META

The Future Is Awesome

Today, I cover Meta since tech is rapidly moving back into buy territory.

I go back and forth on what suits people better—a nice, concise write-up that gets straight to the point or a long-winded one that describes my entire process. I think I’m going to go with the long-winded approach. Also, if you read these things that I write on some level, even if it's just 1%, this is video you:

When I was 11 I audited my parents.

I mean that with love.

Here are the links to the documents I will be referring to:

Back in 2022, I had a chance to buy Meta when it dropped as low as $95 that year. Today, it trades at $625, although that number has been changing rapidly lately. Hindsight can be a real pain. But I wasn’t the only one who thought Meta’s better days were behind it. After all, it took a large market-wide sell-off to drive Meta down to a PE of 6.

There was quite a lot going wrong for Meta at the time. They took a $14 billion loss developing the Metaverse, which was a horrible idea in its original vision. It was meant to be a fully immersive, interconnected virtual world that would serve as the next evolution of the internet. The basic idea was that tens of millions of people would strap a VR headset to their faces and enter into a vast digital world. That was—and still is—a bad idea. First of all, half of the population are women. I can say that my wife puts a decent amount of effort into her hair and makeup. I don’t think she, or many other women, would be eager to strap a large VR device to their heads everyday, ruining all of that effort. Even with men, outside of those who love video games, it’s hard to imagine widespread adoption. An athletic or extroverted man reverting to an incredibly sedentary life instead of seeing people in person? Yeah… no…

Also, in 2022, Meta experienced a decline in daily active people (DAP) for the first time in its history. Then there was the rise of TikTok, and to pile on, Apple started allowing iPhone users to block apps from creepily tracking what they do on their smartphones. This was a blow to Meta’s advertising revenue since it impacted their ability to target users with ads. I can also add that, as a therapist, to this day when I ask teenagers what they think of Facebook, they always reply that Facebook is for old people. Back when I was a teenager, Facebook was cool. When I got my Facebook account, I couldn’t even sign up—I had to be invited by an existing user.

All of this led me to agree with the market consensus that Meta’s better days were behind it, and I passed on buying the stock. But then Zuckerberg pulled off quite the impressive turnaround and showed he isn’t a one-hit wonder who had just one big idea as a teenager.

Meta has two business segments: Family of Apps (FoA) and Reality Labs. FoA includes Facebook, Instagram, Messenger, Threads, and WhatsApp. First, let’s start with Reality Labs because it is what has me bullish on Meta long-term. The Metaverse isn’t some clunky headset that allows you to sit in a chair alone and go to a digital bar instead of just going to a real one in person to socialize face to face.

Oh no, something bigger is afoot now… Meta Ray-Bans…

Zuckerberg’s vision is now Augmented Reality (AR) glasses. Meta Ray-Bans are capable of taking photos and videos, as well as real-time language translation. That bit of information made me sit up in my chair. You can also say, “Hey Meta,” and ask questions of an AI voice assistant. Damn it, Zuckerberg, you’ve done it again—that’s brilliant, and now I’m on board with the vision.

Not only does this solve the problem of a VR headset being bulky, nerdy, and a niche product, but by taking the form of a fashionable pair of glasses that can come in many different varieties, we now have the potential for widespread appeal. Even more impressive is that these features represent the infancy of a new technology, with the end goal being a full AR experience all contained in a pair of glasses. Some features that are in development include:

Transparent AR display to overlay digital objects onto the real world.

Real-time translation & AI-powered assistance.

Eye & hand tracking for interaction without controllers.

The AR overlay display would be truly revolutionary and put companies like Apple and Samsung on their back foot. This would allow you to put on a pair of Meta glasses and see a real-time translation of what someone is saying appear in your field of vision. Your Meta AI assistant could see what you're seeing and give real-time suggestions. Theoretically, you could look down a street, and your Meta AI assistant could display, “You need to take a right at the corner to get to the theater,” in your field of vision. Glasses with this kind of display could eliminate your need to ever look down at your phone. You could open the Substack app and read The Free Press all through your glasses or watch a YouTube video. Even more impressive is that all of this could happen without blinding you to your surroundings. This would constitute a major advancement in how we interact with technology.

For all of these reasons, I don’t care at all that Meta is taking a $17 billion loss annually developing this technology in Reality Labs. I think AR glasses represent a tech arms race in which Meta has a huge lead. Amazon Echo Frames don’t have any substantial features, and they didn’t have the wisdom to partner with a fashion brand. Eddie Bauer has smart glasses that also don’t do much. Add Bose to that list as well. None of these competitors have an integrated camera or language translation.

