A while back, when the stock market took a dive, I sold off my shares in Apple, saying I didn’t want anything with a high PE ratio at that time. Well... I'm about to partially go back on that statement. Sort of. I’m considering both Fiserv and ADP, but today, I'll focus only on Fiserv. Stock market investing is both a science and an art, which is why there are often exceptions to my rules. The same goes for CCB, which remains a great stock on my watchlist, but every investment must be compared to all others, and it hasn't yet edged out the competition to re-enter my portfolio.

The reason I’m generally against owning most high PE tech stocks right now is that investors are paying up for future growth based solely on hopes and dreams for AI. That just isn’t enough for me to invest with confidence. I always had one foot out the door with Apple, essentially capturing the bump in share price when they announced their next generation of products, then cashing out. Fiserv is different from many other high PE companies in a significant way: its valuation is based on the sustainable competitive advantage of products it is selling right now, rather than on expectations of what products might be created years into the future.

Here’s a link to the 2023 10-K if you’d like to follow along. Look at the number at the bottom of each page, not the page number in the PDF reader.

What exactly does Fiserv do? About 20% of its revenue—and the core of its business—comes from core processing systems for banks. In Fiserv's 10-K, this is referred to as their Fintech segment. This software is the most important computer system a bank uses, one it would be completely crippled without. Core processing enables banks to maintain deposit accounts and loans; it’s the software that keeps track of the money in your checking account. Without it, a bank wouldn't know how much money anyone has and wouldn’t be able to transfer money digitally. This is very base level mission critical computer software. It has to be secure and 100% reliable. The entire modern financial system would grind to a halt without this technology, even more so than if the Visa or Mastercard networks failed. Needless to say, their core processing customers are extremely sticky.

Normally in life stickiness is undesirable, especially if you don’t know why something is sticky. But when it comes to sustainable competitive advantages, you want customer relationships to be exceptionally sticky. How sticky are we talking? Fiserv retains 99% of its core processing clients annually. Core processing accounts for about 20% of their total revenue. Consider the risks if a bank tried to switch software providers and something went wrong and nobody can withdraw money from their accounts. Also, think about the learning curve involved in training every employee on a new system. All these factors contribute to high customer retention.

The Fintech segment isn’t exclusively about behind-the-scenes technology, some aspects are more visible. Have you ever used a mobile app to deposit a check? Fiserv can provide that capability to banks. In fact, it can offer an entire mobile banking solution for banks that don't want to or can’t develop their own—a process that is both costly and time-consuming. Fiserv refers to this as Digital Financial Solutions (see page 4 of the 10-K).

The final component of the Fintech segment is Enterprise Payment Solutions. I think it’s best to quote the 10-K directly here since I don’t believe I can simplify the description any further:

Our enterprise payment solutions products and services enable operating efficiencies and management insight by providing financial institutions with the infrastructure they need to process, route and settle non-card-based electronic payments, including Automated Clearing House (“ACH”), wire and instant payments, and to efficiently manage associated information flows. Our enterprise payment solutions business includes our Payments Exchange platform, which provides multiple payment capabilities, including domestic and international wire transfers and real time payments connection to the FedNow Service and RTP Network. Enterprise Payments Platform is a multi-entity, multicountry, multi-currency, multi-clearings, single payments platform processing all payment types, connecting financial institutions to clearings and correspondents wherever they operate. PEP+ is another enterprise payment solutions offering, which is a mainframe system that allows financial institutions to automatically receive and originate electronic payments through the ACH network in a straight-through processing manner. Clients may use our payment platform applications on a licensed or hosted basis, and as an add-on to existing legacy technology or as a stand-alone comprehensive modern payments platform.

Yeah, I didn’t know how to boil all that down.

The next business segment, Payments, makes up about 40% of Fiserv’s current revenue. This includes services like Debit and Network Processing, Credit Processing, Output Solutions, Digital and Bill Payments, and Biller Solutions. So, what does all of that mean? As explained on page 4, Fiserv provides businesses and banks with all the software they need to process virtually any kind of digital financial transaction—credit cards, debit cards, ATMs, direct account transfers, electronic billing, etc. Essentially, any way you can imagine moving money without using cash or checks, Fiserv offers the technology to make it happen.

