Well, I think the best way to describe the stock market right now is perhaps encapsulated in the phrase "shots fired!" On April 3rd and 4th, 2025, nothing was spared from the decline. I’ve liquidated the rest of my bonds in my investment portfolio, and even with the buying I’ve been doing, my portfolio is still 18% in cash. I am just thrilled right now—it takes years for buying opportunities like this to come around.

CNBC had a great quote:

Investors responded by selling everything except bonds. After all, how can anyone know what the proper price to pay for future earnings is when it’s now virtually impossible to figure out future earnings?

How Trump’s tariffs rollout turned into stock market mayhem

This perfectly encapsulates what so many people struggle to understand about the stock market. Language and word choice have a huge impact on how people think about and understand the world around them. Perhaps the most insightful part of George Orwell’s 1984 was the concept of Newspeak, where the government was intentionally changing the definitions of words. When people say things like "X amount of money was wiped out of the stock market," I take strong objection to that choice of words.

This goes back to the core concept in value investing: price does not equal value. For anybody who isn’t familiar with the core concepts of value investing, it’s time to tell you about Mr. Market.

Here’s Warren Buffett discussing Benjamin Graham’s idea:

That video is a must-watch. Buffett’s explanation is glorious and funny—especially how he’s drinking Coca-Cola out of a wine glass.

Benjamin Graham, the creator of value investing, was Warren Buffett’s professor. The basic idea is simple: you own a fractional portion of a business. Then, every day, your friend Mr. Market comes by and offers to sell you a larger stake in the business or buy you out—both for the same price. However, you notice that Mr. Market is mentally unstable. Sometimes, he becomes so depressed that you can buy more for next to nothing. Other times, he’s so out of control that he’ll offer you the moon for your stake in the business. The whole premise of value investing is to think of stocks as what they actually represent—a piece of fractional ownership in a large corporation. Stocks should not be treated like trading cards. If you know what your business is worth, then you can easily profit off of Mr. Market’s wild emotions.

I want to tie all of this together—Mr. Market, the CNBC quote, and my view that certain word choices are highly objectionable. Many people do not realize that what they are buying into are stocks with large expectations of future growth already baked into the share price. When people say “X amount of money has disappeared,” I take strong issue with that, since the money was never there to begin with. If you want to talk about something that’s hard to do, let’s talk about predicting the future accurately. That’s what many people try to do with the stock market on a regular basis. Value investing is 100% based on the concept that intrinsic value does not equal share price.

Notice when Warren Buffett was talking about valuation, he wasn’t making lofty predictions about what could happen next. That is growth investing—and it’s not what I do. I also think it’s best reserved for Wall Street professionals, solely because when the time comes to move fast, they are generally much faster than retail investors. With so many companies out there right now, nothing has changed. If you know the value of what you own, then a 10% dive in two days means absolutely nothing to you—other than a nice buying opportunity. What is changing for so many companies is the collapse of unrealistically high expectations for future growth. A lot of retail investors are learning right now just how risky that is. A while back, I stated that NVIDIA might be coming down to something around $78 a share as these growth expectations get wiped out. Right now, NVIDIA is at $94 a share—down from a high just under $150 per share.

What I always want to deliver to you are investment ideas that are not based on lofty guesses about future growth. I want to provide investment ideas based on the financial strength of a company’s balance sheet, its moat, how it returns value to shareholders, the strength of its earnings and revenue, as well as its cash flows. I want to make my decisions on tangible things—not overly enthusiastic guesses about GPU demand in the future. The exact same thing happened during the Dot Com Bubble. Everyone was right—the internet did change the world. But that didn’t stop people from getting completely carried away with themselves. That has happened again. Those wild guesses about future earnings are evaporating, and Mr. Market is alive and well. A minute ago, he was high on cocaine, and now he’s getting ready to jump off a building.

A few days ago, I stated Aflac (AFL) was faring well in the downturn. Then what happens? It takes an 8.5% dive in price in a single day. That’s just the way it goes sometimes. When markets are this volatile, you’ll drive yourself crazy trying to time everything perfectly. I’ve been increasing my stakes in Aflac, Mitsui, Meta, MGM, and JPMorgan Chase as the market meltdown continues. Thinking back to what Buffett said—I know what the value of the stocks I own is. If I buy a chunk and it takes a dive, meh. I mean, bummer I didn’t get the perfect timing, but I always buy at a fair price to begin with anyway. I also take small bites at a time in situations like this. I’ll get a good deal all the way down and won’t miss the buying opportunity completely in the event of some remarkable turnaround.