There was also the Google Glass, which was launched in 2013 and discontinued in 2023. Google Glass is worth looking into since it was an early attempt at what Meta is now doing, but it was a complete failure. One distinction is that Meta has immediately sought to make its product fashionable by partnering with Ray-Ban, whereas the Google Glass stuck out like a sore thumb. Google Glass also couldn’t do very much, while Meta Ray-Bans have an AI assistant and can translate languages. Another big problem with the Google Glass was privacy concerns since it had a camera, leading people to be suspicious that they were being filmed. It is interesting that this concern simply hasn’t come up with the Meta Ray-Bans. I suspect it goes back to the inconsistent logic of the human mind. Google Glass was meant to be a futuristic, always-on device and it got people's attention quickly, whereas Meta Ray-Bans just look like sunglasses. I also believe the Meta Ray-Bans have a much more obvious LED light that indicates video recording, removing a lot of the creep factor. However, in my opinion, the real reason Google Glass faced backlash and died off while Meta Ray-Bans haven’t is their subtlety.

I often conceal-carry a firearm—a Glock 19, to be specific—which isn’t exactly a subtle weapon. It creates a fairly obvious bulge under my shirt on the side of my hip. When I first started carrying, I was sure some anti-gun person would notice and harass me about having a firearm. But nobody has ever noticed, with the exception of police officers, and since I have a permit, that doesn’t matter. I just don’t think most people are observant enough to notice that a person’s Ray-Bans have a camera. And if they do, since the device just looks like sunglasses, it will lead to much less consternation. It is always funny to me that, as a therapist, I can say the same thing to a person three different ways. The first two times, they reject it, then the third time, they agree with my point—purely because I was able to find a way to communicate the idea that didn’t trigger a defensive response. I think a futuristic device made people worry that they were being spied on, whereas a regular pair of glasses does not.

The future for this technology is very exciting, and Meta doesn’t have any serious competition. An AR display could let me read TGIF by the world famous Nellie Bowles without staring down at my phone. Hand movement recognition could let me scroll through the article again without touching my phone. AR could also offer a display that appears much larger to the eye than the screen on a smartphone. This larger display could even let a publication like The Free Press create a digital newspaper that presents like a classic newspaper, all in a digital format as opposed to a series of blog posts. Some VR devices can already create a display in your field of vision that appears larger than a 50-inch television screen. The future of an AR display inside a pair of glasses has me very intrigued and could massively change how we interact with technology.

If Meta wants to spend $17 billion a year to create a massive lead over its competitors in a very promising new technology, I have no problem with that. $17 billion sounds like a large number, but when we get into the numbers later on, you’ll see that $17 billion isn’t a huge amount of money for Meta. I haven’t even talked about the rest of what Meta is doing.

It’s worth an honorable mention that Meta has developed its own LLM AI, and Llama 4 is releasing soon. On the most recent earnings call, Zuckerberg expressed the view that people will want specialized AIs in the future—a different AI for a different type of task. This is another great insight, and Meta, like many other companies, is developing its own.

NVIDIA investors should take note of something I found while researching Meta. First, Meta continues to develop and implement MTIA, which is neither a CPU nor a GPU. MTIA is an AI accelerator—an ASIC (Application-Specific Integrated Circuit) created for one specific purpose. Currently, Meta is using its MTIA chips to support ranking and recommendation inference workloads. But as Meta continues to refine the design of MTIA, they plan on using it for AI training workloads. On the earnings call, Meta described this as a means of cost-cutting as well as creating hardware specialized to their unique needs. They also talked about controlling costs by extending the useful lifespan of their servers to five and a half years. Then, on page 110 of the 10-K, it states that Meta has $26.2 billion in non-cancelable commitments in 2025, mainly consisting of building out new servers and network infrastructure—very likely referring to the new data centers they are building. However, over the next few years after 2025, only $6.6 billion of these commitments exist.

As a Meta investor, I love this. AI is doing something that hasn’t happened to many software-based tech companies, perhaps ever before. They are having to spend a fair amount of money building up the physical infrastructure to support this new technology. There are even some reports that the demand for electricity in the United States is expected to increase because of AI. I think it is awesome that Meta is taking the initiative to mitigate these costs and following Apple and just about every other major tech company in developing their own computer chips. This is bad news for semiconductor companies such as NVIDIA, which derives a large amount of its revenue from companies that are actively trying to move away from their hardware. Anyway, for Meta, this is all music to my ears.

