When I first heard about Bitcoin, I thought it was the stupidest thing I had ever heard of, and it blew my mind that people would pay for digital monopoly money. I haven’t wavered in that stance at all. Back then, Bitcoin wasn’t expensive either; I heard about it online as soon as it was created. I thought the blockchain was an interesting technology, but buying Bitcoin as a useful currency or as some sort of financial investment was a foolish thing to do. Things have changed quite a bit since 2009, and it's worth discussing. But Bitcoin continues to be a flaming pile of garbage.

I’m no expert on cryptocurrency, but in my mind, there are three general categories. First, you have the shitcoins, which include Bitcoin and all the others that serve as nothing more than mere digital tokens. This is the pinnacle of the Greater Fool Theory. Then, you have decentralized computer networks such as Ethereum, Solana, and probably a few others as well. Lastly, there are the real-world applications of the technology, such as Tether, USDC, Ripple, Filecoin, and Chainlink.

On this fine day let us embark down the crypto rabbit hole into wonderland. Come along and nerd out with me.

First lets start with the shitcoins…

Bitcoin was created in 2009 by an unknown person or group using the name Satoshi Nakamoto. It operates on a peer-to-peer network that allows users to send and receive payments without relying on a central authority. Transactions are verified by network nodes through cryptography and recorded on a public ledger called a blockchain. Bitcoin doesn’t do anything except function as a digital token that can be exchanged between its users and operate securely outside of the traditional financial system.

Bitcoin’s first main use was as a payment processing network for criminals. Let us focus in on February of 2011 and October of 2013.

Above there was perhaps the first exponential curve ever in Bitcoins price chart.

And for October of 2013?

We are now witnessing what is perhaps the second major exponential curve in Bitcoin’s price growth.

Why did I focus on these specific dates? February 2011 was when the Silk Road was created, and October 2013 was when its founder was arrested, eventually receiving a sentence of life without parole in 2015. The Silk Road was an online black market operating on the Tor network that facilitated the sale and distribution of drugs, hacking tools, and personal information used in identity theft. Payment was accepted in— you guessed it— Bitcoin.

It’s more likely than not that these surges in Bitcoin’s price were caused by the Silk Road. Back in 2011, a surge of people needing Bitcoin to buy drugs and stolen social security numbers fueled a rise in the coin's price. Similarly, in late 2013, as the arrest of the Silk Road creator was making headlines, another surge of interest in Bitcoin occurred. The tailwind that Bitcoin and its fellow shitcoins have always had is crime. When I start talking about Tether and USDC, I’ll give a detailed example of how money laundering can work with crypto.

Bitcoin’s rise was not being driven by its function as a store of value or as replacement to the dollar. The initial driving force was its use as an illicit payment system outside of traditional regulated banking. But what about the claims of Bitcoin functioning as a currency?

This is a historical price chart of Bitcoin over the last 20 years. It’s simply too volatile to ever function as a currency. Imagine if the value of the dollar fluctuated this much. Nobody would know when to make a purchase, and similarly, merchants would never know when to sell. Is the value of the currency overheated and set to collapse? How much should someone charge for an item? If the dollar were as volatile as Bitcoin, there would be chaos. So, no, that use case doesn’t make any sense.

Once it became clear that Bitcoin was useless as a currency, the true believers quickly pivoted to the idea of Bitcoin as a store of value, calling it 'digital gold.' The main problem with that argument is that actual gold isn’t that great, and digital gold is an even more useless version of real gold. Gold has legitimate uses in consumer electronics and jewelry. Unlike Bitcoin, there’s something that drives demand for gold aside from people simply hoarding it. But how does it perform as an investment?

So, this compares the prices of an ounce of gold to that of a Bitcoin. Just to make an initial point here about how Bitcoin is a creature of its own and has very little in common with gold in terms of its price performance.

This is the historical price of an ounce of gold going back to 1978. So, let’s cherry-pick the data here in favor of gold and see how it stacks up against the stock market. I’ll create a chart comparing the percent change in the price of gold and the percent change in the stock market, starting in 2005, while conveniently ignoring the decades of poor performance in gold’s price. Let’s give gold every possible advantage in this head-to-head comparison.

Also, take note of how much more volatile Bitcoin’s price is compared to gold. 'Digital gold' isn’t something to brag about, and it’s not even an accurate term.