Now let’s talk about MGM and why this stock has caught my eye. I found it while screening for companies that have been doing a very large amount of buybacks relative to their market cap. This screening almost universally returned companies whose share prices have declined recently. I’ll start off with the big reason why I think the market’s sell-off of MGM is misguided. I don’t think the people selling MGM stock right now have any clue about the grip that vice has on people.

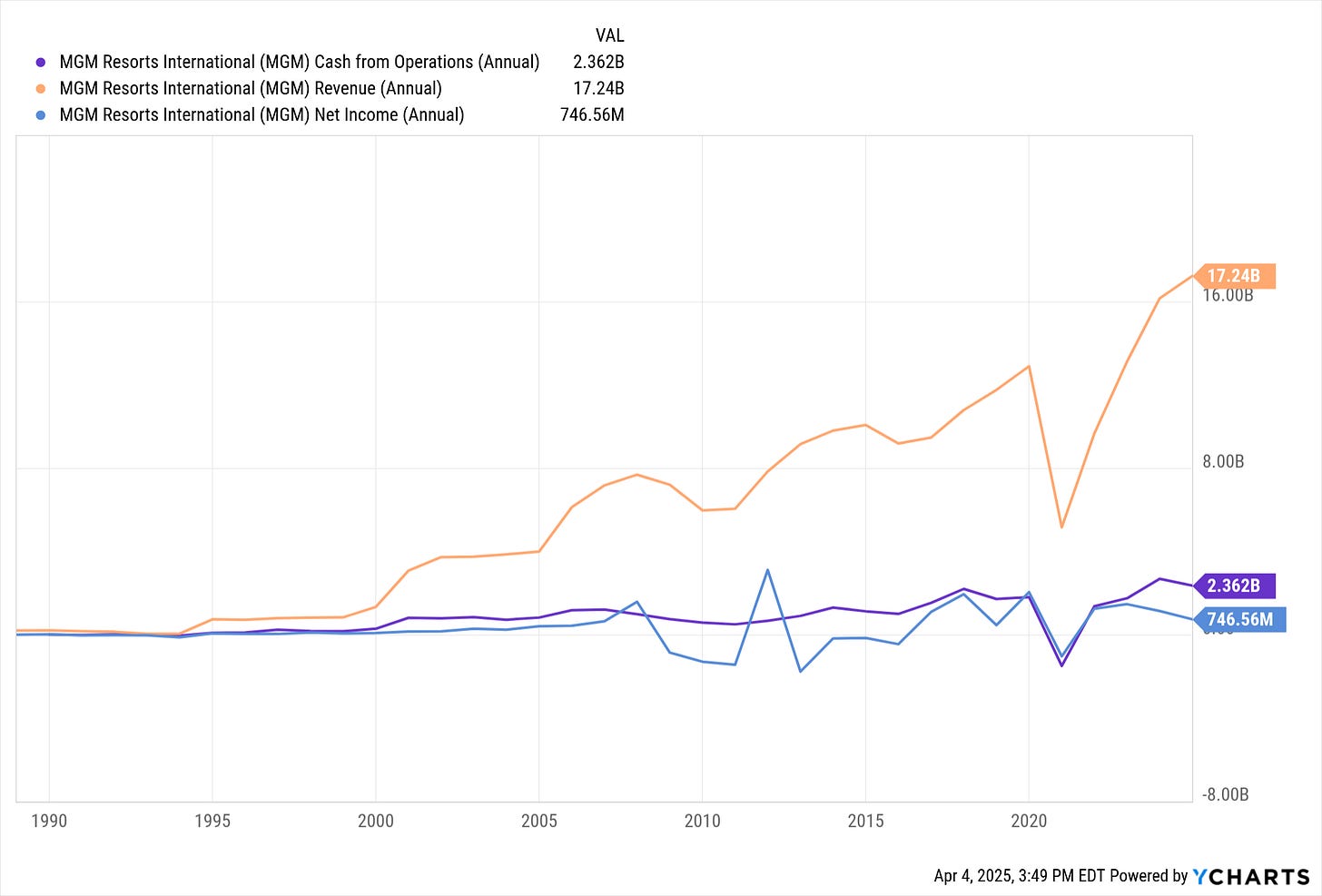

This communicates a lot of very important information. Right now, with the trade war, people are concerned about an economic decline, which is certainly driving at least a portion of the stock market sell-off. Well, how did MGM do during the global financial crisis? The answer is that MGM did just fine. Net income went negative in 2008, but as you can see, cash from operations was relatively unchanged and revenue stayed on an overall upward trend. The only reason net income went negative during the global financial crisis was because the price of real estate collapsed and MGM had to take a large write-down due to the decline in real estate values. Again, this is a cash-based accounting vs. accrual-based accounting difference. In the accrual sense, MGM lost money, but their cash flows remained unchanged. Because people don’t stop partying and gambling just because times are tough—if anything, tough times might lead people to blow off steam even more.

