T-Mobile US Inc (TMUS) is a stock that I used to hold and have been bullish on for a long time. The merger with Sprint and the advent of 5G technology have changed the telecom landscape in a number of ways that I don’t think are fully appreciated yet. Currently trading at a PE of 22, T-Mobile is an interesting prospect. The central part of the thesis here is revenue growth rather than free cash flow and buybacks.

As for T-Mobile’s competition, there is Verizon, AT&T, and Comcast. It is important to note that Comcast’s Xfinity Mobile operates on the Verizon network. Speaking from my experience in the Pacific Northwest, prior to the Sprint merger both Sprint and T-Mobile were fairly useless outside of major cities. AT&T was a bit better in rural areas, but if you lived out in the boondocks or wanted cell phone reception everywhere you went, Verizon was pretty much the only choice. This all began to change with lightning speed in 2020 when the merger with Sprint closed. This also lined up fairly well with the rollout of 5G in the United States that took place in mid to late 2019.

I would encourage you to look at the interactive coverage map and notice how T-Mobile now has vastly more 5G coverage than AT&T and Verizon. You will notice that Verizon and AT&T still have better coverage overall if you include 4G LTE coverage as well. But with T-Mobile, just about everywhere they have coverage, they also have 5G coverage. This creates an interesting opportunity for them to steal market share despite having perhaps the worst overall coverage. It is also worth noting that the mighty have fallen, and it appears that AT&T is even with Verizon in terms of overall coverage.

This is where the difference between 4G LTE and 5G becomes important. 4G LTE download speeds top out at around 100 Mbps, while Sub-6 GHz 5G speeds top out at 400 Mbps, and mmWave 5G tops out at 5 Gbps. For reference, there are a thousand megabits in a gigabit. Mbps = Megabits per second, Gbps = Gigabits per second. The important point to focus on is that 5G allows people, wherever they are, to get internet speeds equal to what they have at home. This now creates the ability for cellular service providers to compete with the likes of Comcast in providing home internet.

Data moves through fiber optic cable at something around 67% the speed of light. In an internet connection, the latency comes from where data is passing through something other than fiber optic cable. For mobile devices, the limiting factor was the connection to cell towers, many of which are connected to fiber optic cable.

Above is an interesting map that lets you look up any address in the country and see which companies offer internet access at that address and at what speed. It’s very interesting how many places in the country still don’t have high-speed internet access. The main reason I mention this is that in more and more places, you see cellular service providers showing up as home internet service providers. I believe, in terms of technology, the cellular service providers have a big edge over the likes of Comcast and other traditional internet service providers (ISPs).

T-Mobile only has to run fiber optic cable to their cell tower and then they can blast out a 5G signal to a large area and offer fixed wireless home internet to everyone in the area. Meanwhile, Comcast and other traditional ISPs have to run cables, either fiber optic or coaxial, directly to each customer’s home. Service through a traditional ISP will be faster and more stable. But with fixed wireless offering speeds of 133 Mbps to 415 Mbps, that is more than enough for the average person’s home internet needs. This touches on a common misconception that people have about internet speeds: faster isn’t faster.

Data moves through fiber optic cable at around 67% the speed of light. Paying for “faster” internet doesn’t make data travel any faster. What you are paying for is extra bandwidth. To use a metaphor, the speed limit on the road isn’t going up—more lanes are being added. There is an elderly couple next door to me who only use the internet to watch shows and movies, as well as access websites through a browser. They pay for gigabit internet, which is entirely unnecessary. It’s the same as having a single car driving down a five-lane freeway by itself. “Faster” internet handles more volume and increases performance by reducing bottlenecks. The reason I mention this is that a person might see 133 Mbps to 415 Mbps and think that because Comcast offers gigabit speeds, it is the superior product. For many people, that just isn’t the case—unless there are a large number of people in a household all streaming at the same time, playing video games, or file sharing. Then a “slower” internet speed would save money and have zero impact on the user experience.

This is a big reason why T-Mobile has my attention. Not only are they fighting for market share with cell phone customers in a way that they never have before—they also can fight for home internet customers as well. That being said, in capitalism everything is a fight. Comcast has Xfinity Mobile, which operates on the Verizon network. Xfinity Mobile also leverages the fact that Comcast routers are everywhere. Comcast routers put out two Wi-Fi signals: one for your home or business needs, and a second separate Wi-Fi signal that any Comcast customer can jump onto. I have Comcast and Xfinity Mobile, I’ll be out and about and notice that my smartphone has jumped onto an Xfinity Wi-Fi signal that I didn’t realize was there. One time I was having a problem with my router and my internet was down, but one of my neighbors also has Comcast and I was able to jump onto an Xfinity Wi-Fi signal.

I say this to paint an accurate picture. T-Mobile has a lot going for it right now. Its cellular coverage is the best that it has ever been. They are the industry leader in 5G service, and they have a newfound ability to expand their business into home internet. All that being said, expect that Verizon and AT&T will continue to fight T-Mobile for market share by offering the same services. Comcast also has unique ways to compete, and traditional ISPs are still the better option for people who use a large amount of bandwidth. But T-Mobile has an edge right now. I was a T-Mobile shareholder in the past, and it was profitable for me. I’m content with my portfolio right now, but T-Mobile is always on my watch list.