Even being as favorable as we possibly can to gold it significantly under performs the stock market long-term. The global financial crisis saw a surge in the price of gold as Glenn Beck went on Fox News nightly, standing in front of a white board, preaching the value of precious metals while taking money from cash for gold businesses on the side. It is worth noting that a major television network was running a gold pump and dump scheme at the time… but I digress.

Over the last ten years its not even close, gold is a bad investment.

And if we go back to the 1980s, gold gets completely crushed by the stock market. So, making the case that Bitcoin is 'digital gold' is a pretty weak argument. Gold isn’t that great, and if you like the idea of investing in scarcity, just buy actual gold instead. Actual gold > Bitcoin. Gold is a tangible asset with real market demand underpinning its value. Bitcoin, on the other hand, is a currency for the criminal underworld and has no intrinsic value.

This circles back to the Greater Fool Theory. Aside from criminal activity, there is nothing that drives demand for Bitcoin other than Bitcoin itself. People aren’t buying it because it’s 'digital gold'; it doesn’t behave anything like gold, and quite frankly, buying gold is a fairly mediocre investment in itself. People are buying Bitcoin as a get-rich-quick scheme. They’re not buying it for its usefulness but because they expect some greater fool to come along and pay even more for it later. That’s the Greater Fool Theory of investing, and it plays out over and over again in history—and will continue in the future.

The market cap of Bitcoin is currently $1.15 trillion as of this date. The lack of any real, tangible demand for Bitcoin is why the price swings so wildly. Bitcoin isn’t stock in a company, nor is it a commodity with a real-world use. It’s a purely speculative instrument, and its possible value ranges anywhere from zero to infinity. If anyone who owns part of that $1.15 trillion in Bitcoin decides there’s a better use for their money, then that’s it. A cascade of selling start sending Bitcoin price straight into the ground.

Bitcoin will always follow the same pattern. Some narrative will drive people to buy Bitcoin, increased demand for the limited supply sends the price sky high. This serves as a self-fulfilling prophecy for people who expected it to go up and more people get greedy and plow more money into Bitcoin. Sending the price even higher. Until saturation occurs, the supply of new people willing to hoard Bitcoin drys up. The price stops rising then people lose the get rich quick reason for holding. Selling starts and the price drops. Like groundhog day this will happen over and over again. Speculating on Bitcoin is likely profitable for some but this is entirely uninteresting to me and tantamount to gambling with a negative expected value.

Crypto could be a gamble with a positive expected value if let’s say, it has a legitimate, real world use that isn’t well understood by the general public yet. But Bitcoin does not fit that bill.

Ethereum and Solana are the leaders in the next category of cryptocurrency. The Acquired podcast has an episode on Ethereum where they spend a lot of time blindly drooling over it. Their perspective is very uninsightful and heavily biased, but they do provide a high-quality history of Ethereum and its creation. These two cryptocurrencies, and others like them, are fundamentally different from Bitcoin and its fellow shitcoins. They are decentralized computer networks capable of processing smart contracts aka programs, and these two have certainly caught my attention.

A smart contract is a programmed agreement on the blockchain that automatically executes when predetermined conditions are met. The advantage is that no middleman is required for the transaction—no bank, no escrow, no larger institution is needed for two parties to complete a transaction on agreed-upon terms. The smart contract becomes part of the blockchain, where it cannot be tampered with, ensuring both parties that the terms of the deal will be upheld. This could apply to almost anything—sales of products, providing goods and services, etc. Buyers would be protected if services aren’t rendered, and businesses would have a guaranteed payment. These decentralized computer networks could also be used to challenge companies like Visa in payment processing. The potential upside here is quite large.