If you are entirely unfamiliar with MGM, I am curious if any of these names ring a bell with you:

Bellagio

ARIA Resort & Casino

The Cosmopolitan of Las Vegas

New York-New York Hotel & Casino

The MGM Grand

Excalibur Hotel & Casino

Luxor Hotel & Casino

Mandalay Bay Resort and Casino

MGM has a significant portion of the real estate on the Las Vegas Strip under their control—an area that is perhaps one of the most iconic and notorious vacation destinations in the United States. The cultural footprint of Las Vegas is also very large; there are quite a number of songs, TV shows, and movies that involve Las Vegas. It even has its own saying: "What happens in Vegas, stays in Vegas."

But MGM isn’t just limited to the Las Vegas Strip:

MGM China Holdings

MGM Macau

MGM Cotai

MGM, in partnership with Orix Corporation, will operate Japan’s first casino resort, part of a broader entertainment and tourism destination.

MGM National Harbor – Maryland

MGM Springfield – Massachusetts

Beau Rivage – Biloxi, Mississippi

Borgata Hotel Casino & Spa – Atlantic City, New Jersey

MGM was selected as a partner for the business venture in Japan in no small part because of MGM’s reputation as a high-performing casino resort operator.

There is also another aspect of MGM that is important to know: as of 2022, MGM doesn’t own any real estate on the Las Vegas Strip. They sold off the land to Vici Properties in a sale-leaseback agreement. MGM has a triple net lease on the existing properties for the next 55 years. A triple net lease is one where the lessee has total control over the property—they can make any changes they want to the structures—but they are also responsible for all maintenance, taxes, and pretty much any other kind of expense related to the property. Details of the transaction are on pages 36, 70, 71, 82, and 83 of the 10-K.

In 2024, MGM paid $2.3 billion in rent. I think a question that naturally comes to mind is, “How is selling your property and paying to lease it back ever a good idea?” Well, that is where the above graph comes into play. Between acquisitions and capex, MGM has been reinvesting the cash flows from the divestitures back into their business. It’s also worth noting that MGM still owns $484 million worth of real estate.

MGM isn’t trying to be a real estate company—they are a casino resort operator. Selling off their real estate unlocks billions of dollars for them to reinvest into their business. It also removes a few different risks from their business. There is a cap on how much their rent can be increased: initially it can only be increased by 2%, and later on, their rent increases are pegged to the consumer price index but cannot exceed 4%. Thus, out-of-control inflation isn’t MGM’s problem—that would actually make their rent cheaper. MGM also avoids having to take the massive write-down they did during the global financial crisis when the price of real estate in America collapsed. That is also not MGM’s problem.

This setup allows MGM to function as a lean casino resort operator. Given the length of the lease on their properties, I will very likely be dead by the time MGM has to renegotiate the terms of their leases. So that isn’t something I care about. Maybe my kids will—if they, for some reason, inherit this stock from me. However, when MGM’s lease is up, Vici Properties has every reason to continue leasing the properties to MGM. MGM has a strong reputation and a proven track record of success. If MGM has a 55-year history of reliably paying their rent, why would Vici want to mess with that? MGM also retains the rights to all the branding associated with their properties. Vici doesn’t own the name Bellagio, Mandalay Bay, Luxor, etc., etc. All the name recognition associated with MGM’s properties would be gone. I also don’t believe there would be anything stopping MGM from gutting the buildings on their way out. Overall, this sale-leaseback transaction is logical.