There's a significant moat here, though perhaps not as strong as in the Fintech segment, which covers the core processing systems. Switching the service provider for debit and credit transactions is no small matter. How happy would you be if a computer glitch meant you couldn’t buy groceries with your debit card? This software must be glitch-free, completely secure, and operational 24/7/365. A company with a proven track record of reliability has a clear advantage over a new startup.

Next, we come to the Acceptance business segment, which starts on page 2 and accounts for the remaining 40% of Fiserv's revenue. The flagship product here is Clover, a point-of-sale system and complete business solution for merchants. It's the physical device you use to swipe, insert, or tap your payment card at a register. Clover also offers online ordering solutions for businesses. I’ve noticed several restaurants in my area using Clover. Additionally, Clover Capital allows merchants to borrow against future credit transactions to get cash upfront (see page 52).

This is the least moaty aspect of Fiserv’s business. While businesses can certainly switch their point-of-sale systems or online ordering solutions, doing so can be costly and inconvenient. As long as the current system works well and is reasonably priced, there’s little incentive for businesses to change.

I feel like my explanation of their business has been a bit underwhelming. None of it sounds very exciting but the important part is how critical their products are to their customers. As well as the difficulty a new start up would have in attempting to steal away a customer. In Fiserv’s industry there is a strong bias towards proven and trusted software providers.

Before I unleash a barrage of charts, it's important to remember that Fiserv is a rapidly growing company:

2024 Q2 Earnings Call Transcript

Before I speak further about valuation lets get to those charts:

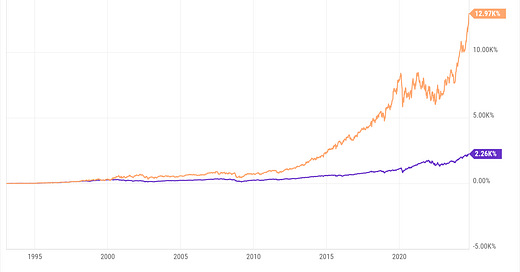

FI vs. SPY as far back as my data goes:

FI vs. SPY last ten years:

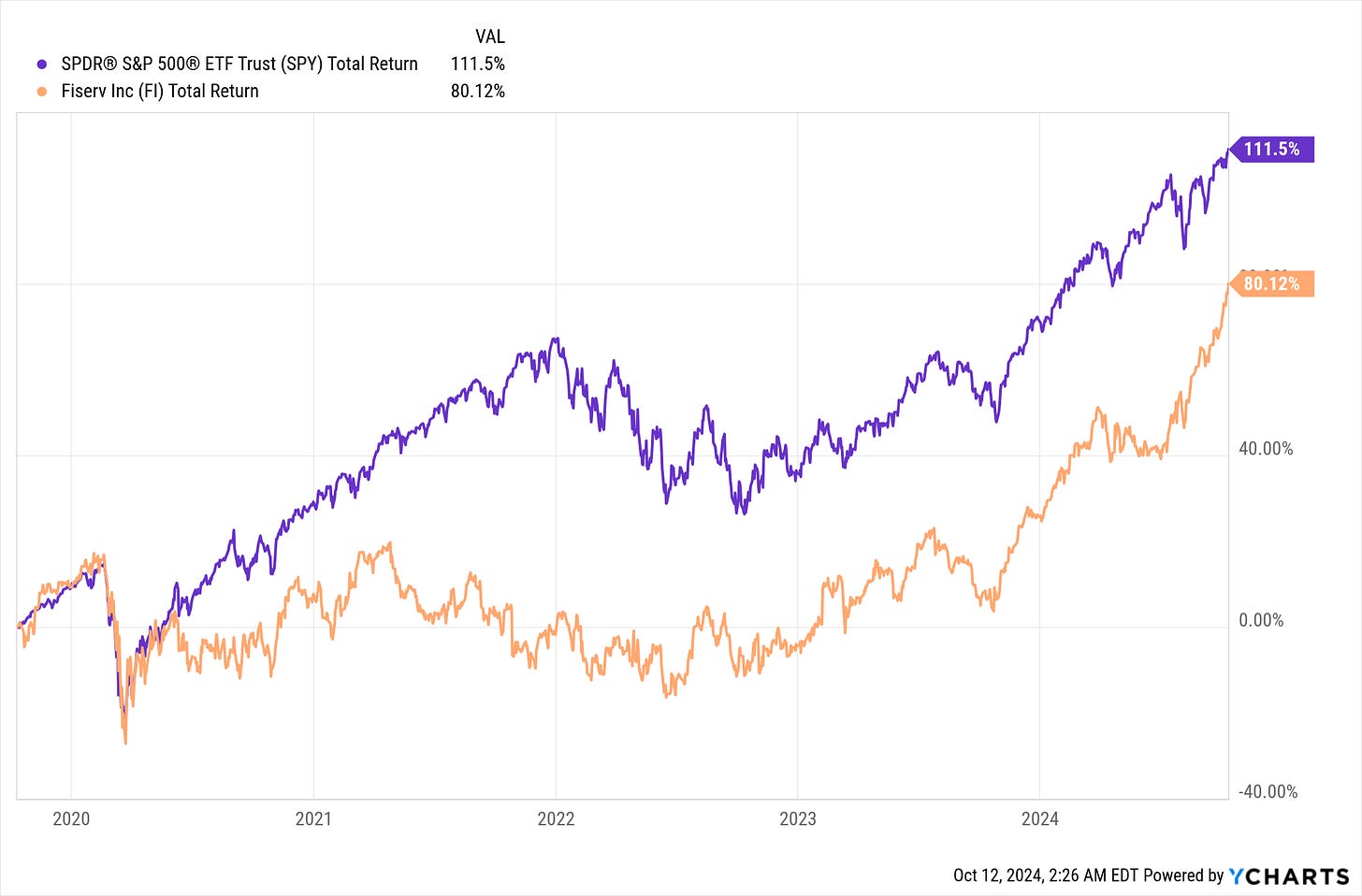

FI vs. SPY over the last five years:

FI vs. SPY over the last three years:

FI vs. SPY over the last year:

Looking at these charts, it’s clear that Fiserv has significantly outperformed the S&P 500 overall. However, there’s an important lesson here, if you bought shares at any time other than five years ago, you still did quite well. The risk of buying at the wrong time is very low. Let's explore how even a difference of six months can impact investment returns:

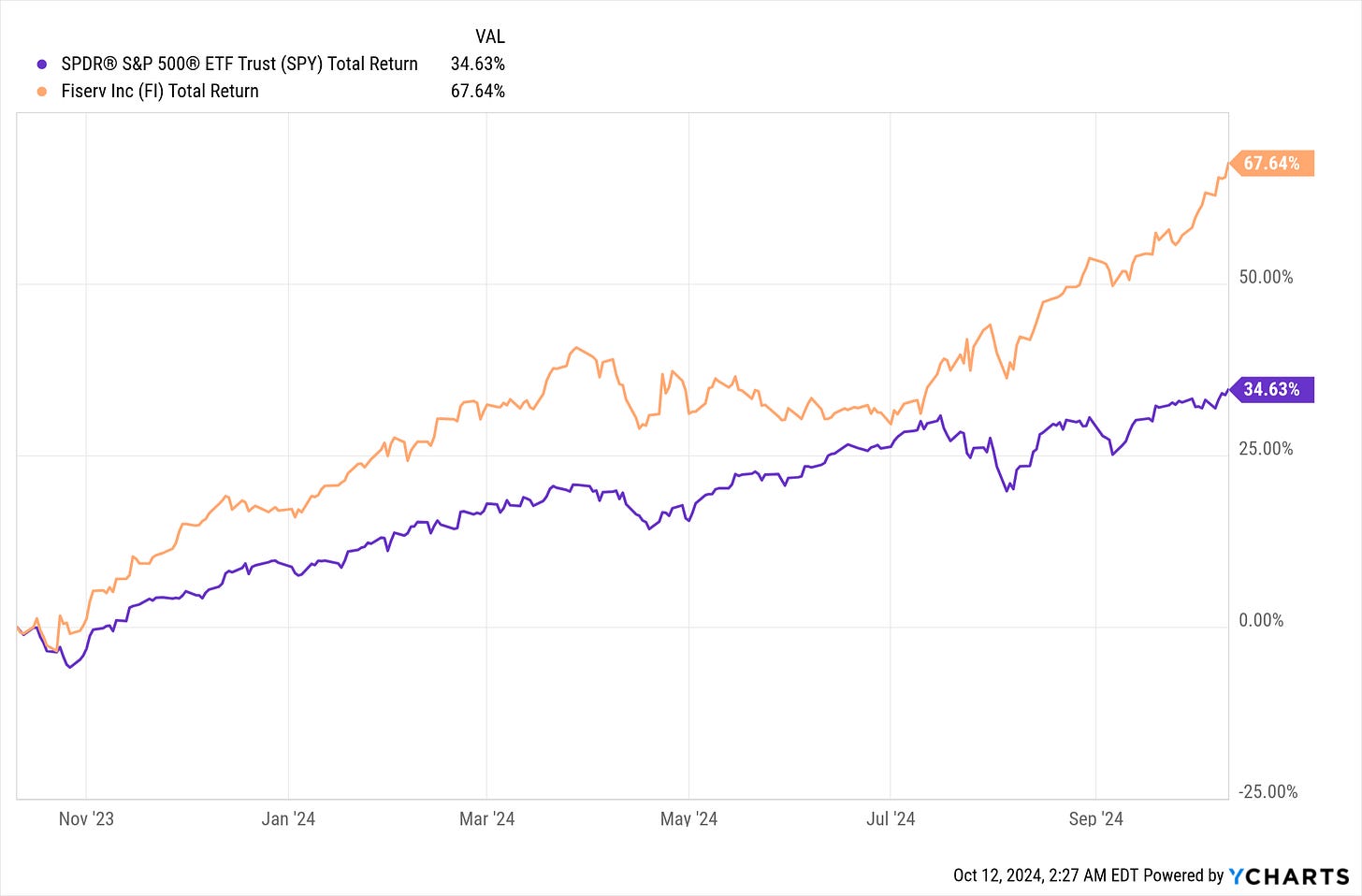

FI vs. SPY since March 1, 2020:

FI vs SPY since August 1st, 2020:

What happened here is that Fiserv was much slower to recover from the bottom of the COVID stock market crash than the overall market. Needless to say, the government-mandated closure of numerous businesses across the country hit a corporation focused on processing financial transactions quite hard. It’s a reminder that stock market crashes can be profitable times, but you have to consider which stocks are going to bounce back like a rubber ball and which ones won’t. Fiserv is a wonderful business, but that wasn’t a great time for it.

At the bottom of the COVID crash, one of my big wins was Park Hotels and Resorts—but that’s a story for another day. The key takeaway is to remember the Q2 earnings slides and call transcript: this isn’t March 2020. Fiserv is humming along just fine right now. If you bought stock before the COVID crash, it didn’t make a difference in the long term, and the same goes for those who bought afterward. It’s hard to underperform with an investment in Fiserv, and there’s no reason to think that right now is one of those times.

Now more charts:

At long last, I’m showing a total return and shares outstanding chart that does not form the perfect inverse correlation I like so much. So, what happened in 2019? Fiserv acquired First Data and funded the acquisition with a large amount of stock. When a company issues shares like this, it comes at a direct expense to shareholders, significantly diluting the value of existing shares. You’ll notice this happened right before the COVID crash, and the timing didn’t work in Fiserv’s favor. The massive dilution only served to further slow down the recovery of the share price.

So, what did we get from this acquisition?