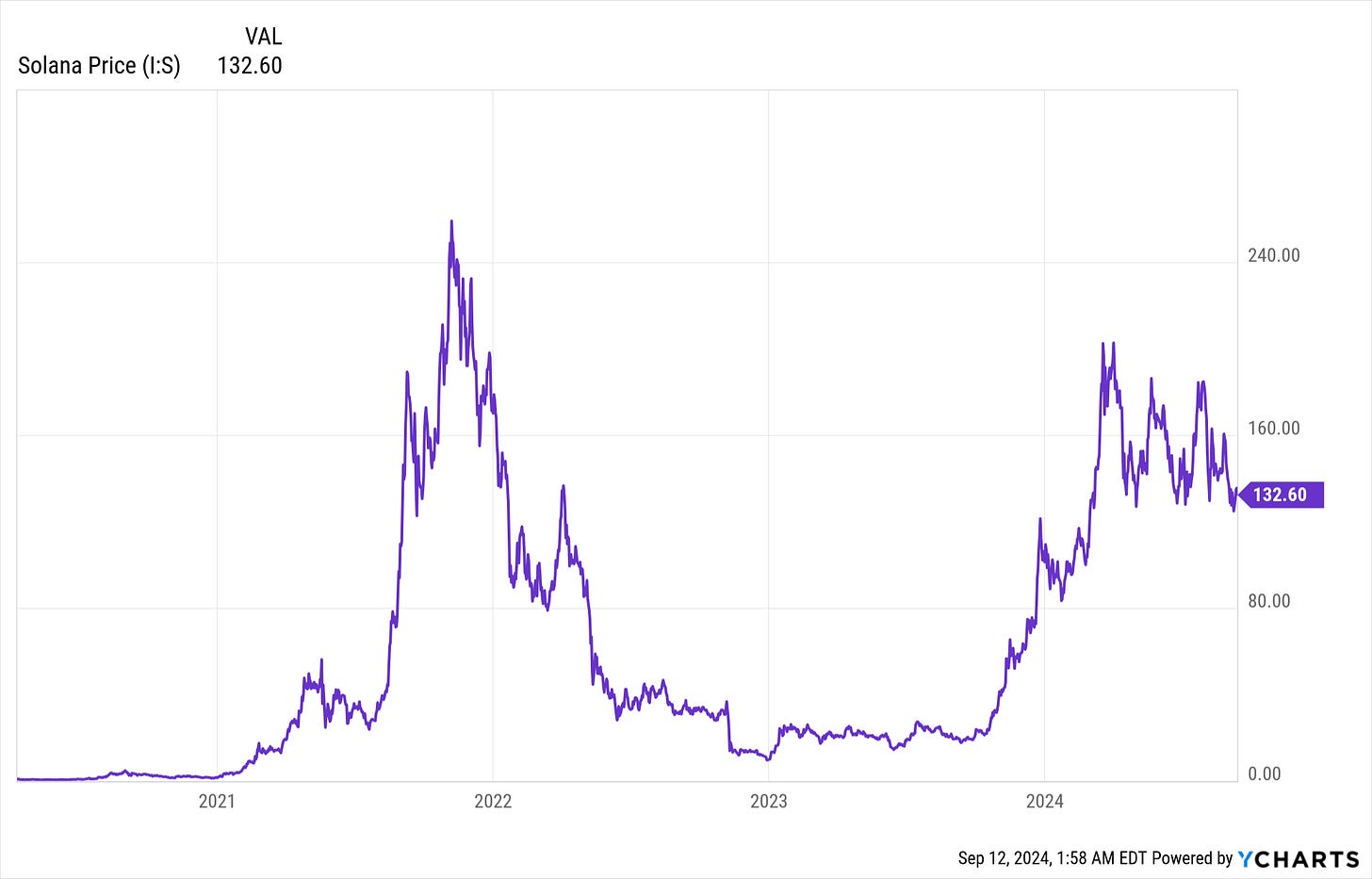

So, where do tokens come into play? People can, of course, buy and hold Sol and Ether tokens, much like Bitcoin, expecting their value to rise. However, these tokens are also used as a method of payment for the use of the networks, meaning they have demand tied to real-world applications, unlike Bitcoin, which is driven mostly by speculation.

The people who operate nodes on the Ethereum and Solana decentralized networks are required to stake their respective tokens. This staking acts as posting collateral, as node operators bear the cost of running computer servers to process and verify the authenticity of transactions on the blockchain. If they attempt to process fraudulent transactions, they are subject to a penalty known as slashing, where the governing body of Ethereum or Solana seizes the collateral posted by the node operator.

The amount of collateral required to validate transactions can be in the millions, providing a substantial incentive for node operators to behave ethically. Meanwhile, if they perform their duties correctly and process transactions as expected, they are compensated with 'gas fees,' paid in the native tokens of the platform.