Now, let’s talk about the products that actually generate revenue for Meta—the FoA. Meta repeatedly states throughout its 10-K that nearly all of its revenue comes from the FoA, which includes Facebook, Instagram, Messenger, Threads, and WhatsApp.

WhatsApp is fairly prolific. This is a strange example, but when Hamas terrorists committed a massacre of Israeli civilians on October 7, 2023, I saw numerous videos where the terrorists can be heard in the background gleefully calling their families and telling them to check their WhatsApp for pictures of the slaughter. Let that sink in—even Middle Eastern terrorists use WhatsApp. They might be using it to document the crimes against humanity they just committed, but you can’t say WhatsApp doesn’t have a huge amount of reach. It has about two billion users globally.

Messenger is pretty much what it sounds like. Meta also doesn’t break out how much revenue comes from Messenger, but apparently, it is substantial. As of January 2025, Messenger has around 194 million users in the United States and over a billion users globally.

Now we arrive at Instagram, which has about 2.4 billion users globally and remains popular among young people. I don’t feel the need to go in-depth explaining what Instagram is. I’ve never used Instagram much, although I did start using it once I started writing this. I can understand the appeal.

I also don’t feel the need to go into detail explaining what Facebook is. That being said..

Facebook Marketplace has more shoppers than Amazon.

It is by a fairly wide margin, too. Amazon has about 320 million active shoppers as of October 2024. Meanwhile, Facebook Marketplace has over a billion active shoppers spread across 70 countries. Facebook Marketplace has also been partnering with eBay to list items for sale on eBay on Facebook Marketplace as well. A big advantage that Facebook Marketplace has is that a buyer can see that the seller has a Facebook profile and is a normal human being. This provides an aspect to the transaction that Craigslist never did.

I think Facebook will always have its place, even if that has changed to being the more grown-up social media platform. The number of both monthly and daily active users on Facebook continues to grow slowly. While Facebook might not be cool anymore, it certainly still remains a relevant force and a platform that billions of people find useful. I am curious if, as Gen Z gets older, they will start using Facebook more. After all, Facebook is very well suited for sharing pictures of your kids or your new house with friends and family—perhaps a more mature use case.

I think, overall, about 30% - 50% of the people on planet Earth interact with at least one of Meta’s products at least once a month. That is a very impressive statistic when you pause to think about it. That is the ultimate network effect.

Before moving on to the 10-K, I wanted to also highlight some remaining insights from Meta’s last earnings call.

Most of Meta’s investment is in their FoA, not Reality Labs.

Fundamentally, all of Meta’s revenue comes from advertising.

Ninety percent of headcount growth is in research and development.

Capex is geared towards AI and Meta’s core business.

Now let’s start digging into the numbers. It is pretty clear why the market has bid up the prices of tech companies during this current market bubble, which is popping as I type this. These companies generate huge amounts of free cash flow. But let’s start at the beginning.

While I spent a large amount of time talking about Reality Labs, 79% of Meta’s costs and expenses come from their FoA. I want to point this out since I think any claim that Meta is focusing too much on Reality Labs, which operates at a loss, is inaccurate. Meta also doesn’t expect Reality Labs to be a significant source of revenue until about 2030. On page 7, Meta also mentions neural interfaces using electromyography. I had no idea what that was, and I had to ask ChatGPT, which said:

An interface using electromyography (EMG) is a system that detects electrical activity produced by muscles and translates it into commands for controlling external devices. This type of interface is commonly used in assistive technologies, prosthetics, rehabilitation, gaming, and human-computer interaction.

It’s certainly interesting that Meta is trying to integrate that into VR and AR devices. Also, on page 7, Meta mentions the Orion prototype, which does have an AR overlay. I want to drop a link to Meta’s page on the Orion.

Now, those glasses do look dorky as hell. But given that the product isn’t on the market yet, that doesn’t matter to me. The functionality they possess is very exciting, even if a partnership with Ray-Ban or LVMH can’t fix the horrible appearance. Those glasses are still much less cumbersome to carry and put on one's face—a drastic improvement over a bulky VR headset. People might not walk down the street wearing them, but they could certainly use them at work or at home. Again, I think it is possible that Meta could give them a more appealing look.