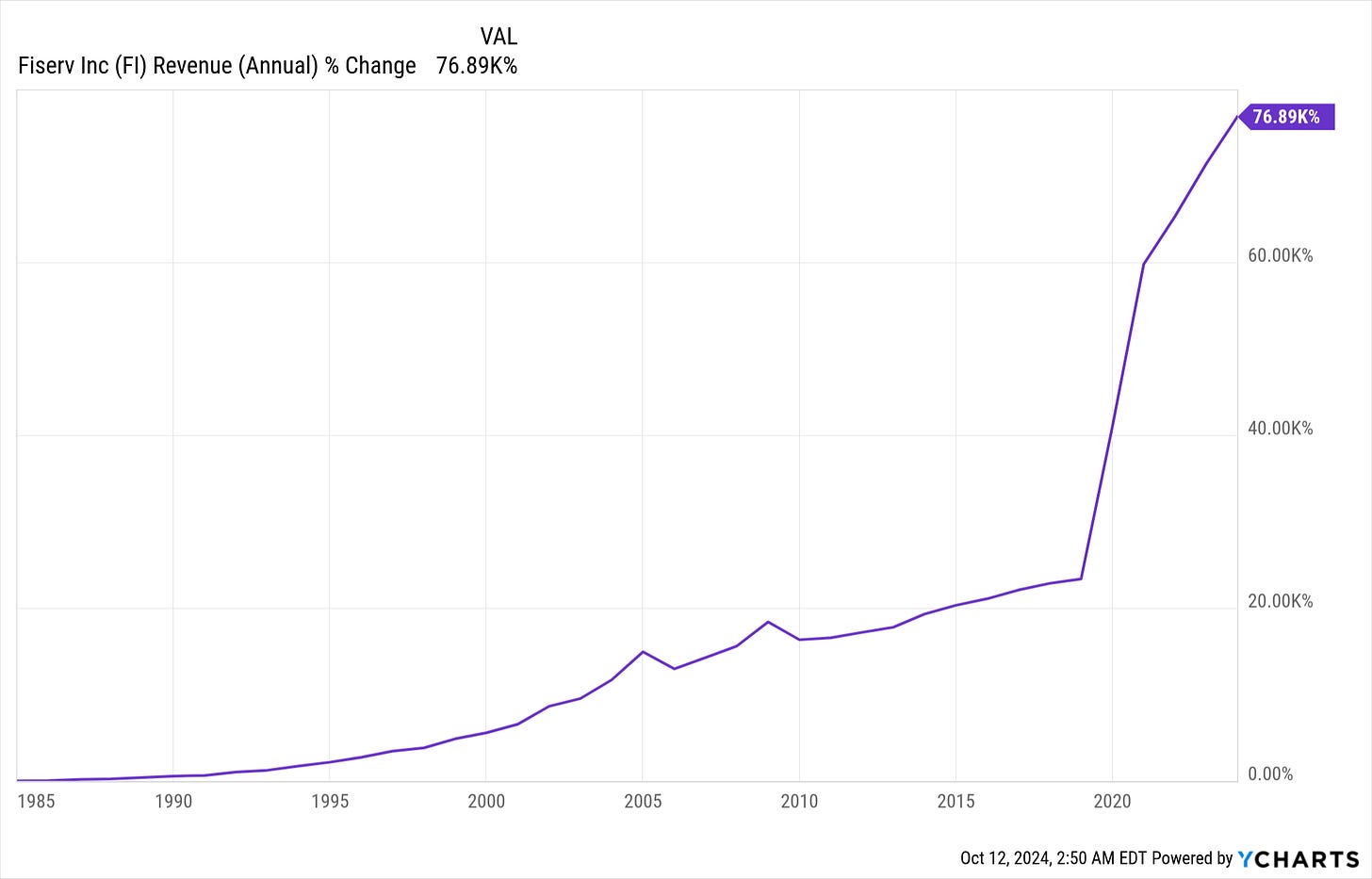

A huge F’ing increase in revenue:

Yeah that spike started in 2019. Heres a chart that shows revenue growth since January 1st, 2019:

Yes, Fiserv made a huge acquisition, largely at the expense of shareholders, by significantly diluting the value of their shares. However, the investment paid off in a big way, and Fiserv has been doing right by shareholders through aggressive share buybacks to reduce the number of outstanding shares.