More activity on the Solana network leads to more demand for Solana’s coin, which is used to pay for network bandwidth. As demand rises, so does the price of Solana’s coin. However, this is where the trouble begins, and it becomes clear that many people in the crypto space are blinded by a kind of religious zeal.

For any financial network—which is the best way to describe Ethereum and Solana, since their primary function is executing transactions using digital tokens as payment—the most important metric is Transactions Per Second (TPS). Referring to how much activity the network can handle.

Guess the TPS of the Visa network, Ethereum, and Solana. Also, note that Visa’s market cap is $564 billion, Ethereum’s is $284.86 billion, and Solana’s is $63 billion. All of these numbers are accurate as of this writing.

So whats the TPS? I’ll wait…

(Keep scrolling)

Visa - 24,000 TPS

Solana - 60,000 TPS

Ethereum - 30 TPS

For the last seven years, Ethereum has been promising an increase to 100,000 TPS, but that has yet to materialize. Why this is so critically important is that every time someone swipes a Visa debit or credit card anywhere on the planet, that transaction processes instantly for every cardholder, 24/7/365. You never swipe your card and stand there for 20 minutes waiting for the Visa network to catch up.

Now, Solana’s claim to fame is having a throughput that is more than double the Visa network, with a per-transaction cost that is a fraction of a penny. With Solana, there would be no more 3% interchange fees on credit cards. Ironically, credit cards essentially involve Visa, the bank, and the customer extorting the merchant for 3%, a portion of which is then returned to the customer in the form of rewards benefits. Anyway… I digress.

There is a legitimate reason to view Solana as a viable technology for the future—a potential rival to the likes of Visa and Mastercard, while also being able to perform many more functions than just simple payment processing. Ethereum, on the other hand, is essentially useless because it’s so slow. Visa typically handles around 1,700 TPS, with extra bandwidth in place to ensure it can handle large surges in usage. In contrast, it would take Ethereum 56 seconds to process the number of transactions that Visa handles in a single second. This would lead to a cascading failure, with an ever-increasing backlog that Ethereum’s network would never be able to catch up with, ultimately leading to people abandoning the platform.

As you can see it doesn’t make a lot of sense why people hold Ethereum instead of stock in Visa or Solana’s tokens. Here’s a link to Solana’s website:

However, there is a massive issue I haven’t mentioned, and it’s why most network activity on Ethereum and Solana is relegated to things like trading the tokens themselves and NFTs. If Bitcoin is dog shit, then an NFT is dog shit covered in vomit. I’m not going to get into NFTs right now—they have some uses—but the most common one, selling fictitious ownership rights of easily copied .gif and .jpeg image files, is incredibly stupid.

The problem here is that the blockchains for Ethereum and Solana don’t connect to the real world or the rest of the internet in any way, shape, or form. Currently, Solana is an impressively powerful, decentralized computer network that is far from being utilized to its full potential. Largely being siloed off from the rest of internet.

There is also one final problem:

You’ll notice a high degree of similarity in the price movements of Bitcoin, Ethereum, and Solana. This is a strong indicator that the rise in token prices for Ethereum and Solana isn’t driven by network traffic or genuine demand for the coins, but rather by Bitcoin-like speculative behavior. This supports the assertion that the Solana and Ethereum networks are largely siloed off from the real world and not being utilized to their full potential. The true purpose of Sol and Ether tokens is to compensate the people operating nodes on the decentralized network for the time and money they invest in maintaining a node and processing transactions or executing programs. Therefore, if network activity increases, the price of an Ether or Sol token would rise even without speculative buying and holding.

Come to think of it, a potential sell signal for these tokens would be if the rise in token price vastly exceeds the growth in traffic on the network. I’ll need to think about that more. There’s probably a way to calculate a fair dollar value for Sol and Ether tokens if it’s related to the organic demand for usage on the underlying computer network.

Now we get into the cryptocurrencies with actual real-world use. First, let’s talk about the stablecoins Tether and USDC. These are pretty simple, and the government seems to hate them. These coins are pegged to the US dollar. One Tether and one USDC are backed by one dollar held in reserve by the governing body that issues each token. Crypto exchanges pay dollars to buy these tokens in large quantities from the organizations the control Tether and USDC respectively. Then the crypto exchanges resell the tokens out to the general public.