There is a consequence here to equity as well. (Pages 57, 72, 73.) MGM has about $6.2 billion of PP&E in buildings, building improvements, and land improvements—as well as furniture, fixtures, and equipment. If MGM ever went into bankruptcy, I wouldn’t hold my breath expecting them to actually realize this $6.2 billion at any point. I’ve seen these types of assets evaporate enough times in bankruptcies to be highly skeptical of dollar values assigned to them. I think it’s much more honest to say that MGM doesn’t have any shareholder equity—or perhaps even has negative equity. However, I’m not stating that MGM is lying or violating GAAP accounting rules. I suppose my problem is with GAAP accounting rules in this regard, rather than with MGM. But yeah, if MGM went bankrupt tomorrow, I wouldn’t expect to see $6.2 billion in furniture and building improvements being sold off and returned to creditors and then shareholders.

Page 58, statement of operations: MGM earns more off their casino operations than from rooms, food and beverage, and entertainment combined. If you’ve been reading my posts for a while, you’ve probably noticed I typically don’t allow hand-wringing, anxious moral considerations to impact my investing choices much—if at all. Something would have to be pretty bad, like prostitution or porn, before I would refuse to invest based on moral grounds. Casino operations include, at a 100% probability, that at least some portion of the earnings come from people with gambling addictions. I suppose this sounds heartless, but I don’t care. I’m an alcoholic. I’ve been sober for 14 years. I harbor no ill will toward businesses that produce alcohol. Plenty of people can drink alcohol without a problem—I’m just not one of them.

The prohibition of alcohol in the 1920s was entirely ineffective and gave rise to organized crime. Las Vegas also has quite the history with organized crime—that’s fortunately in the past now. I think it’s much better to owe MGM money rather than a crime syndicate that will break your fingers. I also believe in personal choice. As a mental health professional, I think the disease model of addiction is highly flawed. I think addiction is more accurately described as a choice disorder. Help is out there, and it’s possible to beat an addiction. Gambling has never been a problem for me. I know all the casino games have a negative expected value. I think it’s fun to play video poker or slots and see if I get lucky, but that’s about it. I don’t get hooked on pushing a button on a machine.

Well, actually, video poker arguably has a positive expected value if comps are taken into consideration, as well as volatility in returns from the machine and session management—assuming, of course, perfect play. But I digress…

Gambling has never been my vice. Maybe profiting off of gambling is a no-go for you. That’s a personal choice for each investor.