This chart shows Shares Outstanding since July 23, 2019—the day after the large spike in shares—capturing all the buyback activity since the acquisition:

Given the huge gains in revenue and the aggressive buybacks I ultimately approve of managements decision. I think the acquisition of First Data has been long-term value added for shareholders.

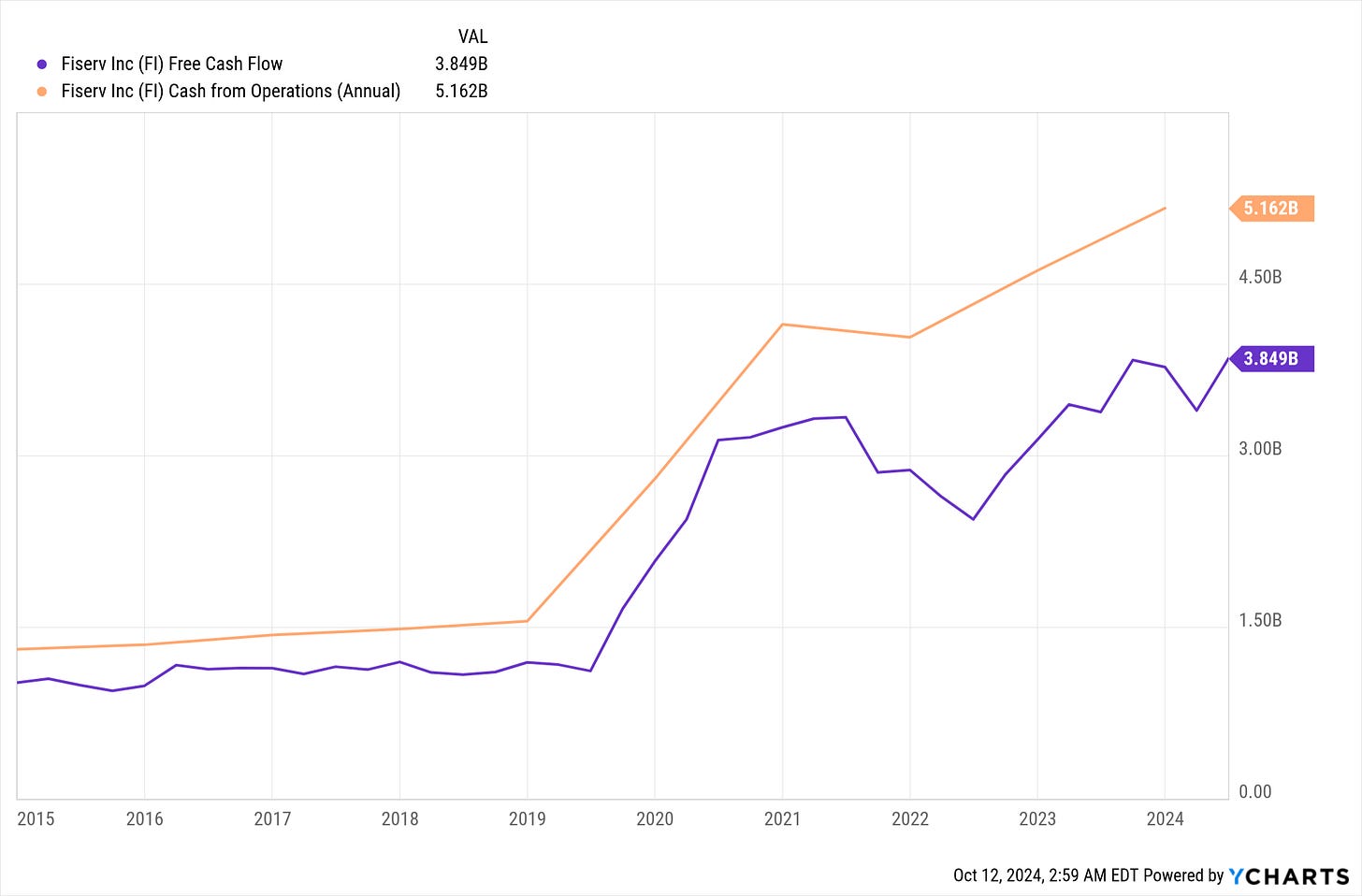

Free Cash Flow and Cash from Operations for the last ten years:

As we can see, a large amount of Fiserv’s Cash from Operations is Free Cash Flow, which allows Fiserv to aggressively return value to shareholders. We can also see how the acquisition more than doubled Free Cash Flow since 2019. Whats not to like?

