NRG Energy, ticker NRG, is a major retail energy provider in the U.S., serving 6 million customers. The company expanded its home services footprint by acquiring Vivint Smart Home in 2023, which brings an additional 2 million customers. NRG is also one of the largest independent power producers in the U.S., with 13 gigawatts of power generation capacity derived from coal and natural gas, primarily in Texas. With the acquisition of LS Power, NRG will gain 13 gigawatts of gas-fired power plants, mostly located in the eastern U.S.

I suppose the first question is: what is a gigawatt? One gigawatt of electricity can power about 1 million households. Currently, there are about 133 million households in the United States. Assuming the LS Power acquisition closes in Q1 2026, NRG could have the capacity to power 19.5% of all the households in the country—assuming, of course, they are only providing residential power, which isn’t the case. But it does put into perspective the scope of NRG’s power generation capabilities.

I also think it is even more important that NRG does not rely on wind and solar energy, which are unreliable and have led to numerous power blackouts. Notably, there was a total failure of wind and solar during a blackout in Texas in 2021 during a blizzard. Properly maintained natural gas infrastructure would have maintained the power grid. The blackout in Spain and Portugal in April 2025 stemmed from an overreliance on wind and solar without enough backup supply from traditional power plants. The same cannot be said for wind and solar during extreme weather events. I once had a therapy client who worked for a power company and stated that while wind and solar are great, they can’t be dialed up on command and can create problems when the amount of electricity they produce changes unexpectedly.

I’m not trying to make a political point about green energy but to explain why I view it as a strong point for NRG that they provide the type of power generation that, for the time being, is still the backbone of the power grid. The only challenge to natural gas and coal would be nuclear power. Nuclear power has zero emissions and can be dialed up on command. The downside is that nuclear accidents terrify people. Because of this, there is a hostile regulatory environment toward nuclear energy. Only three new nuclear reactors have come online in the last 20 years in the United States. These constituted expansions of existing plants. There have not been any entirely new nuclear power plants created in the United States in the last 20 years. At this point, there isn’t a realistic challenger to natural gas- and coal-based power plants.

Q1 2025 Earnings Call Transcript

After perusing these three documents and the data available on YCharts, a few things stick out to me. The first is that the acquisition of LS Power will be a defining moment for the company. The next is that NRG returns capital to shareholders in a fairly aggressive manner. NRG has a market cap of $31 billion and a P/E of 26; thus, much of the future growth from the LS Power acquisition is already priced in. The buybacks are also somewhat negated by the LS Power acquisition, since $2.8 billion in equity is being issued as part of the payment.

That being said, on page 5 of the earnings call, management states their plan to buy back stock at the rate of $1 billion a year for the near future. This is ultimately a good thing, since when they issue new stock to acquire LS Power, they are, in a roundabout way, borrowing money from shareholders and are, in essence, paying it back.

Before I get into something I found that I don’t like, let’s take a look at some of the charts.