Meta also describes the hostile regulatory environment they face in Europe and a number of lawsuits. This had me concerned until I saw just how little this impacts Meta. On page 109 of the 10-K, legal-related accruals amount to only $5.5 billion and are contained within the line item "accrued expenses and other current liabilities" on the balance sheet. Payables and accrued expenses were $19.12 billion at the end of 2024, while cash and short-term investments plus receivables totaled $95 billion. Again, while Meta does get sued a lot and squeezed for money by European countries, overall, it isn’t a very large impact.

Revenue continues to rise for Meta, not just in the United States but around the world as well. On page 100 of the 10-K, it is stated that $63.2 billion in revenue comes from the United States and Canada, primarily the United States, $45 billion from the Asia-Pacific region, $38 billion from Europe, and $17.92 billion from the rest of the world.

As you can see, Meta has a long history of revenue growth. That did hit a bump in the road in 2022 but Meta quickly returned to its winning ways. I also want to point out that, given how much free cash flow Meta has and how little debt they carry, that debt isn’t worth spending much time discussing since it is so insignificant.

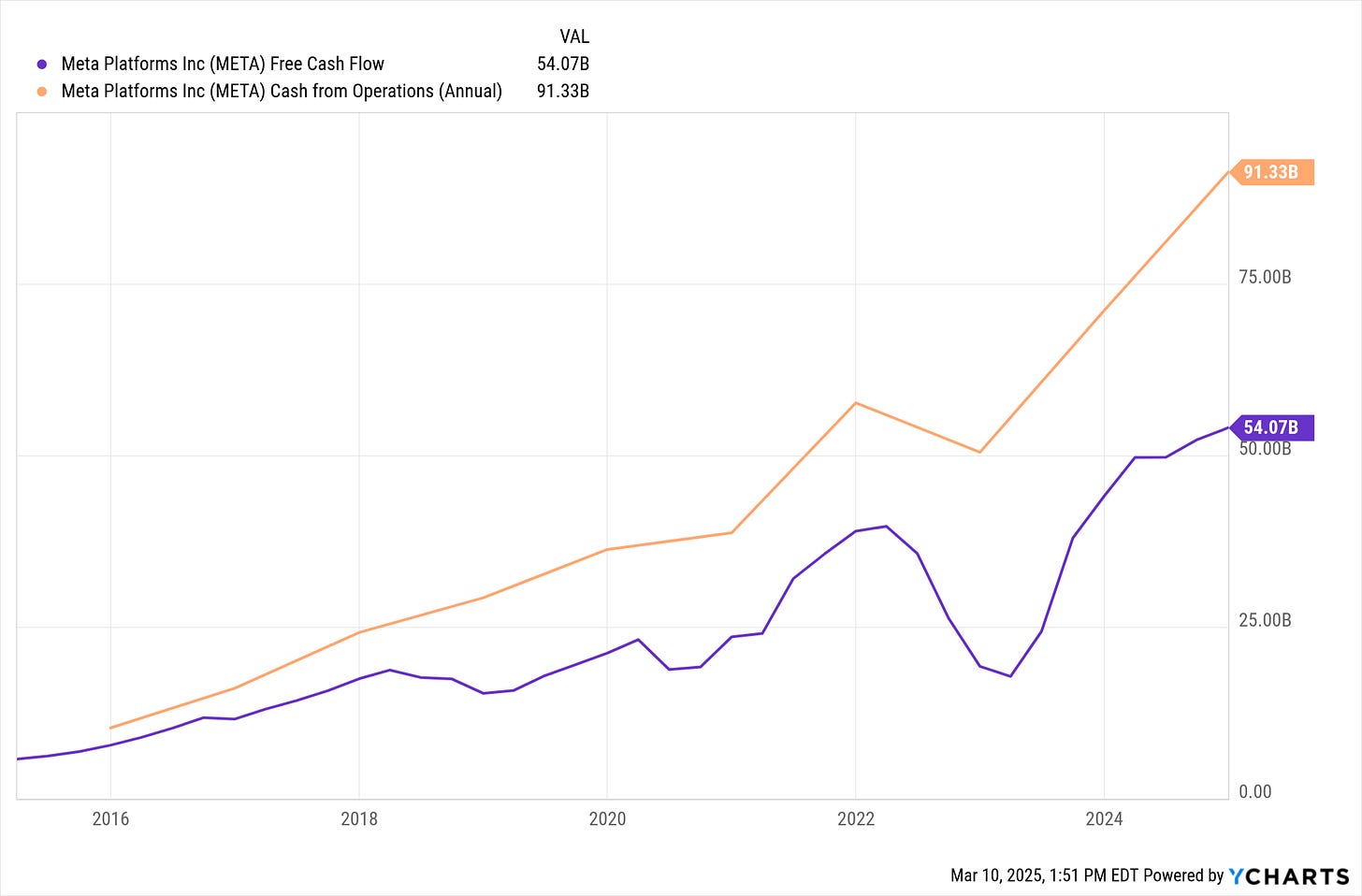

The gap between cash from operations and free cash flow has widened as Meta has matured as a company. But in Meta’s case, I haven’t seen anything that looks like wasteful, pointless spending. Back in 2022, the original vision for the Metaverse certainly looked that way, but right now, I think everything they are doing in R&D is very value-added and money well spent.

That pretty much says it all about Meta’s debt. They could pay off over half of it just using the free cash flow from a single year. There is about zero to be worried about here, and as I read through the 10-K, I didn’t find anything that I consider to be noteworthy regarding Meta and its use of debt. Also, when you consider that Meta has $54 billion in free cash flow, spending $17 billion on R&D in Reality Labs, which isn’t generating a return yet, hardly seems like a problem.

Page 60 in the 10-K is where it is again stated that nearly all of Meta’s revenue currently comes from advertising. With Alphabet, I view this as a big negative since so much of their advertising circles back to Google Search, which is fast becoming an outdated technology. Meta, however, is fundamentally different. Their product ecosystem has a sustainable network effect. What makes Instagram and Facebook work is that everybody you know is already there—this creates a self-sustaining effect. Meanwhile, with Alphabet, there is nothing stopping you from simply using a different search engine or ChatGPT. I firmly believe most of Google’s dominance came from anti-competitive practices due to this total lack of switching costs and a massive amount of name recognition. This is why I see two different tech companies, both with a huge amount of revenue coming from ads, and in one situation, I don’t mind at all, while in the other, I am very reluctant to buy in. I’ll get more into this during the 7 Powers analysis.

