Berkshire Hathaway is the creation of two investing geniuses, Charlie Munger and Warren Buffett. The company is a conglomerate that operates wholly-owned subsidiaries and holds a non-controlling interest in a large number of other corporations through its stock market portfolio.

https://www.berkshirehathaway.com/subs/sublinks.html

https://www.cnbc.com/berkshire-hathaway-portfolio/

Warren Buffett has a strong cult following who buy up Berkshire stock no matter what is happening in the market and who insist that Berkshire beats the market. This misguided belief of his religious faithful comes from a very elementary-level misreading and misunderstanding of historical price charts.

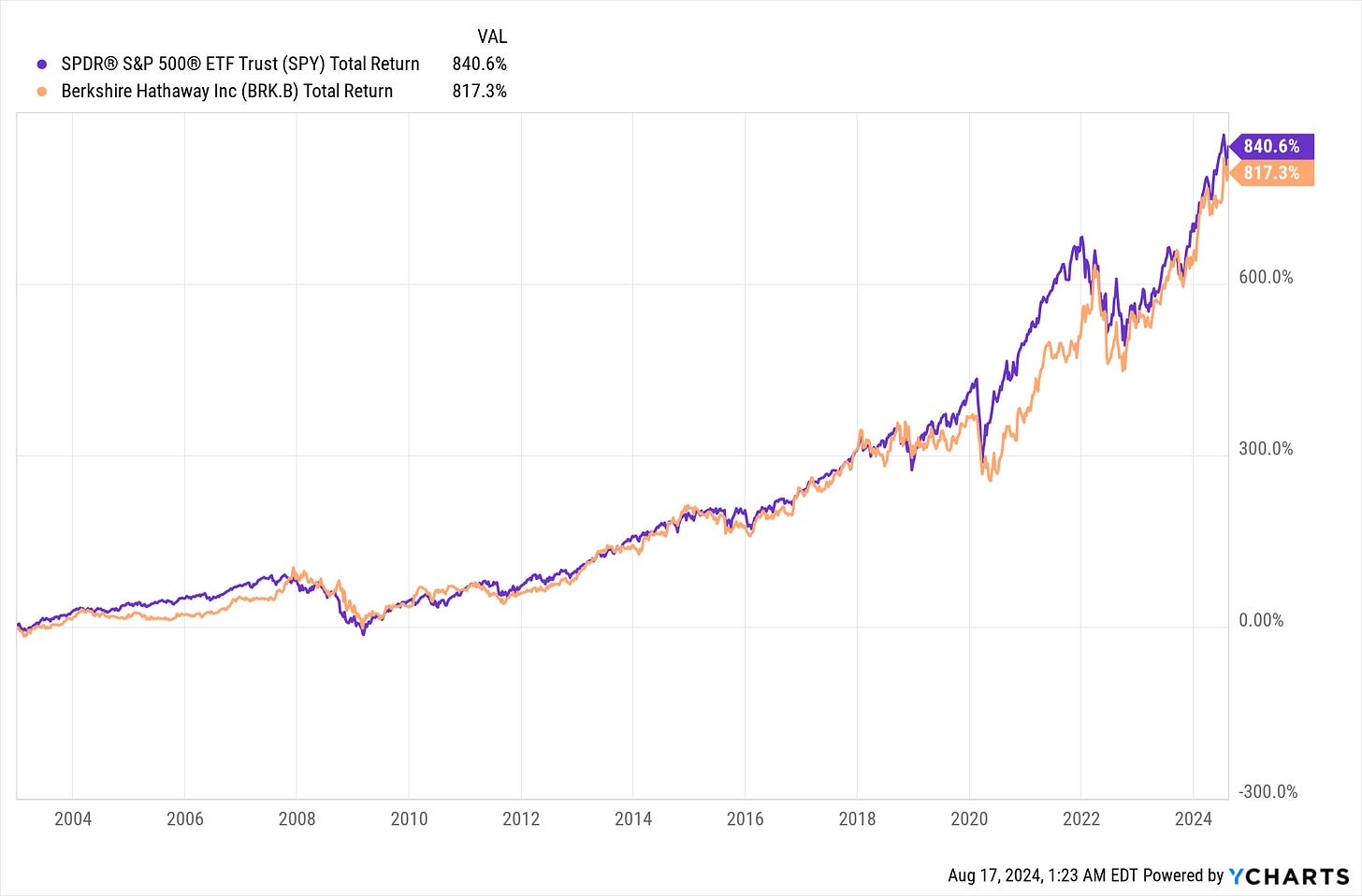

Chart 1 starts in May of 1996, it’s the furthest back that Ycharts would graph historical price data for me. I have found charts in other locations that go further back. Berkshire includes one in its shareholder letters. Needless to say, the further back in time you go, the wider margin Berkshire beats the market by.

I think most people look at this and assume it means that Berkshire has beaten the market for decades and conclude that if they buy and hold Berkshire long-term, they will also beat the market. But that isn’t what the chart shows. The chart shows that if you purchased Berkshire in May of 1996, this would be your return. Except it’s not May 1996 anymore, and it won’t ever be May 1996 again, the chance to lock in this investment return passed decades ago. If you steadily bought Berkshire consistently over the years this would not be your return. This chart reflects the return on a one-time purchase.