Now lets get into the numbers:

T-Mobile vs. S&P 500 as far back as I have data:

T-Mobile vs. S&P 500 over the last ten years:

T-Mobile vs. S&P 500 over the last five years:

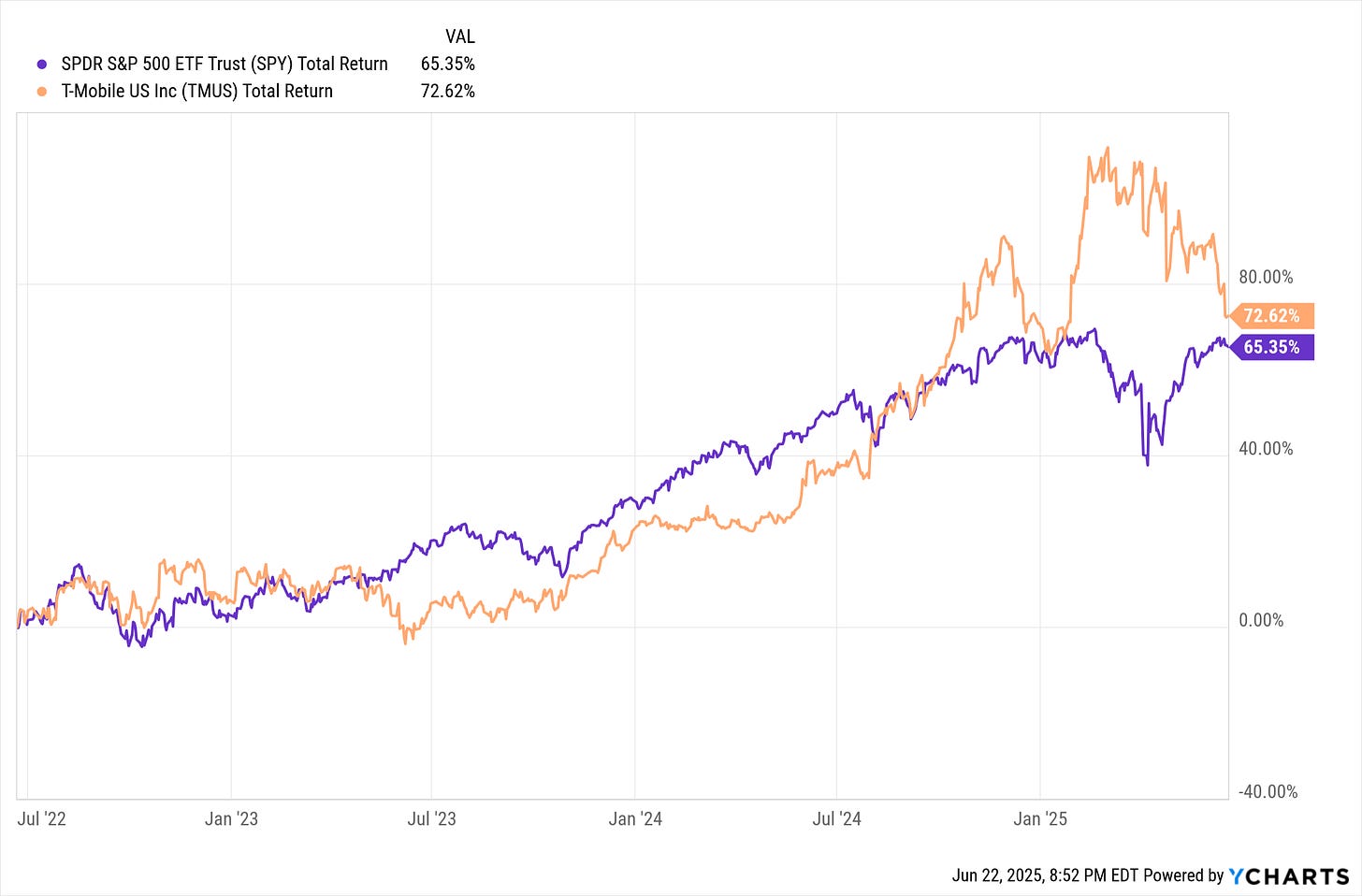

T-Mobile vs. S&P 500 over the last three years:

T-Mobile vs. S&P 500 over the last year:

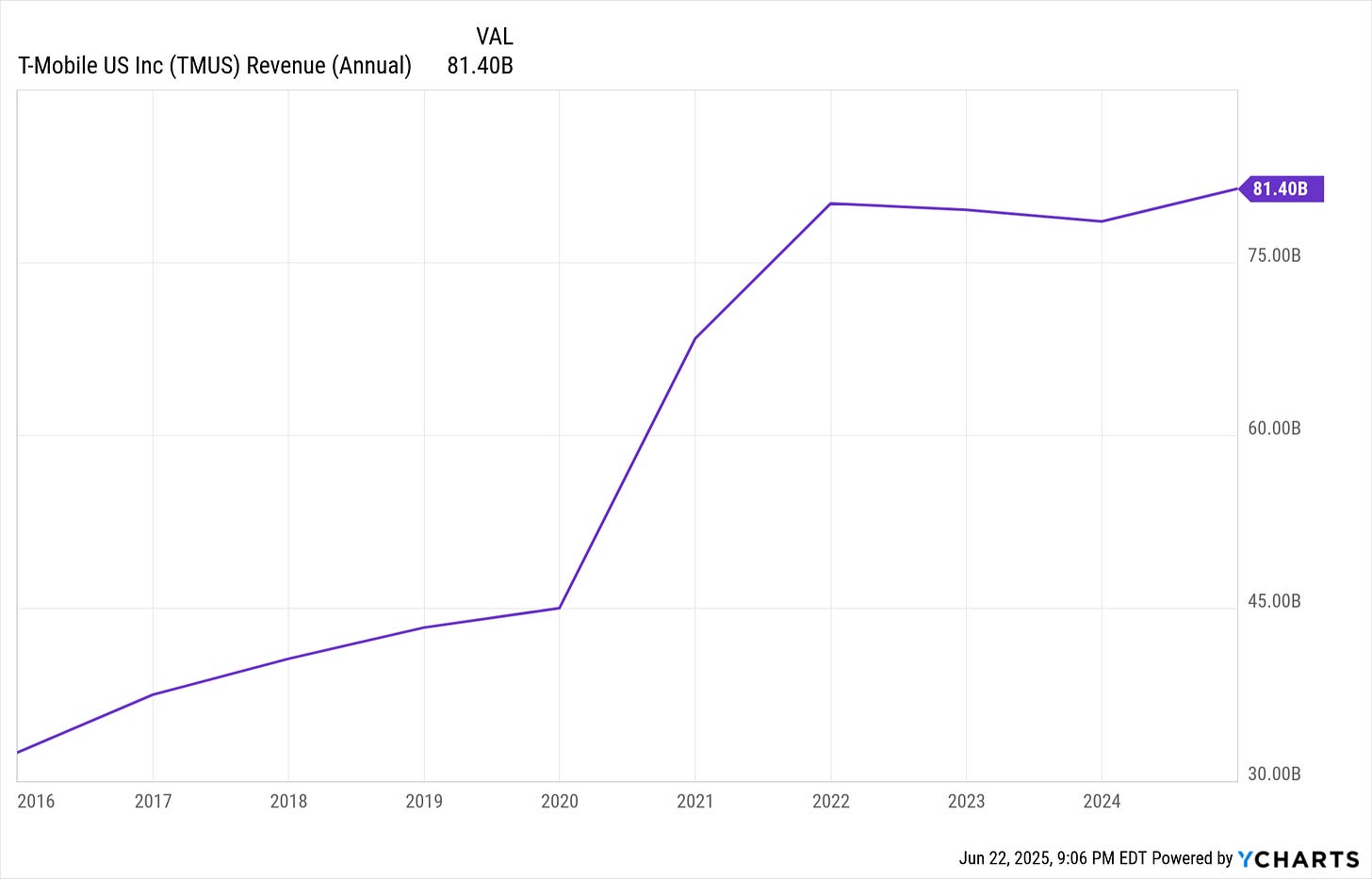

The story surrounding this stock is very compelling. However, the performance is inconsistent. Although, if it were, the stock wouldn’t be trading at it’s current PE. T-Mobile, at times, outperforms the market. There are always three main drivers of outperformance: revenue growth, dividends, and buybacks.

The current dividend yield is 1.59%. Eleven billion dollars in share buybacks sounds nice, but with a market cap of $251 billion, the impact is very mild. Revenue growth has also leveled off in recent years. I just don’t see a catalyst for share price growth currently. There also isn’t a lot of free cash flow to support aggressive buybacks. However, T-Mobile does return a lot of its free cash flow to shareholders.

That being said….

T-Mobile is currently cheap compared to how high its PE has been in the past. The current ratio and the debt-to-equity ratio both point to a well-run company. I see enticing possibilities for T-Mobile to grow and compete with its competitors in ways it hasn’t been able to in the past. However, that growth case isn’t materializing yet. Given that, as a shareholder, the path to profit is through revenue growth—not buybacks or dividends—it would seem logical to sit back and wait until some of that revenue growth starts to materialize.

I’ve noticed that markets are most efficient at responding to revenue growth. It would be very easy to miss out if that growth does arrive. While individual investors are going about their lives, Wall Street analysts aren’t just listening to the earnings calls—they get to participate and ask questions. We don’t. I mention this to say that if one is very confident in the growth case for T-Mobile, now would be a decent time to buy. However, that is a definite risk, since if the growth doesn’t arrive or takes too long to arrive, this could turn into an underperforming investment.

For me personally, T-Mobile is staying on my watchlist. It is a very intriguing stock.

Okay, bye bye now.

My Portfolio:

MCD, MITSY, AFL, META, JPM, MGM, SPG, COF

*I think it is worth stating that just because I hold a stock doesn’t mean I think it’s a good idea to buy it right now.

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.