Warren Buffett really stole my thunder on this one. Here I am halfway through writing about Mitsui and he mentions it in his annual shareholder letter. Oddly enough, I didn’t realize Berkshire Hathaway was invested in these companies when Mitsui popped up on my stock screener. Typically, I stick to domestic stocks, but since large cap domestic stocks are generally overpriced these days and I’ve already picked through the large and mid cap stocks that aren’t overpriced I decided to go international. One problem with international stocks is the political risks that I might not fully understand. However, sticking to industrialized democracies with strong connections to the United States goes a long way toward mitigating that risk. Mitsui is a Japanese trading company but before I go any further I feel I need to address the elephant in the room:

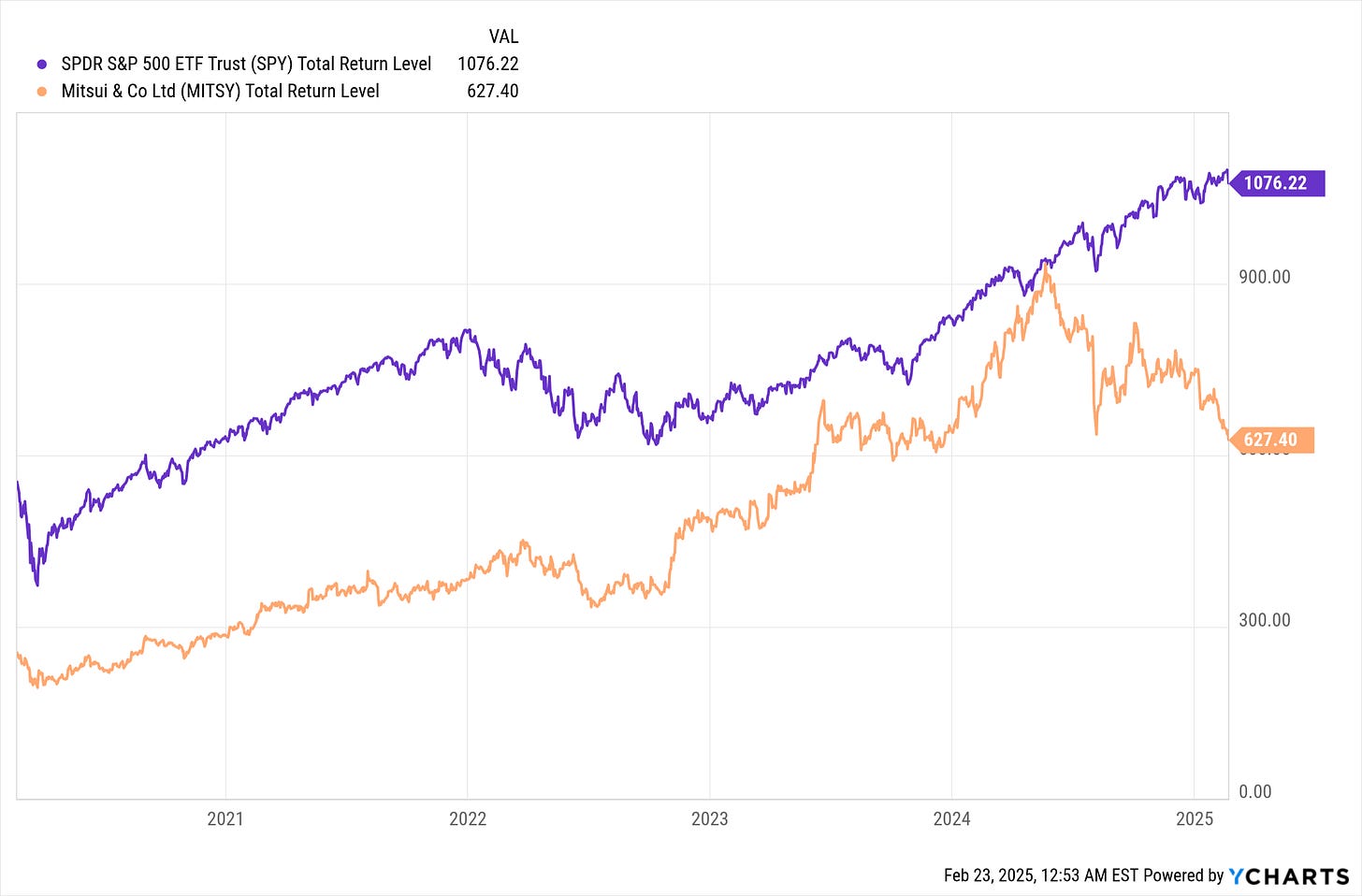

Mitsui vs. S&P 500 as far back as I have data:

Mitsui vs. S&P 500 over the last ten years:

Mitsui vs. S&P 500 over the last five years:

Mitsui vs. S&P 500 over the last three years:

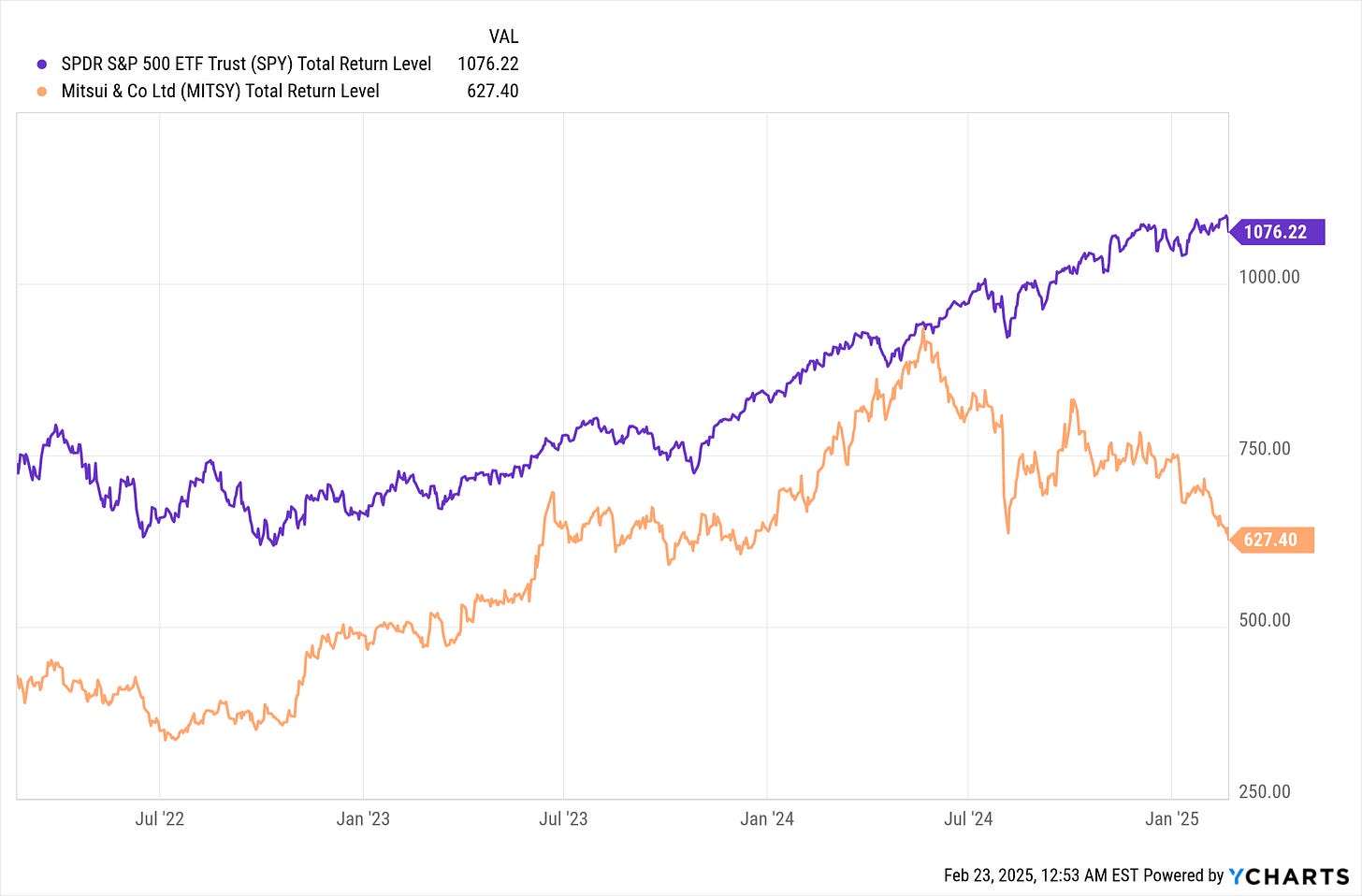

Mitsui vs. S&P 500 over the last year:

Mitsui momentum:

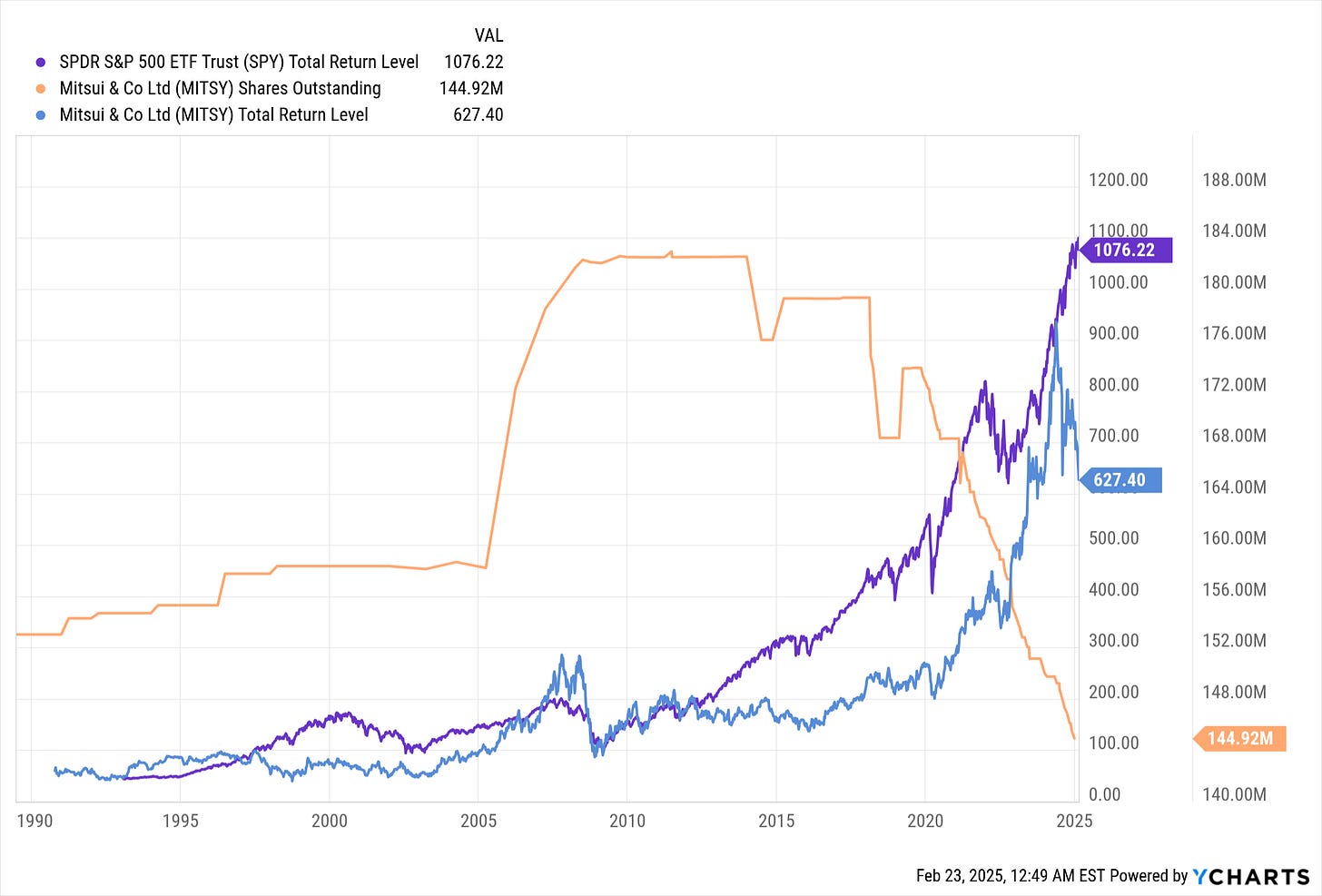

If Mitsui hasn’t performed well historically and doesn’t have momentum then why am I recommending it? Because its behavior has recently changed:

These two charts provide the answer and are quite frankly exciting to see. Mitsui has a high amount of free cash flow relative to cash from operations which I love to see. Also, we can see that in 2021 Mitsui's behavior drastically changed. They started aggressively buying back shares. In the last five years, shares decreased by 15.38% and given that Berkshire Hathaway owns 10% of Mitsui’s common stock, I am confident this behavior will continue into the future. It only gets better:

Mitsui generally doesn’t have a very high PE which means these buybacks pack a good punch. Why this is so exciting to me is there has been a large change in how Mitsui conducts business and the rest of the market doesn’t seem to have noticed yet. This is strange since Warren Buffett, unbeknownst to me, has been talking about them for a couple of years now and he hasn't exactly been quiet about it. I suppose it speaks to the bias most investors, myself included, have to domestic US stocks. It also highlights how many investors are fixated on shiny tech stocks these days. When I talk about McDonald’s, which has high free cash flow, strong share buybacks, and a wide moat, The market has known about it for a long time and the PE never sits as low as 7, McDonald’s PE is 26.

Earlier, I mentioned the political risk of investing in foreign countries or the possibility that other nations may not be as zealous as the SEC in regulating corporations. I have no concerns about Japan and a great example why is the story surrounding Carlos Ghosn. At the time of his arrest by Japanese authorities he was the Chairman and Chief Executive Officer (CEO) of Renault, Chairman of Nissan, and Chairman of Mitsubishi Motors. He was arrested for financial misconduct regarding his business dealings. He ended up bailing out of jail and Japan and hiring a former United States Special Forces operator to smuggle him to Lebanon. It’s a fascinating story, but the relevant part here is that Japanese authorities actively prosecute white-collar crime in their country.

I’ve shared a lot of information at this point but I haven’t said one word about what Mitsui does. First let me provide you with links to the sources of information I used to write this. There is no 10-K for Mitsui since that is the name of a form that is filed with the SEC and Mitsui is a Japanese company. That being said, I somewhat prefer the way financial statements and reports are prepared in Japan.

Consolidated Financial Results for the Nine-Month Period Ended December 31, 2024

Annual Report Fiscal Year 2024

All of the information and data I used to write this came from Ycharts and the above financial reports and presentations. Be mindful if you click those links the currency is in Yen not dollars, the numbers will look very strange otherwise.

Mitsui is a Japanese trading company. A Japanese trading company, known as a "sogo shosha," is a diversified enterprise that engages in a wide range of business activities, including the import and export of goods, investment in various industries, and the provision of services such as logistics and financing. These companies play a pivotal role in Japan's economy by facilitating international trade and business development across multiple sectors.

Mitsui, established in 1876, has been actively involved in various natural resource projects worldwide and is one of Japan's largest and most prominent trading companies. Mitsui has evolved into a global conglomerate with business interests spanning energy, machinery, chemicals, food, retail, healthcare, IT, and finance. The limited amount of natural resources located in Japan created the necessity for trading companies with a global reach to create a supply chain that is vital to the Japanese economy.

A comparison can be made between Berkshire Hathaway and the structure of a Japanese trading company. Both are large conglomerates that have a stake in a diverse range of businesses. The primary difference being that Berkshire Hathaway will buy other corporations outright and turn them into subsidiaries. While Mitsui also acquires other businesses, it also engages in a number of joint ventures. Mitsui also has a large focus on the base materials and energy sectors. That being said the similarities between Berkshire and Mitsui are quite large.

Now, let's talk about Mitsui’s business segments:

Mineral & Metal Resources - Approx. 35.5% of earnings.

Iron ore, Metallurgical coal, Copper, Nickel, Aluminum, Ferrous raw materials, Metal Recycling, and others.