Berkshire outperformed since May of 1996 since it didn’t get wiped out in the dot com bubble like the S&P 500 did. Berkshire underperformed during the bubble, of course, but crushed over the long run. This is an important theme to remember about when exactly it is that Berkshire outperforms.

Chart 2:

Now if you purchased Berkshire Hathaway in January of 2003, you got the exact same return as an S&P 500 index fund.

Chart 3:

Now, in January of 2006, the world has entered the sub-prime lending mania, and it was a good time to buy Berkshire Hathaway stock. Berkshire didn’t take that bad of a hit during the global financial crisis. So, buying Berkshire in 2006 would have been a good choice. But only because of impending doom on the horizon that very few people saw coming. Don’t believe me? Watch the movie “The Big Short.” Do you trust your ability to foresee historical events in financial markets?

Chart 4:

Oh no! What happened!?!?! If you bought stock in January of 2008 after the stock market crash, the S&P 500 kicks Berkshire’s ass.

Chart 5:

Every single year from January 2008 to January 2021, Berkshire Hathaway performs on par with the S&P 500 or worse. However, in January 2021 Berkshire Hathaway starts winning again.

Chart 5:

But the window for victory was small by January 2023, the AI tech bubble started and Berkshire is back to merely matching the stock market.

So what was so special about 2021 and 2022 that led to Berkshire's outperformance? It’s recent enough that I don’t think anybody has recognized its significance yet. From about 2015 to 2021 the big trade was the FAANG stocks. Facebook, Amazon, Apple, Netflix, and Google. These companies commanded sky valuations, some had crazy PE’s over 100.

Chart 6:

Well, between January 2021 and January 2023, the bubble was popping and the tech party was over. The darling stocks of the FAANG days were getting wiped out. People would be wise to remember this and the tech bubble of the late 90’s when holding the current Magnificent 7 stocks. Or the S&P 500 currently since 40% of its value is in tech. But buying Berkshire while the bubble was popping was again a great trade to make.

However, in November of 2022, ChatGPT came out and the next bubble started. Or the old bubble resumed depending on how you look at it.

Chart 7:

Here are the same stocks as above since January of 2023.

The reason I chose to nerd out on a Friday night and dig through historical price charts year by year was to demonstrate a few different points:

The cult of Warren Buffett is very real.

Buffett himself has stated that due to Berkshire’s size it will struggle to beat the S&P 500. Since, at this point, it is one of the largest corporations on the index. But for most value investors, this is tantamount to Jesus telling them that he is done performing miracles. Buffett’s faithful just brush it off and keep going.

I have do not dislike Warren Buffett and Charlie Munger. I have read everything either man has ever written. I have learned a tremendous amount from them. They are two of the three biggest figures in value investing. My problem lies with the beliefs and behavior of their groupies.

The historical data clearly shows Berkshire only outperforms the S&P 500 at very specific times that are hard to predict.

Not every downturn in the market means Berkshire will outperform. The COVID crash of 2020 did nothing for Berkshire.

During the global financial crisis, it outperformed if you purchased Berkshire stock before the crash, but Berkshire did horribly if you purchased it after the crash.

In 2021 and 2022, Berkshire only outperformed if you purchased it as the tech bubble was popping.

However, with the tech bubble in the late 90’s Berkshire did the best if it was bought it during the bubble and as it was popping but not after.

There is no consistency or easy rule to follow and if a person is slowly buying Berkshire stock bit by bit overtime they are diluting the effect from when it does outperform guaranteeing a return on par with the overall stock market.

This gets to a core principle: there is no free lunch when investing. You can never turn your brain off and follow a simple rule.

A good idea does not equal a good investment.

Price and when you buy is fundamentally tied to the performance of the investment.

It is generally a bad idea to add to a position in small bits and pieces over time. When you act, it needs to be decisive and

When I gradually add money to my portfolio, it goes into MOAT and SPGP until I see a moment to strike and make one large move into an investment with better prospects. Both MOAT and SPGP track with or outperform the S&P 500. They have a better track record than Berkshire and don’t lean on the genius of Warren Buffett to get the job done.

Everything I just said needs to be constantly reevaluated for its accuracy as time moves on. Who knows, maybe one day in the future, the market will have shapeshifted into something different, and buying stocks in small bits and pieces will be the thing to do. Right now, that’s not the case.

When you’re considering an investment, no investment is good at every point in time. So many value investors eschew any attempt at market timing, and yet it is clearly critical to the success of an investment. I don’t invest in Berkshire since I don’t think I have an edge in spotting when it will outperform. I can certainly spot bubbles, but I can’t say when they’ll pop or what effect that will have on Berkshire's long-term performance. There are too many other quality investments that give much stronger buy and sell signals than the enigma of Berkshire, which gives the same return as the S&P 500 about 99% of the time.

The stock market is a shifting, moving creature that takes different forms. No single business is a great purchase at all times. Quality is half the equation; the other half is timing. That’s why I follow a Value Momentum strategy and I don’t engage in the buy-and-hold forever nonsense.

I’m still chipping away at a post on General Dynamic. I suspect the buying window for Toyota will come and go before I get a chance to write anything substantial about it. Perhaps another takeaway is the importance of paying for access to services like Ycharts if you intend to pick your own stocks, but that is a story for another day.

My Portfolio:

JPM, TMUS, GD, AXP, KR, TM, SPGP, MOAT, ITB.

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.