PE last ten years:

EV to EBIT last ten years:

This gets into the nuance of value investing. A search of the Value Investing subreddit shows that Fiserv hasn’t been mentioned there in two years, highlighting the simplistic view many people have of value investing. The basic premise is to find mispriced stocks—situations where you can buy a ten-dollar bill for five dollars. The idea is that markets aren’t always efficient, and people can get carried away by emotions. The subreddit tends to focus on well-known stocks that have taken a dive in share price. The problem is that professional investment bankers don’t always get it wrong. In fact, more often than not, they’re decent at their job.

This is why if you average the PE ratios of the five individual stocks I’m currently invested in, you get a PE of 21. This never would have happened in my early days of value investing. It goes against the original Benjamin Graham approach, which is what I followed when I bought Toyota stock on a dip. It’s still a profitable strategy to pull out of the playbook from time to time, but this approach is better. There’s a reason Charlie Munger convinced Warren Buffett to shift to focusing on wonderful companies at fair prices instead of cigar butts. Wonderful companies like Fiserv, which generate free cash flow consistently, and are likely to continue outperforming due to their moat.

This is the nuance to value investing, other people aren’t clueless and have priced in a lot of future growth. If you take the Graham view that a fair PE is 15, as I do, then Fiserv’s PE suggests the market is valuing it at double its no-growth value. This is why I don’t buy in gradually over time, I make one big move, then stop. People can be irrational and bid the stock up for too long. Referring back to the charts, Fiserv had a total return of 83%, compared to the market’s 39%. If you made one big move three years ago, even if some bad news caused Fiserv's share price to drop 15% tomorrow, you’d still be well ahead and could cash out if you wanted. But if you bought gradually over three years, a drop in share price could mean you underperformed the market.

Both Munger and Buffett address this directly. Munger often says that investing involves a lot of sitting on your hands doing nothing, followed by sharp, decisive action. Buffett likens investing to playing baseball where nobody calls strikes, you can let pitches go by until you see the perfect one to hit a home run. That’s how I can look at a stock with a PE of 30 and still see it as a value investment. Right now, I view it as undervalued relative to the company’s long-term cash-generating ability and moat. This is the distinction from most tech stocks right now. Fiserv provides mission critical products that have well established long-term demand. This is not the same risk that is present with a stock that is entirely dependent on the rise of AI. Fiserv isn’t waiting on the rise of the global financial system, it already exists, Fiserv is simply making it better.

There’s a reason I only hold five stocks. One of my favorite movies and books is The Big Short, about the people who predicted the 2008 global financial crisis and profited by shorting the housing market. What I found inspiring was how Michael Burry discovered the trade: by reading through hundreds, if not thousands, of pages of data, examining the exact mortgages in various mortgage-backed securities, and recognizing that Moody’s and S&P had grossly overstated their creditworthiness. That’s what I do—I spend hours and hours digging through stocks to find gems. I read many 10-Ks of companies I never end up investing in.

One of my favorite movies scenes of all time:

The point of this long ramble, mostly written at 1:00 a.m., is to say that Fiserv has a high PE right now. But it’s still undervalued relative to the company’s free cash flow, future growth, and momentum.

Speaking of momentum:

One year daily price movements and SMA’s:

Five year weekly price movements and weekly SMA’s:

As you can see, Fiserv has strong momentum. There has been quite a bit of movement in my portfolio recently, but I expect that to slow down soon. I'll likely start writing more about investments I believe are bad ideas or share my thoughts on the market in general, as it might be a while before another opportunity catches my eye. Then again, the market is an unpredictable place, so you never know.

