I wrote about Simon Property Group (SPG) a while back, although the post was fairly brief since I wasn’t buying stock at the time. I was more so just explaining why SPG is permanently on my watch list of stocks to buy. However, I recently bought into SPG at a P/E of 19, and I intend to buy more if SPG dips below a P/E of 20 again.

First, let me cover some details I think I skipped over after rereading my original post. I don’t think I was very thorough.

If you don’t know what a REIT is, here’s an explanation:

Normally, I focus on free cash flow and a strong record of share buybacks. Since REITs are legally required to pay out 90% of their taxable income in the form of a dividend, large-scale buybacks aren’t possible. I love the concept of a REIT, and although I prefer share buybacks to dividends, I don’t have a problem investing in a company with a strong and growing dividend. That being said, SPG still does a minimal amount of share buybacks from time to time. Even more importantly, SPG doesn’t engage in some of the trash behavior that is all too common with REITs.

I wrote a post a while back about a bunch of REITs I screened and passed on. A large number of REITs have the habit of funding expansion by diluting their shareholders—aka issuing large amounts of new stock. SPG doesn’t do that.

Speaking of dividends:

Since equity REITs are, by definition, landlords, they don’t produce some impressive new product that the market is going to go crazy for and bid the share price up to an insane P/E. As you can see above, the driver of share price growth is dividend growth. However, dividend yield is what’s important here. As SPG grows and generates larger profits, the size of its dividend increases. The market, being at least a somewhat rational place, recognizes this, and the share price roughly tracks with the dividend—although this is far from a perfect correlation.

For example, in January of 2010, the share price was $73, and the total annual dividend per share was $2.24. For someone who bought and held since January of 2010, now that the total annual dividend is $8.40 per share, the yield would be 11.5% today for that investor. To avoid any confusion, the chart above shows the quarterly dividend—you have to multiply by four to get the annual figure. If the market never reacted by raising the share price alongside the dividend, that would be everyone else’s yield as well. Generally, though, you can view the dividend yield on a REIT as a measure of the degree of risk the market associates with the stock.

The riskier the REIT, the higher the yield investors will require before buying in. I do not view SPG as a risky choice, and I am more than happy to buy in at a dividend yield of 5.7%. That is why the best times to buy SPG are during times of uncertainty and fear. If someone bought SPG at the bottom of the COVID market crash, the dividend yield on their initial investment would be about 14%.