On page 61, it was mentioned that Meta is expanding Reels, but that Reels has a lower monetization rate than other types of content. Page 63 once again mentions that Meta is experiencing global growth currently, as opposed to growth only in localized areas. Page 65 had the interesting insight that Average Revenue Per Person (ARPP) is increasing for Meta. On page 67, global ad impression growth is increasing as well. There just isn’t anything here that makes me nervous about their advertising business. More users, more impressions, and more revenue per user is all music to my ears.

Page 71 breaks down costs and expenses. About 27% of revenue goes to R&D, and about 18% of revenue goes to “cost of revenue.” If that sounds unclear, cost of revenue includes data centers, product delivery, and traffic acquisition costs. It is also important to note that most of the cost of R&D comes in the form of salaries for employees, although the exact percentage wasn’t stated in the 10-K or in the earnings call. On page 73, as a percentage of revenue, R&D expenses have dropped by 3% since 2022.

I also noticed something called “marketable securities” on the balance sheet that caught my attention. I was curious what that was exactly. On page 95, there was a reference to equities, which made me curious if Meta was holding a stock portfolio. Page 103—It didn’t end up being all that noteworthy. Of marketable securities, nearly all of it is bonds. Out of the $33.92 billion, only $1.2 billion are in equities. I don’t believe it says anywhere in the 10-K what exactly those equities are, but since it is such a small amount of money in the grand scheme of things, I don’t care. The rest of it is in government and corporate bonds.

Now, let’s get into share buybacks, dividends, and overall return. Meta issued perhaps its first-ever dividend of $5 billion in 2024. That is such a small amount of money relative to Meta’s size that the yield on that is only 0.34%, so once again, I don’t really care.

Warren Buffett once said that share buybacks are only intelligent when a company's stock is undervalued. Meta seems to have done a decent job following that advice. The drop in the above chart is the steepest during 2022 when their PE was the lowest—excellent work. That being said, on page 78, it states that Meta has authorized $51.28 billion in share buybacks for 2025. That sounds great, but with a market cap of $1.5 trillion, it is kind of a drop in the bucket. It’s great that Meta is establishing a pattern here, as they have done share buybacks consistently since 2017. But even more importantly, the amount of the buybacks has varied.