Now let’s get into some more charts…

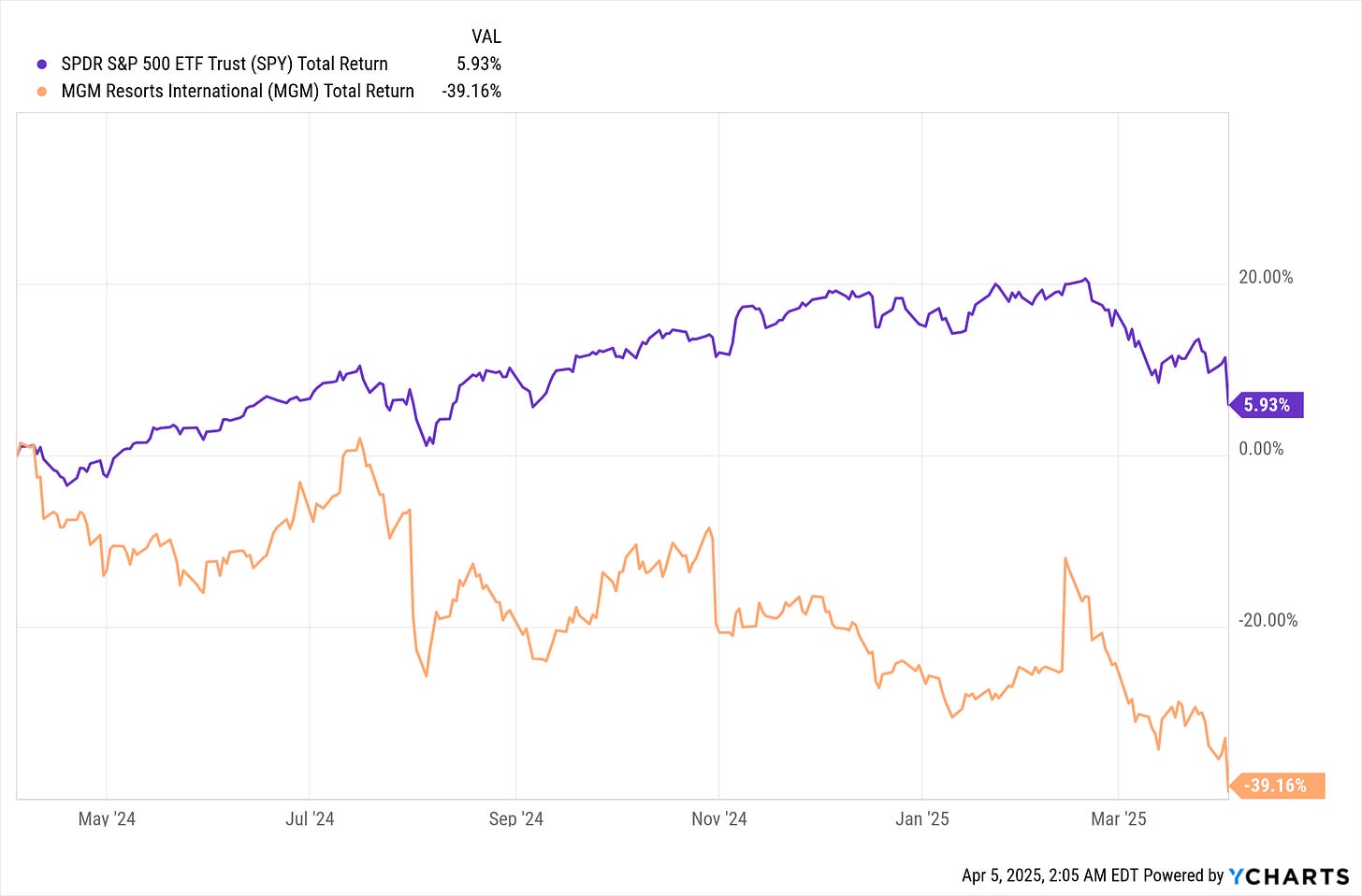

MGM vs. S&P 500 over the past year:

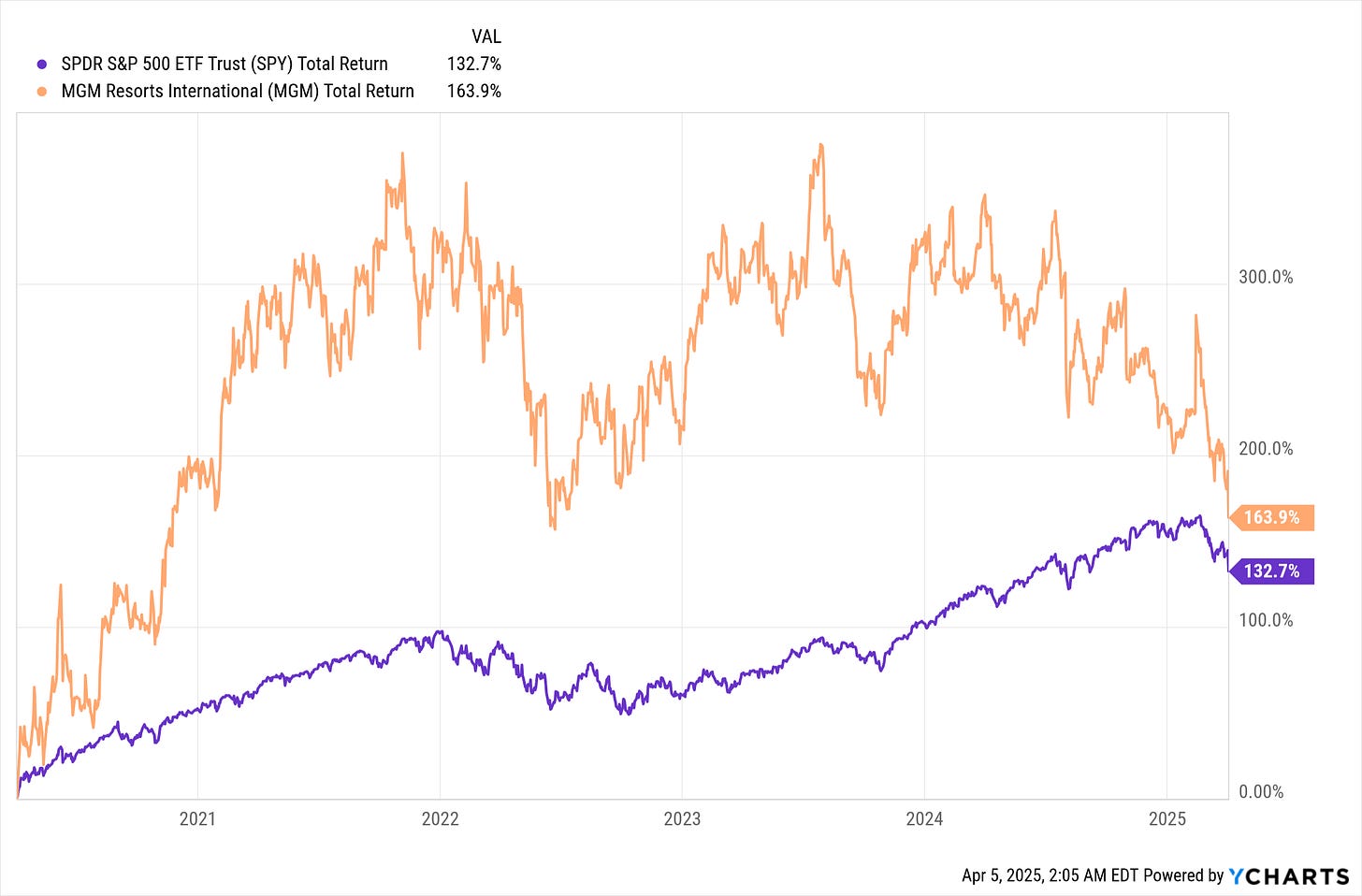

MGM vs. S&P 500 over the last three years:

MGM vs. S&P 500 over the last five years:

MGM vs. S&P 500 over the last ten years:

MGM vs. S&P 500 as far back as I have data:

So, what gives? Why am I recommending an investment that historically does not outperform the overall market?