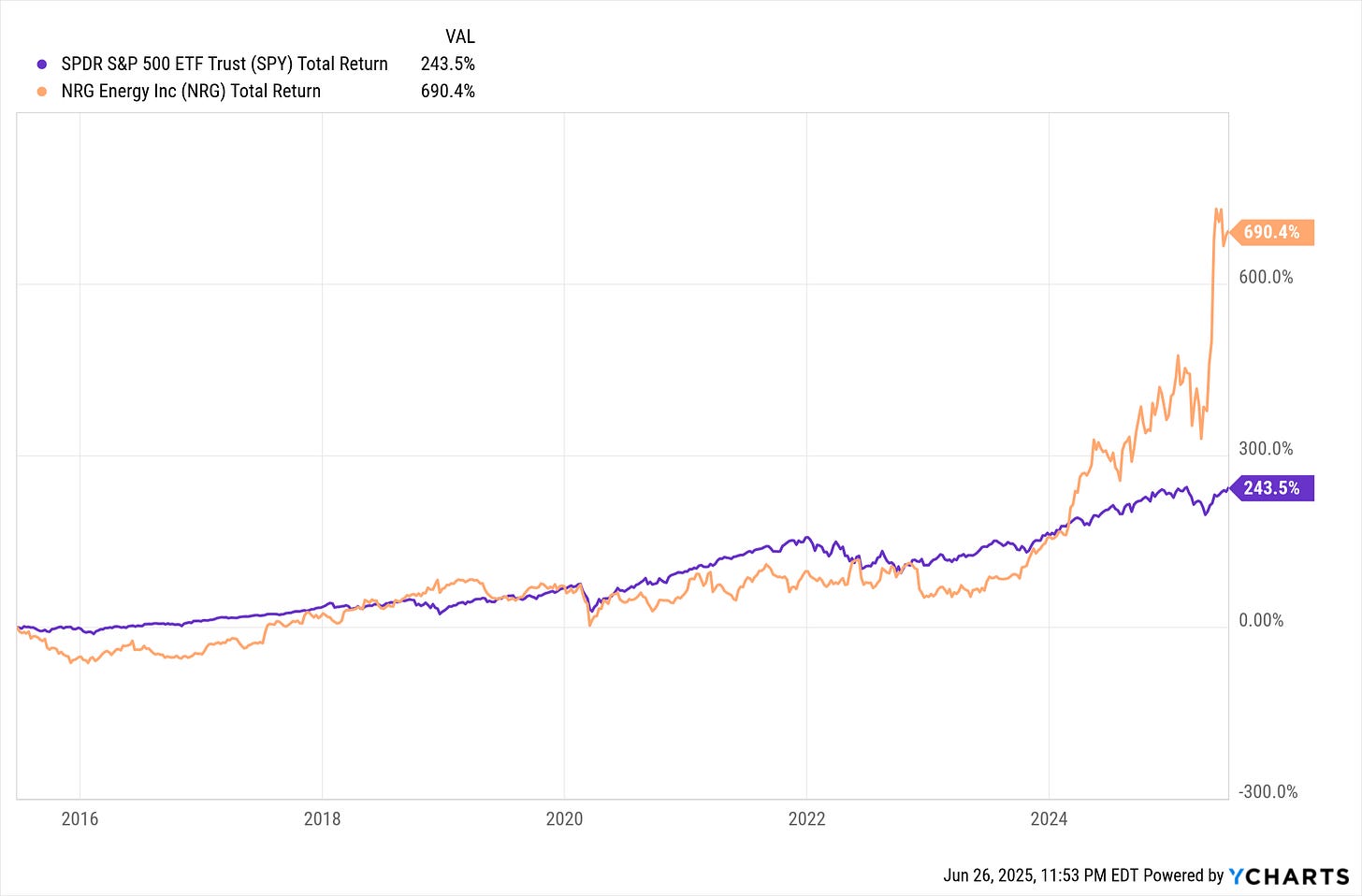

NRG vs. S&P 500 as far back as I have data:

NRG vs. S&P 500 over the last ten years:

NRG vs. S&P 500 over the last five years:

NRG vs. S&P 500 over the last three years:

NRG vs. S&P 500 over the last year:

Revenue and net income:

You’ll notice the spike in the total return charts above and in the revenue chart starting around 2021, with the share price performance catching up in 2024. Part of the reason for the delay is that net income hasn’t increased in tandem with revenue.

Notice that in 2023, free cash flow was negative, indicating that capital expenditures greatly outpaced cash from operations. More concerningly, cash from operations itself was negative in 2023. I don’t always care about negative free cash flow, but negative cash from operations is something I do not like.

There’s more from 2023 that I find problematic. For some reason, my chart won’t display this accurately—I suspect the issuance of preferred stock is the culprit. Regardless, cash from operations was negative in 2023, yet that didn’t stop NRG from buying back $1.17 billion in common stock and paying out $381 million in dividends. NRG also issued $635 million in preferred stock. From management’s perspective, they likely see unchanged revenue and a one-off problem that impacted their cash flow. Viewing this as a temporary issue, they probably chose to continue with their buybacks. Of course, this is just conjecture on my part.

I am very picky about this sort of thing, and I don’t like when a company has a bad year but still pays out a large amount of cash. I particularly dislike when they issue new debt to do so—preferred stock is more like a bond than common stock. Not everyone shares my perspective on this issue, but this alone is enough for me to pass on the investment.

That being said, NRG is set to become the backbone of the power grid in a significant portion of the United States—at a time when AI is expected to increase the demand for electricity. I always go back to what Warren Buffett said: investing is like a game of baseball where you can’t strike out. You have the ability to just sit there, watching pitches go by, waiting for the perfect one to hit a home run. Maybe NRG is a home run—it’s certainly an interesting investment. But it’s not something I would currently liquidate a position to invest in, and I don’t like what I saw in 2023.

Okay, bye bye now.

My Portfolio:

MCD, MITSY, AFL, META, JPM, MGM, SPG, COF

*I think it is worth stating that just because I hold a stock doesn’t mean I think it’s a good idea to buy it right now.

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.