Tether has a market cap of $118 Billion making it the third largest cryptocurrency behind Bitcoin and Ethereum.

USDC has a market cap of $35 Billion.

I personally would use USDC over Tether. USDC is much more transparent than Tether, and USDC’s reserve funds are held in SEC-registered money market funds. USDC also undergoes third-party audits to verify the presence of its cash reserves ensuring that each USDC token is backed by an actual US Dollar. Tether simply isn’t as transparent, and since they do the exact same thing, I would personally choose USDC. That being said the United States government has a general dislike of these stablecoins:

The Shadow Dollar That’s Fueling the Financial Underworld:

The Crypto Outfit That's More Profitable Than BlackRock:

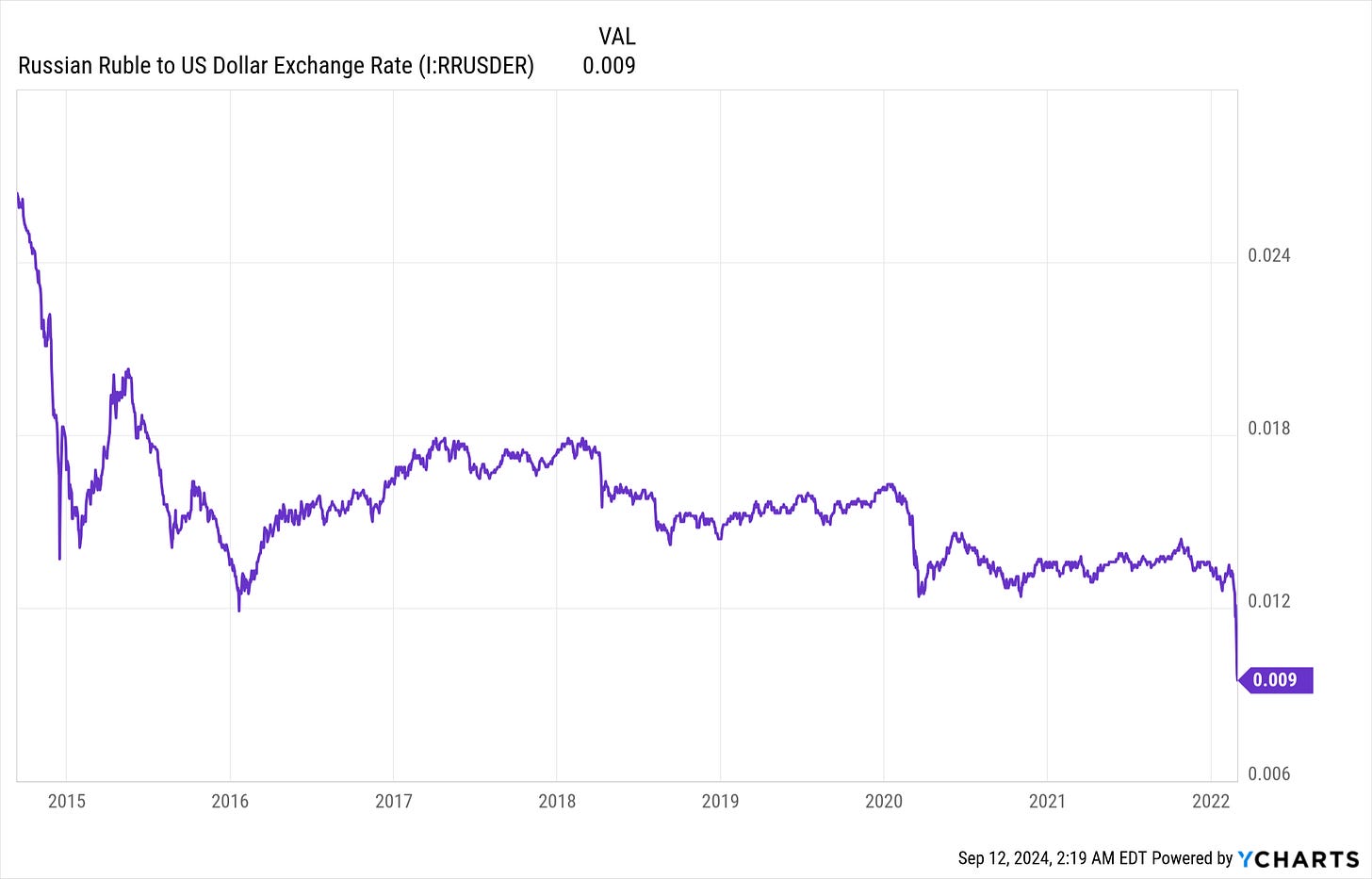

The general problem the United States government has with stablecoins is that they break the government’s complete control over the U.S. dollar and who can use it. A large part of how the U.S. enforces sanctions is by prohibiting certain entities from using the world’s reserve currency, the U.S. dollar. Tether and USDC allow foreign governments to bypass sanctions by accepting these currencies as a form of payment. For example, if Russia needs to buy arms from North Korea, but North Korea doesn’t want the Ruble, which is constantly losing value—no problem, they can be paid in Tether or USDC.

But this is also a positive use case for Tether and USDC. If you are a normal person living in a country with an unstable currency, storing your money in Tether or USDC could be beneficial. It would prevent the value of your savings from getting wiped out by your countries inflationary currency. Also, if you’ve noticed that the Ruble to U.S. Dollar exchange rate chart stops in 2022, it’s likely because Russia invaded Ukraine, and sanctions are preventing people from swapping Rubles for dollars. However, you can still swap Rubles for Tether or USDC. So, while Tether and USDC do have an illicit use case—one that is probably fairly common—they also have equally common legitimate use cases.

Tether will also slash its crypto from wallets known to be violating U.S. government sanctions, but that’s a game of whack-a-mole that’s difficult to play. The torrent website Pirate Bay is still online after all these years, despite numerous government attempts to shut it down, and Pirate Bay is a stationary target. Trying to track Tether and USDC as they move from wallet to wallet is an even harder task, and one that will probably never be 100% effective.

