Yup, just like the title says…. I also recommend you track this stuff yourself since I’ll always be slow to do a write up and I don’t do them every quarter. These ones released around the same time.

MGM Q1 2025

MGM repurchased $494 million worth of shares in Q1 2025.

MGM has $6.2 billion in liquidity between cash and short-term investments along with credit revolver availability.

As of the date of the report, MGM had repurchased $215 million in shares thus far in Q2 of 2025.

MGM has repurchased nearly 45% of its total common stock since 2021.

Now here’s something interesting about slot machines. In Q1 2025, the total slot handle was $5.68 billion, and the slot win was $545 million, giving MGM a profit margin of 9.6% on slot machines. Think about that—people put $5.68 billion into MGM slot machines in Q1 2025, and the slot machines paid about $5.1 billion back out. A casino near where I live has a nice steakhouse; I go there sometimes, have a steak, and play slots for fun. Long-term, the house wins and the gambler loses. But short-term, with $5.1 billion going back out the door, there are definitely people leaving as winners. Kind of a brilliant business model when you see the numbers. The chance of winning big is always dangled in front of you. In a very real way, if you spent enough time in a casino, I imagine you would see people hit the jackpot. It makes the risk of addiction make a lot more sense to me. I never understood how someone could get hooked on something where it's common knowledge that you lose long-term. Now I get it a lot more.

Also, the margin on table games was 26.7%, but the table drop (a.k.a. amount gambled) was only $1.5 billion—much less than slot machines. If you go to Las Vegas on vacation and want to see if you get lucky, your best bet is slots over table games.

There’s nothing else that stands out to me as noteworthy here. I would encourage you to read all of the documents for yourself and double-check if I am missing anything. I am thrilled to see MGM striking while the iron is hot and buying back stock aggressively during the market decline. Warren Buffett would approve of that behavior.

MCD

Q1 2025 Earnings Call Transcript

McDonald's is fairly uneventful, and that's the way I like it. If you're a shareholder, I recommend reviewing the reports yourself in case I overlooked something—which can happen. I didn't find anything particularly noteworthy in Q1 2025.

AFL

Financial Supplement First Quarter 2025

Adjusted earnings down 5.7% YoY – adjustment removes investment loss.

Net earnings down 98.5% YoY due to a $924 million non-cash investment loss.

Aflac hedges against large swings in the value of the Yen but not moderate or mild ones.

The Yen strengthened against the dollar. This is good for revenue when the Yen is converted into dollars. But in the short term, it causes problems because the cost of Aflac's liabilities in Japan increases as well.

Aflac’s reported cash from operations (in USD) can increase when the Yen strengthens, but only due to currency translation—not because more Yen was actually generated. Long-term, this is a positive change.

United States sales up 3.5% YoY, sales in Japan up 12.6% YoY.

Cash from operations down 30% YoY, vastly different from the 98.5% drop in earnings YoY.

This wasn’t an amazing quarter for Aflac, but I do want to highlight something important:

Quarterly cash from operations and revenue tend to fluctuate. This is why I don’t put much stock in quarterly reports. I prefer to analyze stocks on an annual basis.

