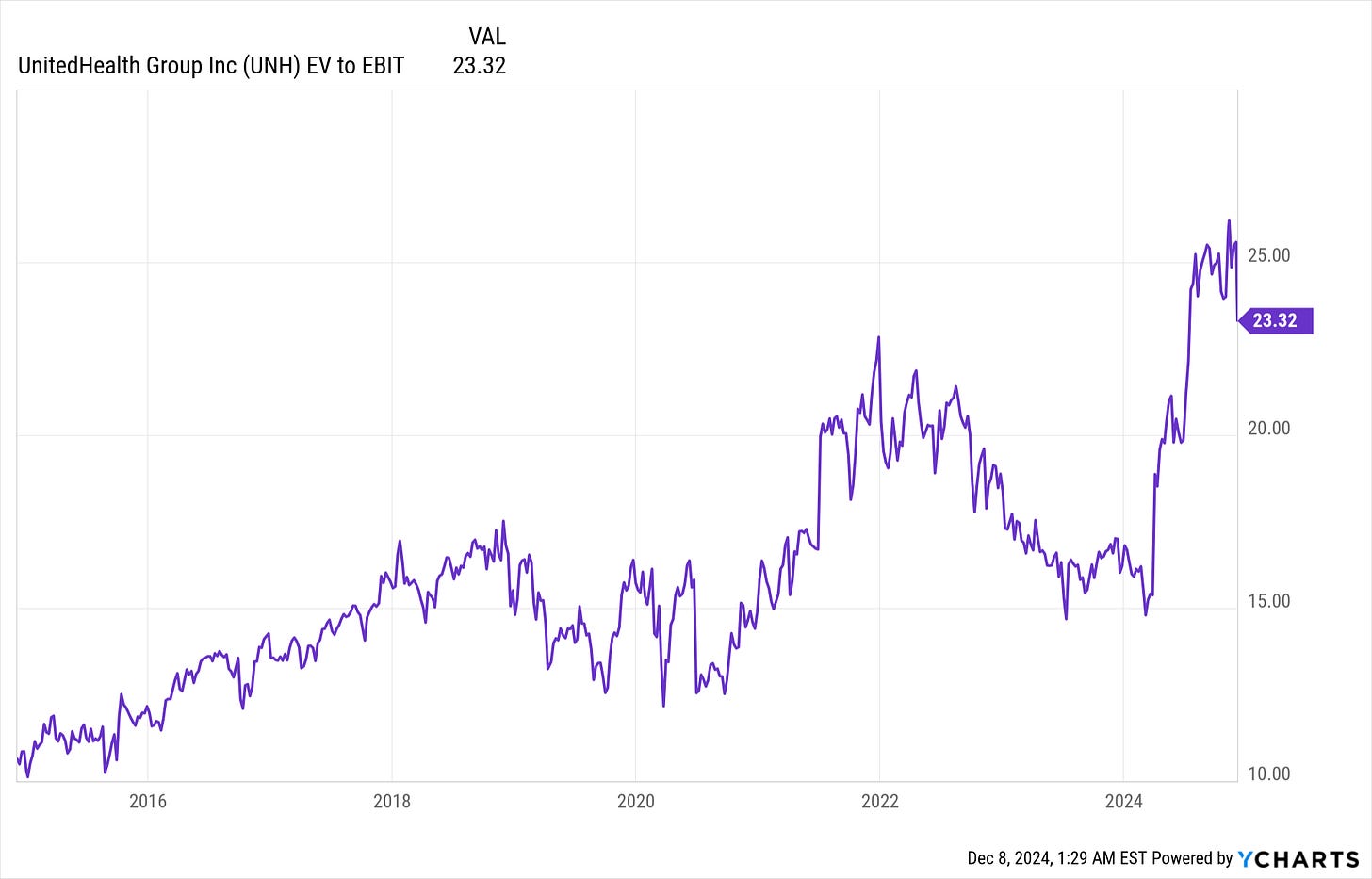

Let’s take a gander at valuation:

10 Year PE History:

10 Year EV to EBIT:

The valuation here is quite high and is based entirely on earnings growth. The larger a company gets, the less I like this as the reason to invest. It is a matter of common sense that the larger a corporation gets, the harder it is to double in size. Revenue growth is inherently logarithmic.

Now let’s get into the 10-K and more about the nature of UNH’s business. Federal law pushes health insurance companies to become healthcare conglomerates. As previously mentioned, the Affordable Care Act (ACA) includes a provision called the Medical Loss Ratio (MLR) rule, which indirectly caps insurance companies' earnings. This rule requires insurance companies to spend a certain percentage of premium dollars on medical care and quality improvement activities rather than administrative costs, marketing, or profits. If a health insurance company wants a wider margin, it has to expand into other parts of the healthcare industry, such as operating retail pharmacies, health clinics, hospitals, and primary care practices.