Now, let's nail down Fiserv's moat using Hamilton Helmer's 7 Powers:

1. Scale Economies

Definition: Achieving lower unit costs by increasing production volume. Businesses with scale economies can spread fixed costs over a larger number of units, making it harder for smaller competitors to match their efficiency.

Fiserv is primarily a financial software company, and computer software represents the ultimate scale economy. Once the engineers build the product, the company can replicate the software and distribute it to hundreds of customers at virtually no additional cost. In contrast, auto manufacturers spend years perfecting their production processes to be as cost-efficient as possible. Software companies, on the other hand, can just click a few buttons and—boom!—a copy of the program is ready.

2. Network Economies

Definition: The value of a product or service increases as more people use it. Businesses that can create network effects build strong competitive barriers, as customers are drawn to platforms with the largest user base.

I don’t see a network effect here. One could argue that as more people use a piece of software or the Clover point-of-sale system, the company generates more revenue to improve the product. However, that’s true for virtually any product and doesn’t accurately characterize a true network effect.

3. Counter-Positioning

Definition: A new business adopts a superior model that incumbents cannot replicate due to the disruption of their existing business practices. This strategy forces incumbents into a dilemma, where adopting the new model would harm their current operations.

As far as I can tell, Fiserv is the incumbent in this space and doesn’t employ any sort of contrarian approach.

4. Switching Costs

Definition: High switching costs make it difficult for customers to leave a company once they are invested. These could be financial, psychological, or technical barriers.

Yes, there are significant switching costs. Nearly all of Fiserv’s products are mission-critical financial services that must be error-free and constantly operational. They are also deeply integrated into customers' businesses. Switching providers comes with the risks of worse performance, the expense of purchasing an entirely new system, and the challenge of migrating all of a corporation’s data. Some of Fiserv’s products even boast a 99% annual customer retention rate.

5. Branding

Definition: Strong brands create customer loyalty and trust, allowing companies to command premium prices and gain customer retention. Branding power is about being associated with positive and differentiated characteristics in the minds of consumers.

I believe Fiserv benefits from its brand. Since these are mission-critical systems, established brands with a strong reputation have an advantage. Businesses are unlikely to take risks on cheaper products when it comes to essential computer systems that need to perform reliably.

6. Cornered Resource

Definition: A company controls a valuable resource that others cannot easily access. This could be intellectual property, regulatory approval, or access to unique natural resources.

No, computers aren’t a cornered resource, and I don’t think Fiserv’s intellectual property is entirely unique.

7. Process Power

Definition: Superior business processes that are difficult for competitors to replicate. This can involve proprietary techniques, company culture, or workflows that lead to better performance.

I think Fiserv does have process power, especially given that its products are mission-critical. I once had a therapy client who was a software engineer, and he was laughing about a new competitor to his company. His reasoning was that they had thousands of hours of runtime on their software, which had undergone years of debugging and refinement. He found it amusing that a startup was claiming its product was equally reliable. I think this describes Fiserv’s position well—they’ve been at this game for a long time.

Sometimes I forget to mention personal edge when recommending a stock, but today, let's not overlook it. The edge here is straightforward: individual investors make up about 20% of trading volume on the stock market, and I doubt many of them take the time to understand what Fiserv does. It’s not that they couldn’t grasp it, but they'd rather buy more Nvidia stock and follow the latest investment trend than put in the effort to understand Fiserv's business.

As for institutional investors, I think there’s a lack of appreciation for Fiserv’s moat and the difficulty of replicating what it does, especially in the realm of computer software that most people working in investment banking never directly interact with. I’m continually grateful that my older brother, a software engineer, got me interested in programming at a young age.

I have a feeling I won’t be making significant moves in my portfolio for a while. I believe the stocks and ETFs I currently hold still have plenty of room to run. But then again, the stock market is unpredictable—it could crash tomorrow, presenting more attractive opportunities. Since every investment is measured against all other potential investments at all times, it’s best not to get sentimental about holding stocks.

My Portfolio:

FI, ADP, MCD, AFL, VLO, ITB, PPA, MOAT

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.