Well…

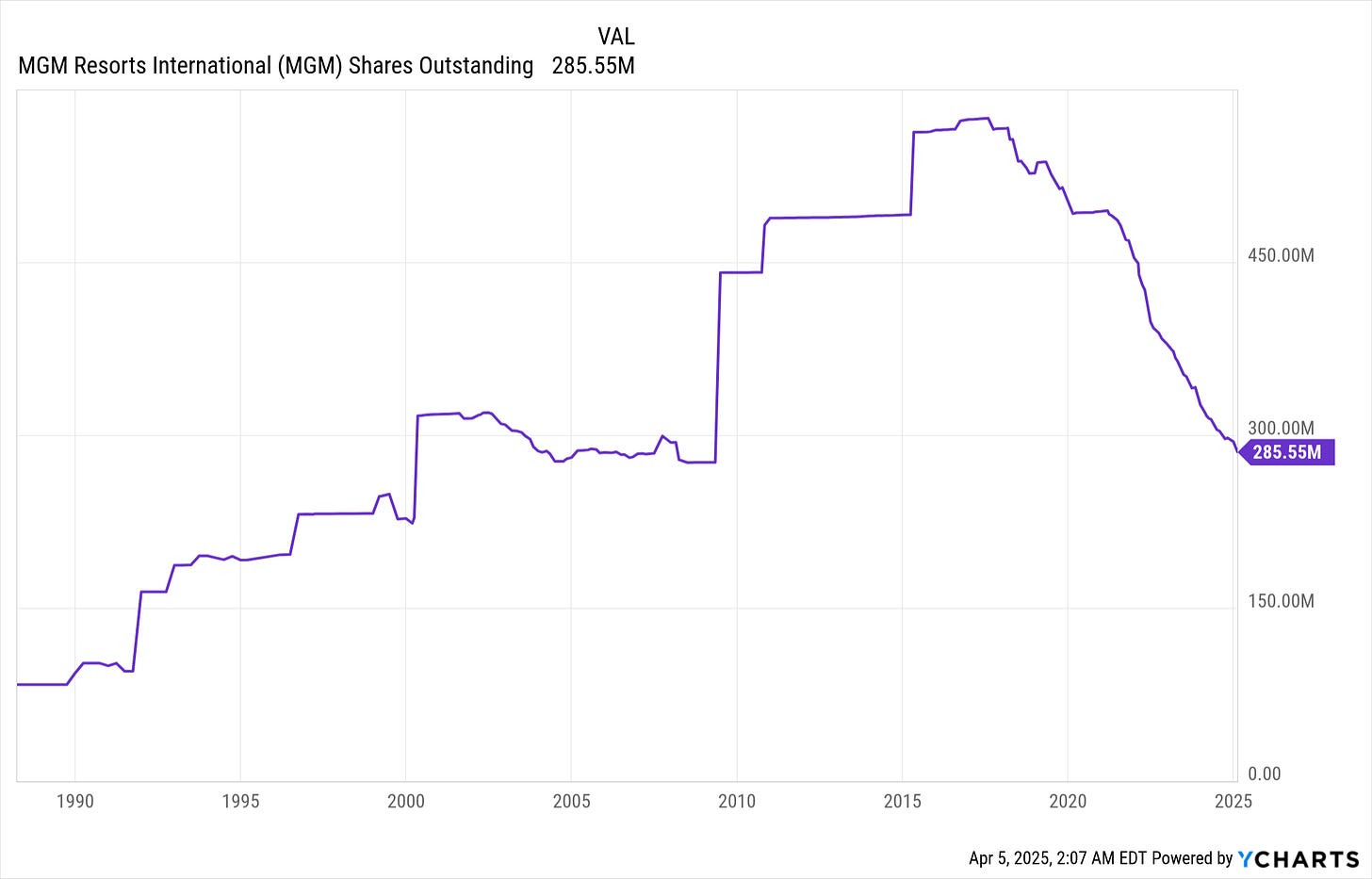

Since 2015, MGM’s behavior has drastically changed. They also recently eliminated their dividend to double down on share buybacks, which I think is an excellent choice—especially at MGM’s current PE of 11.

This change in behavior has also particularly accelerated in the last four years, during which MGM has bought back 42.1% of its common stock.

Before, I stated my opinion that the calculation of MGM’s equity is perhaps representative of a problem with accrual-based accounting. But I wanted to add these two charts to provide more clarity about MGM’s financial strength, which I think is stellar. The interest they owe on their total long-term debt is a very small portion of their cash from operations.

Also, MGM is behaving in a responsible manner with their share buybacks. All too often, I see corporations taking on debt in order to buy back shares—which is irresponsible, and I will instantly pass on the investment if I see a company doing that. Not only does MGM have a strong record of returning value to shareholders through buybacks, but they also halted their dividend to focus on buybacks, which I like even more. At the same time, they’ve been paying off their long-term debt.

Call me a nerd, but I love financially responsible behavior.

Hamilton Helmers 7 powers:

A great way to understand moat.

Scale Economies – Cost advantages from larger scale.

I don’t think this is present over any of MGM’s competitors. I don’t see their scale getting them a better deal on much of anything over their competition. At least not to a point where it would be meaningful.

Network Economies – Value grows as more people use the product.

I actually think the opposite is true. Resorts and amusement parks need to control the number of people present because too many people make the experience worse. Disney does this with their amusement parks. Four hour long lines for every ride is a negative not a positive. A true network effect is where more users make the experience better.

Counter-Positioning – New model disrupts incumbents who can’t copy it.

No, MGM is the incumbent not the distruptor.

Switching Costs – High friction for customers to change providers.

No, people can go to another resort with zero barriers.

Branding – Strong brand creates customer preference and pricing power.

This I do agree with—I think MGM’s properties carry strong brands. In The Hangover Part 3, Leslie Chow parachutes over the top of the fountain at the Bellagio. Tupac was shot after leaving the boxing match between Mike Tyson and Bruce Seldon at the MGM Grand. These locations are burrowed deep into the American consciousness.

Cornered Resource – Exclusive access to a valuable asset.

100% — There is only a finite amount of real estate on the Las Vegas Strip, and MGM has control over a large portion of it.

Process Power – Unique processes that are hard to replicate.

I do think there is a bit of this here. Casinos have to comply with a lot of government regulations. Creating an establishment that offers its patrons more than what a mere roadside casino does is a skill. Creating an experience rather than just providing a simple service is a degree of process power.

Everything I’ve said is why I like MGM—why I think this is an inflection point in MGM’s share price performance compared to how it has performed historically. This current stock market collapse means MGM’s share buybacks will only be more impactful. They did $1.35 billion in buybacks last year, and as of this writing, that is 17.5% of MGM’s total market cap. What’s not to like about that?

Right now, I’m just going to kick back, relax, and gradually increase the size of my stakes in the stocks that I own. I might add an investment to my portfolio if something on my watchlist falls far enough to become enticing.

Okay, bye-bye now.

My Portfolio:

MCD, MITSY, AFL, META, JPM, MGM

METC $17 Call 6/20/2025 - You might be wondering why this is here. This is best understood as a guess that I took with an extremely small amount of money—think 0.005% of my total portfolio.

18.24% of my portfolio is cash right now.

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.