In a critique of UNH having the highest claim denial rate, people on social media pointed out that Kaiser has the lowest denial rate. This is the debate equivalent of walking into a sliding glass door. Kaiser is overwhelmingly an HMO. HMOs control costs by tightly controlling their provider network and dictating how, when, and what medical services are provided. Claims aren’t getting denied because HMO doctors aren’t submitting them—the doctor is telling the patient no, not the claims department. The HMO’s doctors already know what box they are painted into since they are Kaiser employees.

Anyway, this is the model that federal law pushes insurance companies toward. This is evident in the vertical integration of UNH and CVS, which owns Aetna. Cigna also merged with Express Scripts. This is the driving force of industry consolidation.

I mention this because when I dig into the 10-K, this is what I am looking for: How is vertical integration a factor in UNH’s business? How much money comes from the non-core business? Also, just to satisfy my own curiosity, what is the precise amount UNH is making off insurance claims?

Lets dig into it:

Remember I refer to the page number on the page itself, not the PDF reader.

Page 1: Four reportable business segments Optum Health, Optum Insight, Optum Rx, UnitedHealthcare. In the interest of saving time lets just quote the 10-k:

“Optum Health delivers primary, specialty, surgical and urgent care; helps patients and providers navigate and address complex, chronic and behavioral health needs; offers post-acute care planning services; and serves consumers and care providers through advanced, on-demand digital health technologies, such as telehealth and remote patient monitoring, and innovative health care financial services.”

“Optum Insight connects the health care system with services, analytics and platforms that make clinical, administrative and financial processes simpler and more efficient for all participants in the health care system.”

“Optum Rx provides a full spectrum of pharmacy care services through its network of more than 65,000 retail pharmacies, through home delivery, specialty and community health pharmacies, the provision of in-home and community-based infusion services and through rare disease and gene therapy support services.”

As for the UnitedHealthcare segment, well that is the insurance business. Moving on…

Page 38 - Balance Sheet

Do these guys have float? That doesn’t jump out at me.

What is with $103 billion in goodwill? Seems high. Are they just documenting the value of insurance contracts they have signed?

Page 39 - Consolidated Statement of Operations

$371.6 billion in total revenue, $290.8 billion of which comes from premiums. They are still very much an insurance company despite everything else they do.

Ah! $4 billion in investment and other income, so they do have float, but not much of it.

Okay, here we go—the specifics: $241.9 billion in medical costs. So, if their maximum possible margin on insurance premiums is 20%–25%, UNH is earning 16.8%, and that’s before expenses. This is why their operating margin is much lower.

Page 42 - Statement of Cash Flows

Repurchases of common stock are increasing, which is encouraging.

While equity is still rising, they are accumulating new debt much faster than they are repaying it.

In 2023, 2022, and 2021 combined, UNH did $36 billion in acquisitions, which would explain the rising debt. What have they been buying?

The 10-K is strangely tight-lipped about what their acquisitions have been. The best mention is on page 31, where a $6 billion acquisition in 2024 is noted, but that’s it. Zero detail. I bet if I searched through their press releases, I could figure out what they’ve been buying, but I don’t like that they are making it difficult. I have read hundreds of 10-Ks, and companies usually give very detailed accounts of other companies they have acquired, going back years. It strikes me as suspicious when a company doesn’t provide a detailed list. The shareholders own the company. Shouldn’t they be transparent about what they’re spending shareholders’ money on?

The last unanswered question was goodwill, and on page 42, they are equally unhelpful. Now, UNH probably isn’t going bankrupt anytime soon, but in the past, I have intentionally made investments in companies that were going bankrupt and trading for less than their equity. The idea was that, in bankruptcy, the equity gets paid out, and shareholders who bought in at the right time can walk away with bags of cash. This mostly worked, but—you know a funny thing that tends to happen? All those billions on the balance sheet listed as “goodwill” tend to vanish in bankruptcy.

So, I am very curious about what the hell a company means by goodwill. Are these acquisitions? Intellectual property? Does this “goodwill” ever turn into cash? UNH’s 10-K provides zero answers there. Again, my best guess is they are listing the value of their contracts with clients, which isn’t much of an asset in my opinion. If you removed goodwill from the balance sheet, UNH would have negative equity.

So, what’s my verdict here? I’m not going to bother with the 7 powers because, for me, this is a no. This isn’t the worst investment in the world. UNH certainly has a moat. But I don’t like negative equity, I don’t like the lack of buybacks from a mature business, and I don’t like the general lack of transparency in the 10-K. Warren Buffett once compared investing to a game of baseball where they only call strikes if you swing. A player can just stand there holding the bat, waiting for the perfect pitch to come in and hit a home run. While the CEO’s murder has provided an enticing drop in the share price, it isn’t a dip that I will be buying.

Also, one final thought: Over the years, I have read the financial statements of hundreds of companies. I don’t see anything here that constitutes a level of greed so high that a man must be murdered. I think the discussion about how to improve the American healthcare system is more complex than simply saying it’s corporate greed.

My Portfolio:

FI, ADP, MCD, AFL, AXR, VLO, ITB, PPA

METC $17 Call 6/20/2025

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.