Major Subsidiaries:

MITSUI BUSSAN METALS, Mitsui Iron Ore Development, Mitsui Iron Ore Corporation, Mitsui Resources, BUSSAN SUMISHO CARBON ENERGY, Oriente Copper Netherlands, Japan Collahuasi Resources

Major Equity Accounted Investees:

Inner Mongolia Erdos Electrical Power & Metallurgical, NIPPON AMAZON ALUMINIUM

Energy - Approx. 34.7% of earnings.

Natural gas, LNG, Crude oil, Petroleum products, Environmental and next generation energy, and others.

Major Subsidiaries:

Mitsui Oil Exploration, Mitsui E&P Middle East, Mitsui E&P USA, MEP Texas Holdings, Mitsui E&P Australia Holdings, Mitsui E&P Italia B, MEP South Texas, Mitsui & Co. Energy Trading Singapore, Mitsui & Co. LNG Investment USA, Mitsui & Co. Energy Marketing and Services (USA), MIT SEL Investment, MyPower.

Major Equity Accounted Investees:

ENEOS GLOBE, JAPAN ARCTIC LNG, Japan Australia LNG (MIMI), Mitsui E&P Mozambique Area 1, Forsee Power

Machinery & Infrastructure - Approx. 14.4% of earnings.

Electric power, Marine energy, Gas distribution, Water treatment and supply, Logistics and social infrastructure, Automotive, Construction, Transportation, Ships, Aircraft, and others.

Major Subsidiaries:

Portek International, Mit-Power Capitals (Thailand), MIT Wind Power, Mitsui & Co. Middle East and Africa Projects Investment & Development, MIT Power India, MITSUI GAS E ENERGIA DO BRASIL, Ecogen Brasil Solucoes Energeticas, MIZHA ENERGIA PARTICIPACOES, Shamrock Investment International, Mitsui & Co. Infrastructure Solutions, Mitsui & Co. Plant Systems, Tokyo International Air Cargo Terminal, Mitsui Water Holdings (Thailand), GUMI BRASIL PARTICIPACOES, Toyota Chile, Mitsui Automotriz, MITSUI AUTO FINANCE CHILE, Mitsui Auto Finance Peru, HINO MOTORS SALES MEXICO, Komatsu-Mitsui Maquinarias Peru, Road Machinery, KOMEK MACHINERY, KOMEK MACHINERY Kazakhstan, Aptella, Veloce Logistica, MBK USA Commercial Vehicles, Ellison Technologies, lnversiones Mitta, OMC SHIPPING, ORIENT MARINE, M&T AVIATION, Mitsui Bussan Aerospace.

Major Equity Accounted Investees:

PAITON ENERGY, 3B POWER, SEA TERMINAL MANAGEMENT & SERVICE, SAFI ENERGY, Caitan, IPM Eagle, Compania de Generacion Valladolid, India Yamaha Motor, TOYOTA MANILA BAY, HINO MOTORS SALES (THAILAND), TAIYOKENKI RENTAL, KOMATSU AUSTRALIA, VLI, Penske Automotive Group, Bussan Auto Finance, WILLIS MITSUI & CO ENGINE SUPPORT.

Chemicals - Approx. 8.7% of earnings

Petrochemical raw material and products, Inorganic raw material and products, Synthetic resin material and products, Agricultural material, Feed additives, Tank terminal, Living and environmental materials, and others.

Major Subsidiaries:

Mitsui Bussan Chemicals, Japan-Arabia Methanol, MMTX, Shark Bay Salt, MBWA Investment, Intercontinental Terminals Company, MITSUI & CO. PLASTICS, Mitsui Plastics Trading (Shanghai), Diana Elastomers, Lee Soon Seng Plastic Industries, Mitsui Bussan Packaging, Mitsui Bussan Woodchip Oceania, MITSUI PLASTICS, Mitsui AgriScience International, Certis U.S.A., Bharat Certis, DAIICHI TANKER, Mitsui Bussan Agro Business, B Food Science, Bussan Animal Health, Mitsui Agro Business, Novus International, Consorcio Agroindustrias del Norte.