I’ve been talking a lot about crime in relation to crypto, but it doesn’t sour my overall perspective on it. As I’ve mentioned, Tether and USDC have legitimate uses for people in countries with unstable currencies and banking systems. I also believe that the ability to operate outside the traditional financial system is an important check on government power. Remember when Canada declared martial law and froze the bank accounts of truckers protesting the lockdowns? If they had their money in Tether or USDC, they would have been just fine. That was a clear example of a tyrannical government crackdown. Maybe you aren’t sympathetic to that protest movement but if a western government can crackdown on one protest movement in that manner they can do it to any of them. Having money outside the traditional financial system is protection against debanking if the political winds ever start blowing against you. Or maybe if an over zealous bank falsely suspect you have committed fraud.

https://www.nytimes.com/2023/04/08/your-money/bank-account-suspicious-activity.html

https://www.newsweek.com/bank-america-boycott-maga-john-eastman-1892134

https://www.bbc.com/news/business-63252035

But the world is complex, and if something can be used to ensure personal freedom from oppression, it can also be used to buy cocaine on the Silk Road or gamble illegally. You can’t have one without the other.

Let’s get more detailed on USDC and Tether. This example applies both to someone seeking to launder money gained through illegal activities and to someone trying to avoid government oppression. Perhaps you’ve converted your dollars into USDC and moved them from an exchange to a private crypto wallet to gamble at an illicit online casino, because the authorities in your state have banned playing poker for money online. Or maybe you’ve been accepting payment for work in USDC due to worrying political developments in your country, and you’d rather not have someone like Trudeau seize your bank account. Either way, you’ve earned a lot of money, all in USDC, and you don’t want to move it into the traditional banking system.

You might avoid doing so either because it would raise alarm bells (since deposits over $10,000 require extra documentation) or because you wish to operate entirely independent of the traditional financial system. Additionally, breaking up a large sum of money—$10,000 or more—into smaller deposits and gradually feeding it into your bank account is called structuring or smurfing. It violates the Bank Secrecy Act and is a federal crime.

Well, what now? First off, there are crypto ATMs where people can directly convert crypto from their wallet into tangible, physical dollars that they can spend. Additionally, both Coinbase and Crypto.com offer crypto debit cards. These function like prepaid Visa cards, where you load Tether, USDC, or other cryptocurrencies onto them and use them like any other credit or debit card. Crypto.com also allows you to cash out your crypto in the form of gift cards.