Historically, Meta has increased its share buybacks as its PE has gone down, which is excellent behavior. Overall, I have zero complaints about their capital allocation.

Now it’s time for Hamilton Helmer’s 7 powers:

Scale Economies – The cost per unit decreases as production volume increases, creating a cost advantage over competitors (e.g., Amazon, Walmart).

I don’t think Meta benefits from economies of scale since its FoA products are not tangible items. However, this might become relevant if Meta begins mass-producing AR glasses.

Network Economies – The value of a product or service increases as more people use it, creating a self-reinforcing loop (e.g., Facebook, Visa, Airbnb).

The irony here is that it lists Facebook as an example of a network economy, which is one of the most difficult powers to establish. The concept is simple: the more people who use the service, the more valuable it becomes. Facebook and Instagram matter only because everybody else is already on the platform. This is the problem that Threads has—it's a nice and well-designed platform, but all of the public figures have accounts on X and not on Threads. I can’t tweet random information at writers for The Free Press on Threads, but I can on X. Facebook and Instagram have a network economy, as do Messenger and WhatsApp. Maybe Threads will one day, but right now, it does not.

Counter-Positioning – A new entrant adopts a superior business model that incumbents can’t or won’t replicate without harming their existing business (e.g., Netflix vs. Blockbuster).

Maybe when Facebook was brand new, it was counter-positioned against Myspace, but these days, Facebook and Instagram are the incumbents. So, no, I do not think Meta has any counter-positioning.

Switching Costs – Customers face significant costs (financial, time, effort, data loss) when switching to a competitor, making them stay loyal (e.g., Microsoft Office, Salesforce).

There is no switching cost; deactivating an Instagram account is free, as is creating an account on TikTok. Nothing is stopping anyone from leaving.

Branding – A strong and unique identity allows a company to charge a premium and retain customers, independent of the functional benefits (e.g., Apple, Nike).

I think Meta has a strong brand. Name recognition for their products is readily apparent. Who hasn’t heard of Facebook or Instagram? However, their brand certainly doesn’t allow them to charge customers more, since their platforms are free to use. It might help them charge more for ads, as businesses know they are getting prime placement on a legitimate social media network.

Cornered Resource – Exclusive access to a valuable asset (intellectual property, talent, supplier relationships) that competitors can’t easily replicate (e.g., Pixar’s creative team, exclusive rights to a rare material).

Again, I would say no for right now. Llama 4 and its predecessors are open source. Their MTIA chip could perhaps be considered a cornered resource, as could their IP around AR glasses. However, both of these technologies are still in their early days at this point.

Process Power – Unique, hard-to-replicate internal processes that improve efficiency and product quality over time (e.g., Toyota’s lean manufacturing, Zara’s fast fashion supply chain).

No.

After all of that, what is the thesis? What is our edge? The thesis is simple: Meta controls an immense FoA with a wide moat and has remained a premier social media network for decades. This generates a massive amount of advertising revenue, which they are using to create possibly the largest change in how we interact with technology since the iPhone. If you haven’t taken a look at Meta Orion, you really should:

https://about.meta.com/realitylabs/orion

That’s also what I think the edge is here. I’m a huge nerd, and I think I have a good understanding of what only appeals to us nerds and what has wide-ranging appeal to everyone. Would my mom wear some big, giant VR headset? No. Would she wear those glasses? Perhaps, at least at home. The biggest part of this is that I don’t see who else is competing in this space right now. Apple has the Vision Pro, which costs $3,500, requires a physical cable to run down your back and connect to an external battery pack, and is also the kind of bulky headset that I think only has niche appeal to nerds like me.

The last time the stock market crashed, I had too much risk in my portfolio and got caught flat-footed. I was stuck doing damage control and couldn’t aggressively pursue the best investments. This time around, I saw it coming, moved my money into defensive stocks, and put 65% into bonds. Now I have half of my money in cash, and I’m ready to go big-game hunting as other people panic sell. I took a small bite of Meta stock at a PE of 25, and I’m waiting for it to drop to 20 or lower before making a larger move. This investment follows Charlie Munger's value investing philosophy of buying wonderful companies at fair prices. This is not growth investing, where one pays a high PE for something that might happen. Even if AR glasses are a dud, Meta is still a great company.

Happy hunting.

My Portfolio:

MCD, MITSY, AFL, META

METC $17 Call 6/20/2025

FedEx Bond CUSIP: 313309AP1

As I said 50% of my portfolio is in cash right now.

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.