Major Equity Accounted Investees:

Kansai Helios Coatings, Honshu Chemical Industry, HEXAGON COMPOSITES, LABIX, SMB KENZAI, OURO FINO QUIMICA, MVM Resources International, Nutrinova Netherlands, Ourofino Saude Animal Participacoes, ITC RUBIS TERMINAL ANTWERP, Kingsford Holdings.

Iron & Steel Products - Approx. 0.5% of earnings.

Steel products for infrastructure projects, Automotive components, Steel products used in energy industry, and others.

Major Subsidiaries:

Mitsui & Co. Steel, EURO-MIT STAAL, Regency Steel Asia.

Major Equity Accounted Investees:

Agroindustrias del Norte Kansai Helios Coatings, Honshu Chemical Industry, HEXAGON COMPOSITES, LABIX, SMB KENZAI, OURO FINO QUIMICA, MVM Resources International, Nutrinova Netherlands, Ourofino Saude Animal Participacoes, ITC RUBIS TERMINAL ANTWERP, Kingsford Holdings Iron & Steel Products Steel products for infrastructure projects, Automotive components, Steel products used in energy industry, and others Mitsui & Co. Steel, EURO-MIT STAAL, Regency Steel Asia GRI Renewable Industries, NIPPON STEEL TRADING, MM&KENZAI, Shanghai Bao-Mit Steel Distribution, Gestamp Brasil Industria De Autopecas, GESTAMP 2020, NuMit, GEG (Holdings), SIAM YAMATO STEEL.

Lifestyle - Approx. 3.6% of earnings.

Foods, Fashion, Healthcare, Outsourcing services, and others.

Major Subsidiaries:

XINGU AGRI, United Grain Corporation of Oregon, Mitsui & Co. Agri Foods, PRIFOODS, KASET PHOL SUGAR, Mitsui Norin, Mit-Salmon Chile, Retail System Service, Bussan Logistics Solutions, VENDOR SERVICE, MITSUI FOODS, Mitsui & Co. Retail Holdings, S.V.D., WILSEY FOODS, MKU Holdings, MAX MARA JAPAN, Mitsui Bussan Logistics, SANLI HOLDINGS, Mitsui & Co. Foresight, AIM SERVICES, ARAMARK Uniform Services Japan, MBK Wellness Holdings, MBK Human Capital.

Major Equity Accounted Investees:

FEED ONE, IPSP Oriental Holding Company, Starzen, Mitsui DM Sugar Holdings, Euricom, BIGI HOLDINGS, MN Inter-Fashion, IHH Healthcare.

Innovation & Corporate Development - Approx. 2.3% of earnings.

Asset management, Leasing, Insurance, Buyout investment, Venture investment, Commodity derivatives, Logistics center, Information system, Real estate, and others.

Major Subsidiaries:

MITSUI KNOWLEDGE INDUSTRY, Mitsui Bussan Secure Directions, World HiVision Channel, M&Y Asia Telecom Holdings, Mitsui & Co. Insurance Holdings, Mitsui & Co. Alternative Investments, Mitsui & Co. Asset Management Holdings, SABRE INVESTMENTS, MITSUI & CO. REAL ESTATE, MBK Real Estate Asia, MBK Real Estate Holdings, Mitsui & Co., Principal Investments, MITSUI & CO. Global Investment, Mitsui Bussan Commodities, Mitsui & Co. Global Logistics.

Major Equity Accounted Investees:

QVC JAPAN, Altius Link, JA Mitsui Leasing.

I hope this gives you an idea of just how massive and international the footprint is of this $51 Billion corporation. This brings me to another aspect of Mitsui that I like, much of its business never touches the United States. It captures the commerce between Japan and other countries. If Trump starts a trade war I don’t think it will have much of an impact on Mitsui.

Now, let's take a closer look at Mitsui’s cash flows and balance sheet. We already see how they have shifted to returning money to shareholders through buybacks. This acts as a catalyst for the share price to rise, something that has never been present for Mitsui before. But are they doing this in a responsible manner, in the past four years Mitsui has paid off $7.29 Billion in debt. For the past 10 years Mitsui has maintained a consistent level of capex. Cash and Short Term Investments + Total Receivables are more than double Payables and Accrued Expenses. Shareholder equity has risen by 33% since 2017.