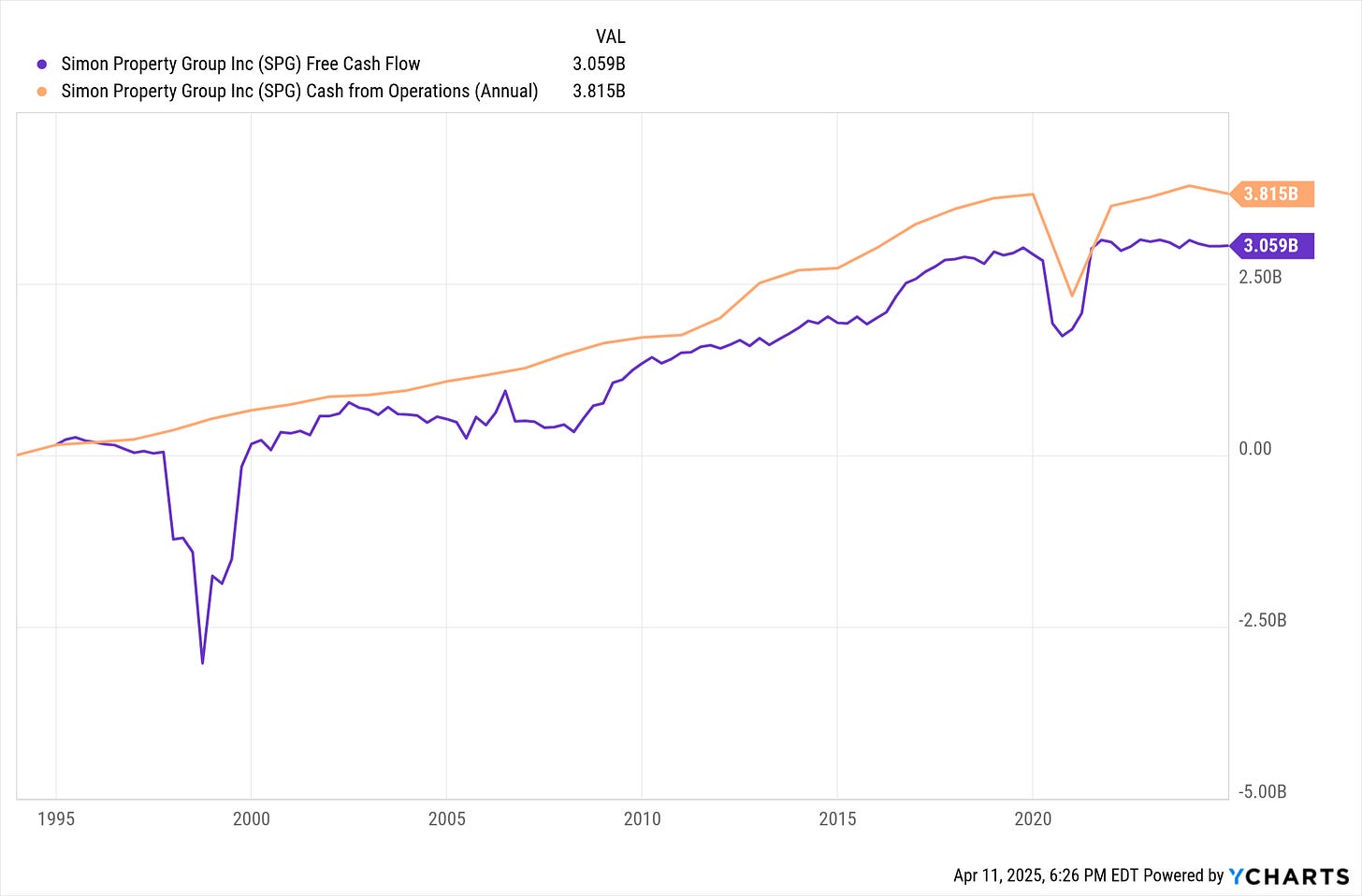

First, above you can see there is an excellent amount of free cash flow relative to cash from operations. The interest on SPG’s debt is also a relatively small amount of money when compared to both. Additionally, it is important to note that interest expense is accounted for on the income statement. Thus, when net income is carried over to the statement of cash flows, interest expense has already been deducted. I think this puts an exclamation point on how manageable SPG’s current level of debt is.

Simon Property Group’s 2024 10-K

Page 126:

Just to further the point about SPG’s debt being of no serious concern: with $3 billion in free cash flow, they could completely pay off the debt coming due in every year except 2026. Even then, they would only have to refinance $1.8 billion. This is a fairly common practice that nearly every corporation engages in—refinancing debt and paying it off in bits and pieces as the years go by. But if some horrible catastrophe occurred and refinancing wasn’t possible, between free cash flow and tangible assets, SPG would be under zero threat of bankruptcy.

2024 Q4 Supplemental Information

Why would someone buy into a shopping center REIT in the middle of a trade war? Isn’t that obviously a bad idea?