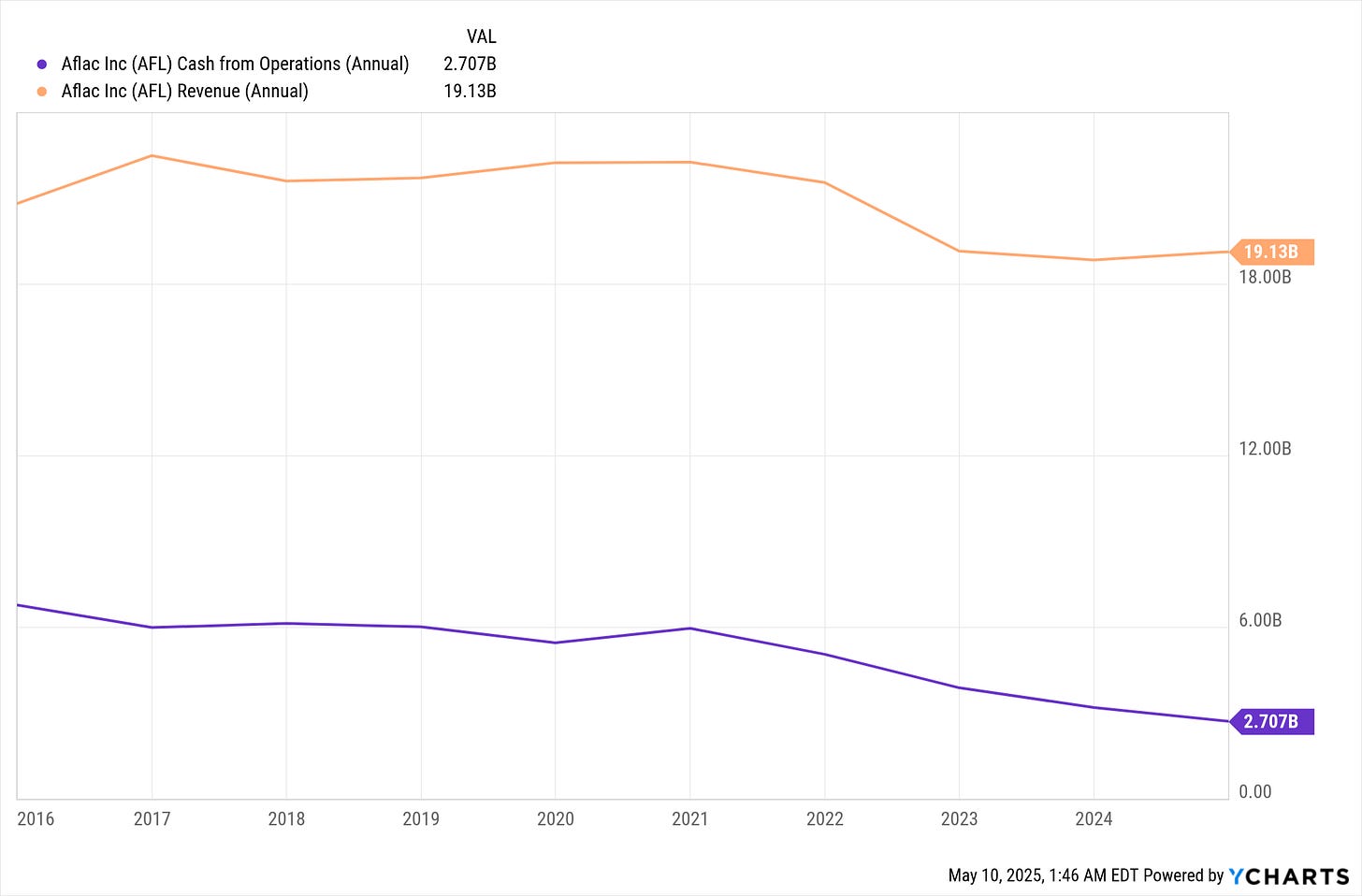

As I’ve shown before, the trend in cash from operations and revenue has been declining. However, this directly correlates with the decrease in the value of the Yen. If the Yen strengthens against the dollar, it will be beneficial long-term, but short-term, there will be significant non-cash charges that will impact earnings. This remains an investment that I have a strong conviction in. On that note, I want to add that Aflac repurchased $895 million in common stock in Q1 2025.

META

Q1 2025 Financial Highlights

Revenue: $42.3B (↑16% YoY, ↑19% constant currency)

Expenses: $24.8B (↑9%)

Operating Income: $17.6B (41% margin)

Net Income: $16.6B or $6.43/share

Free Cash Flow: $10.3B

Stock Buybacks: $13.4B; Dividends: $1.3B

Cash & Securities: $70.2B; Debt: $28.8B

CapEx: $13.7B (mainly servers, data centers, infrastructure)

Segment Breakdown

Family of Apps

Revenue: $41.9B (↑16%)

Ad Revenue: $41.4B (↑16%; ↑20% constant currency)

Other Revenue: $510M (↑34%) from WhatsApp Business & Meta Verified

Operating Margin: 52%

Expenses: $20.1B (↑10%)

Reality Labs

Revenue: $412M (↓6%) due to lower Quest sales, offset by Ray-Ban AI glasses

Expenses: $4.6B (↑8%)

Operating Loss: $4.2B

There’s not much to add here. The major uncertainty remains the outcome of the ongoing antitrust trial. I invested before this, anticipating that once the uncertainty clears, the share price will adjust accordingly. It's a substantial profit opportunity for those willing to take the risk, but if META is forced to divest Instagram, it would significantly impact the share price. I don't foresee that happening, as the government's entire case rests on a narrowly defined market segment. META clearly doesn’t hold a monopoly across all social media platforms. The government is attempting to argue that META has a monopoly specifically in social media focused on friend and family interactions. I don't expect them to succeed, but there's always the risk of being wrong and facing a major loss.

Okay, Bye bye now.

My Portfolio:

MCD, MITSY, AFL, META, JPM, MGM, SPG, COF

*I think it is worth stating that just because I hold a stock doesn’t mean I think it’s a good idea to buy it right now.

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.