This is all very responsible stuff. They aren’t funding share buybacks with debt, which is an all-too-common corporate practice that I dislike. There is also no concern about Mitsui’s ability to pay its debts in the short term, in fact they are so well positioned that if revenue spontaneously went to zero they would be fine possibly for an entire year. A concern can arise when a corporation pays out shareholders by foregoing maintenance on existing operations or expansion. A consistent level of capex is a great sign that once again Mitsui is behaving in a responsible manner.

One point that I would like to address from the income statement is that revenue has declined since 2022:

However, this tracks with the decline in the yen, which is good in the sense that it doesn’t reflect an underlying problem with Mitsui’s business. The strength of the yen against the dollar is out of their control.

Now lets talk about moat…

Hamilton Helmers 7 Powers:

Scale Economies – When unit costs decrease as production volume increases, creating a cost advantage that competitors struggle to match.

This is a tricky question to answer for a trading company. I’m going to say no. Perhaps one of Mitsui’s many subsidiaries benefits from economies of scale that competitors struggle to match. However, as a conglomerate, I don’t think Mitsui has one, particularly since a large portion of its earnings comes from mineral and metal resources, as well as energy.

Network Economies – When the value of a product or service increases as more people use it (e.g., social networks, payment platforms).

This one is hard no.

Counter-Positioning – When an upstart company adopts a new business model that incumbents can’t easily replicate without harming their existing business.

No, there are numerous trading companies in Japan.

Switching Costs – When customers face significant costs (financial, effort-based, or psychological) in switching to a competitor, leading to customer retention.

Nope, it’s not that hard to change who you buy your natural gas, or iron ore from.

Branding – When a company builds a deep and lasting association in customers' minds, creating pricing power and differentiation.

I think Mitsui deserves some points on this one. They have been around since 1876, which is a long time to build a strong reputation with business partners. Any company this old has its scandals. For example, during WWII, Mitsui sold “Golden Bat” cigarettes in China. These cigarettes were laced with opium, which was not disclosed to the purchasers, who consequently became addicted to opioids. They also used Allied prisoners of war in forced labor camps. This is similar to German corporations of the same time period, nearly all of which were strongly linked to the Nazi party. However, just as BMW is now associated with quality rather than slave labor, I believe Mitsui has similarly rehabilitated its international reputation.

Cornered Resource – When a company gains privileged access to a valuable resource that others cannot easily obtain (e.g., intellectual property, exclusive deals).

Nope. Mitsui does have exclusive deals around the globe, but they are for basic materials like metallurgical coal and natural gas. Neither of these are cornered resources.

Process Power – When a company develops unique processes that are difficult to replicate, leading to long-term efficiency or product advantages.

Yes, I believe Mitsui does have process power. This also ties into its long history as a company. Japanese trading companies are unique in their structure, and the only comparable company that comes to mind for me is Berkshire Hathaway, and that’s the only one. I think Mitsui and Japanese trading companies as a whole have process power. They are large businesses with an international footprint that are involved in a wide variety of business activities. It took Warren Buffett’s genius to duplicate this type of business, either intentionally or unintentionally, in the United States. It would be very difficult for someone to build a corporation that replicates what Mitsui and the other trading companies in how they manage business ventures around the globe.

One final detail I want to note is that I sold off my positions in Valero and Amrep to consolidate into Mitsui. I sold off Valero not because I have anything against it. I still am very optimistic about it as an investment but because Mitsui has significant exposure to the energy sector, and I don’t want the energy sector to be overweighted in my portfolio. I’ve soured on Amrep as the real estate market in the United States has cooled off. I stated that Amrep was a higher-risk investment, and it was. I expected it to rise sharply, but it did the opposite. I’m going to take my losses and move on from that one. I just don’t have strong enough conviction at this point to hold it long-term.

Ok, bye bye now.

My Portfolio:

MCD, MITSY, AFL, SITC, SHV

METC $17 Call 6/20/2025

FedEx Bond CUSIP: 313309AP1

JP Morgan Chase Bond CUSIP: 48130CVM4

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.