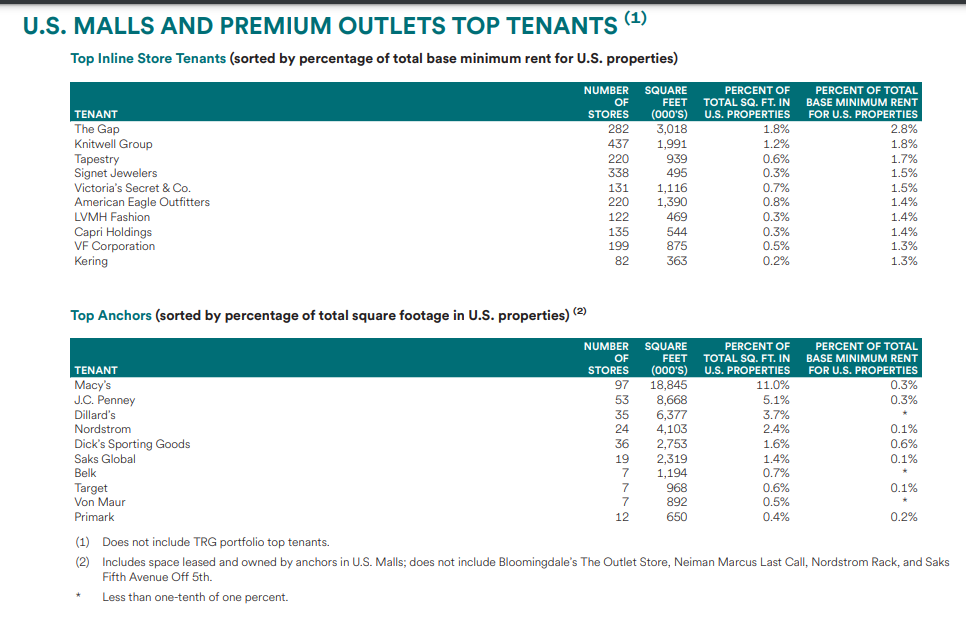

The above charts are taken from SPG’s Q4 supplemental information. I want to make a critical point about why, for SPG, a trade war isn’t the end of the world. Kering owns the Gucci brand, Tapestry owns Coach and Kate Spade, and LVMH owns a plethora of luxury brands including Tiffany’s, Louis Vuitton, Dior, Fendi, Hennessy, and many others. Capri Holdings owns Michael Kors and Jimmy Choo. Saks Global and Nordstrom are premium retailers. Don’t be fooled by the small percentages—these represent the percent of square footage in relation to the total square footage of all SPG real estate across all of their properties nationwide. Even with such small overall percentages, these luxury stores are present in a large number of SPG shopping malls.

The point here is that these tenants attract higher-net-worth shoppers who are less price-sensitive. If a trade war increases the price of a $2,000 Gucci handbag to $2,300, does a customer who can already afford a $2,000 handbag care? Probably not much.

Also, I think it’s important to mention what an anchor tenant is.

An anchor tenant (also called an anchor store or key tenant) is a large, well-known retail store that serves as a major draw for customers to a shopping center or mall. These tenants are strategically placed to attract foot traffic, which benefits the smaller retailers around them. You’ll notice that Macy’s is by far SPG’s largest anchor tenant, comprising 11% of all SPG square footage in malls in the United States. Target is a bit off-brand for an SPG property, but Macy’s certainly is not. That being said, higher-net-worth shoppers need to buy groceries like everyone else.

Also, when you see J.C. Penney mentioned above, it’s important to note that when J.C. Penney went bankrupt in 2020, SPG and Brookfield Asset Management jointly acquired J.C. Penney out of bankruptcy, each taking a substantial ownership interest. I can’t think of another REIT that owns its own chain of retail stores. This creates an interesting synergy, where SPG can give their own store preferred placement in their shopping centers.

This would also be the time to talk about Catalyst Brands. Catalyst Brands is a retail conglomerate formed in January 2025 through the merger of JCPenney and SPARC Group, bringing together several iconic American retail brands under one umbrella. The combined entity includes JCPenney and its private labels (such as Stafford, Arizona, and Liz Claiborne), as well as SPARC Group's portfolio: Aéropostale, Brooks Brothers, Eddie Bauer, Lucky Brand, and Nautica. Catalyst Brands operates as a joint venture, with stakeholders including Simon Property Group, Brookfield Corporation, Authentic Brands Group, and Shein.

As of Q4 2024 SPG continues to hold a 33.3% noncontrolling interest in SPARC Holdings, the former owner of SPARC Group, which now primarily holds a 25% interest in Catalyst.

However…

As per IRC § 856(c)(3), at least 75% of the REIT's gross income must be derived from the following sources:

Rents from real property

Interest on obligations secured by mortgages on real property or interests in real property

Gains from the sale or other disposition of real property

Dividends or other distributions on, and gain from the sale or other disposition of, transferable shares in other REITs

Income and gain derived from foreclosure property

Income from temporary investments of new capital

Thus, while it is very interesting that SPG has expanded as far as they have beyond merely being a landlord, in order to maintain their status as a REIT, a large majority of their income must come directly from real estate. Therefore, all these other things that SPG does only serve to augment their main source of income.

Page 65:

Page 72:

Growth for SPG is straightforward—they are a landlord. Thus, growth equals developing and purchasing real estate. As you can see, this is a continual process for SPG. I usually find that I have less overall to say about REITs since they are fairly simple to understand and straightforward in their structure.

I do want to hammer home the point about SPG targeting shoppers with an above-average income. SPG is the only REIT that I know of which offers its own American Express card with 5% back at SPG shopping centers. SPG has its own brand and goes to great lengths to keep it associated with luxury.

https://www.cardless.com/cards/simon

SPG also has a strong online presence, and people can shop their premium and luxury brand outlet malls online.

It is also important to look at their property list:

Nothing about SPG is cheap or poorly done; it is all geared toward shoppers who have more money to spend.

Now I have this feeling like there's something I'm forgetting to say... hmm... I'm sure once I hit the post button I'll suddenly remember…

SPG vs. S&P 500 as far back as I have data:

SPG vs. S&P 500 over the last ten years:

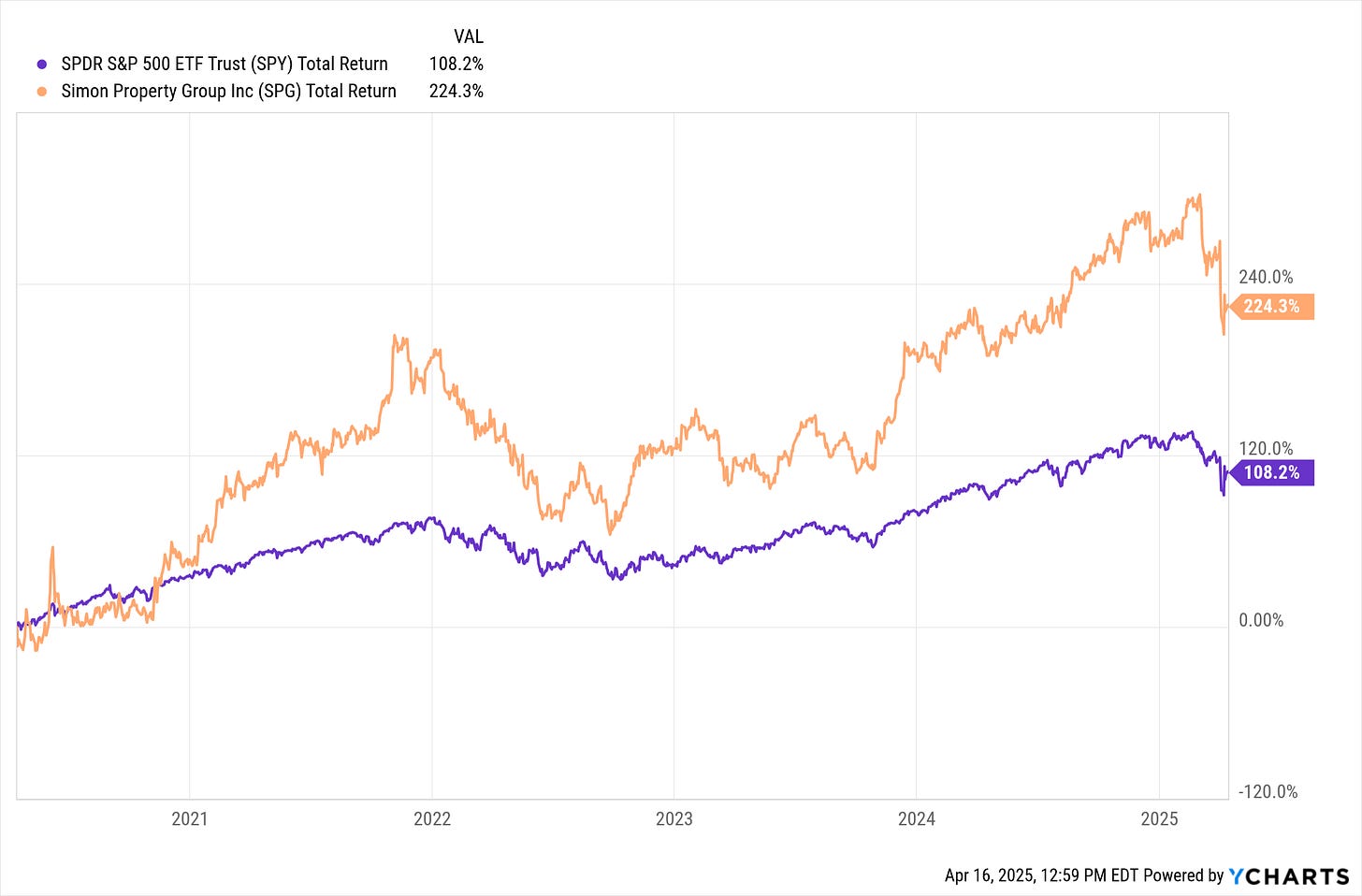

SPG vs. S&P 500 over the last five years:

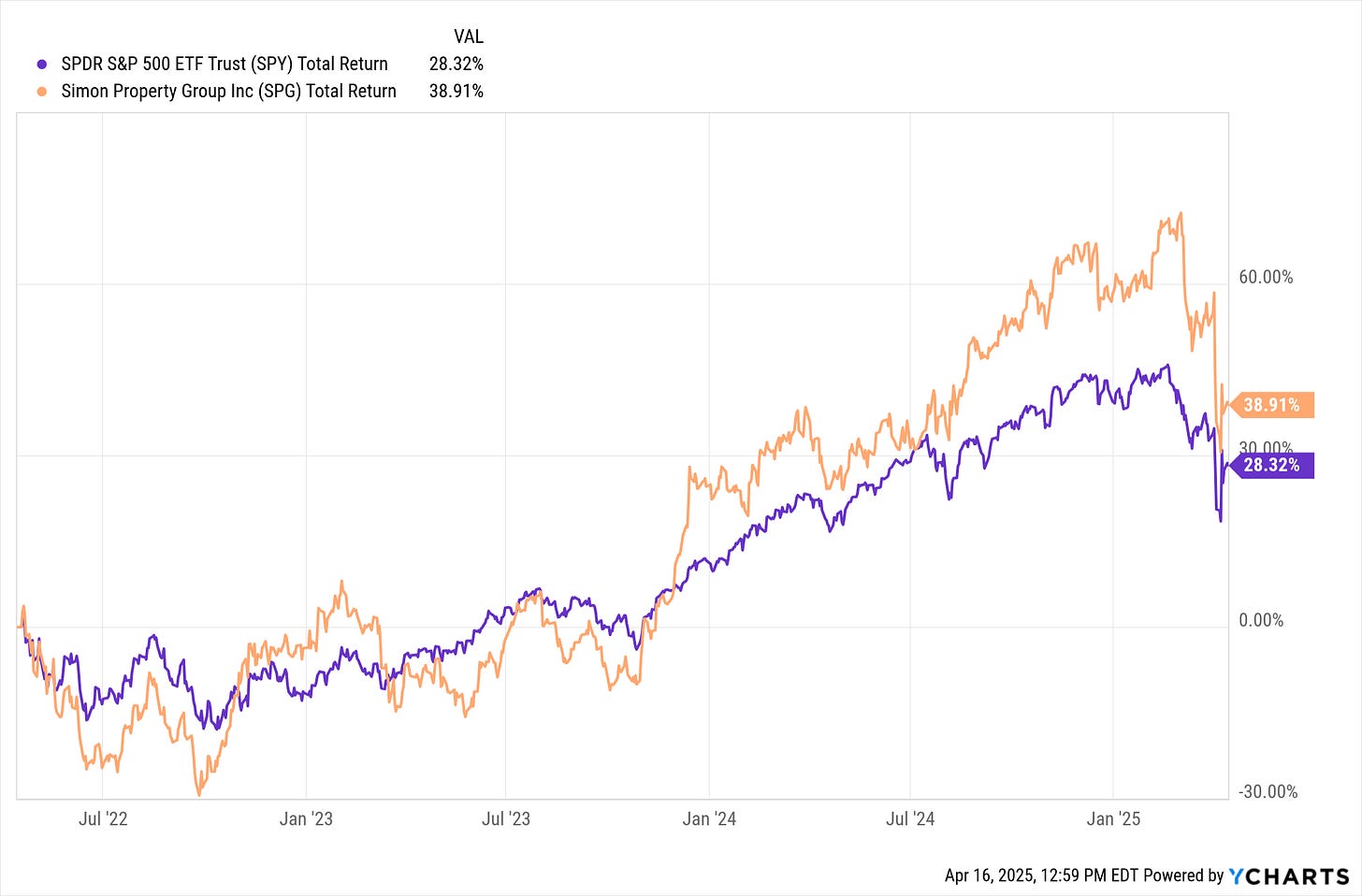

SPG vs. S&P 500 over the last three years:

SPG vs. S&P 500 over the last year:

SPG vs. S&P 500 from the bottom of the COVID crash:

SPG vs. S&P 500 from the bottom of the Global Financial Crisis:

As you can see, when you buy SPG is very important.

If you compare this chart to the charts above, it’s clear that paying a high P/E for SPG doesn’t usually work out well. I think the only major exception was during the Global Financial Crisis, where buying SPG at a high P/E did lead to years of outperformance—until the government decided to screw over the entire retail shopping industry with COVID lockdowns that didn’t accomplish anything. If you’ve been reading my posts for a while, you’ll already know why I’m permanently sour about that.

Now let me just throw a few more charts at you for good measure:

This is perhaps my only complaint here: that SPG has a current ratio of less than one, which can be an indication that the business will struggle with liquidity during a crisis. However, in 2020, SPG went through a stress test when every shopping center in the United States was forcibly closed—and they survived. Given SPG’s track record, I’m willing to accept a current ratio of less than one in this situation. A current ratio below one and a leveraged balance sheet is where things get scary.

Just to summarize the thesis here: Simon Property Group (SPG) is a financially sound company with a long track record of competent management. They have a proven record of growing their dividend and buying back shares when possible. The current trade war isn’t a major cause for concern because Simon Property Group operates upscale shopping centers that target customers who are less sensitive to price increases.

Simon Property Group also has a number of unique factors that set them apart from other REITs. They have large non-controlling interests in certain fashion brands and retail stores. SPG also has a brand of its own, which is fairly unheard of for a REIT. This is evidenced by their Simon-branded American Express Card as well as their eCommerce platform, where customers can shop their outlet stores nationwide online.

Simon Property Group is a truly unique business. At a P/E of 20 or lower, I believe it trades at a fair price and historical data shows that it performs well. That’s in line with the classic wisdom from Charlie Munger: wonderful companies at fair prices.

Ok, bye bye now.

My Portfolio:

MCD, MITSY, AFL, META, JPM, MGM, SPG

METC $17 Call 6/20/2025

11.46% of my portfolio is cash right now.

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.