None of this will buy you a house or a car—both of which would be unusual to pay for with physical cash or a debit card. However, it’s quite easy to use your money from outside the traditional financial system to cover most of your daily expenses, allowing your documented dollars within the banking system to accumulate for larger purchases in life. It’s also possible to circumvent the $10,000 deposit limit, a way of not directly depositing the money in your account yet still ending up with that amount in your account. But I’m not going to share how to do that because, well, it just seems like a bad idea.

You can see why the government isn’t thrilled about USDC and Tether. How does the IRS tax you if you’re transacting in crypto outside of the banking system? How does the government seize your money? How can anyone twist your arm financially? They can’t, and that’s Big Brother’s problem with it all.

We’ve covered stablecoins, the first strong real-world application of cryptocurrency. However, you can’t make money from buying stablecoins—they simply give you more freedom as a human being. Now, let’s look at three more big ones with real world use: Ripple, Chainlink, and Filecoin."

Ripple or XRP isn’t exactly a stablecoin but kind of needs to act like one:

Ripple is a cryptocurrency currently used by major financial institutions, including Bank of America, to facilitate international payments. It bypasses pesky exchange rate problems. You’ll notice that compared to Bitcoin, its price is much more stable. It has to be that way—extreme volatility would make it difficult for banks to use in international financial transactions. While I’m brushing past Ripple a bit here, I do want to mention it as a noteworthy real-world application of cryptocurrency.

Next comes Chainlink (LINK):

You’ll again notice that the price chart looks similar to all the other crypto price charts. This shows how many people use crypto primarily as a means of wild speculation, hoping to get rich quick, rather than buying it based on a deep understanding of what the various tokens represent.

Chainlink isn’t your typical crypto however. First of all it isn’t a blockchain, its a decentralized network of nodes referred to as “oracles.” Remember when I said that Ethereum and Solana while very interesting computer networks are somewhat useless because they are siloed off from the rest of the world? Well Chainlink fixes that. My guess is that’s where the name Chainlink comes from, you know, linking the blockchain to the real world… Chainlink…. Anyway…

LINK, the token of Chainlink, operates on the Ethereum blockchain. The setup of the Chainlink network is very similar to Ethereum and Solana, where LINK tokens serve as a reward for node operators and as a method for enforcing compliance and preventing fraud, using the same principles of staking and slashing. Chainlink also has a reputation system for nodes based on their historical performance, accuracy, and the amount of LINK they have staked. Nodes with higher reputations are more likely to win data service contracts for smart contracts, allowing operators to earn more LINK.

Let me tie this all together. Let’s say I want flood insurance for my house, but I can’t get it from the federal government for some reason. However, I find someone willing to make an agreement with me to pay out if the river next to my house floods. A smart contract could be created on the Solana blockchain to handle what is essentially an insurance contract. It would collect payments from me and send them to the counterparty. The smart contract on the Solana blockchain could then communicate with an oracle node on the Chainlink network, which monitors the NOAA webpage for the river and gathers data on the water level.

If NOAA determines that the river has reached a major flood stage, the Chainlink oracle would pass this data to the smart contract on the Solana blockchain, which would then execute the lump-sum payment from the counterparty to me. All of this would happen instantly, in response to real-time, real-world data, and it would remove the need for me to trust that the other party will honor the agreement and not breach the contract.

As you can see, if smart contracts begin interacting with the real world, the possibilities are endless. With many legitimate uses, I’m sure this will also anger government regulators at some point. For example, the insurance agreement I just described would be an unregulated contract, or smart contracts could easily facilitate gambling.

Much like Tether and USDC, there are plenty of legitimate uses for smart contracts. They allow for greater personal freedom, but they also provide plenty of reasons why people in positions of power will become angry, as these technologies erode their control over others. But the exact same thing was the case with the internet. Just look at Substack, major news organizations don’t have an information monopoly any more. This new technologies could be very impactful on the world.

Now, let's talk about Filecoin and the Interplanetary File System (IPFS), which, I have to say, is just such a cool name. Many of the same concepts we’ve discussed will apply here: network nodes, staking, slashing, Filecoin as the token, etc. The IPFS is a separate entity from Filecoin. Filecoin was created to incentivize the use of IPFS protocols and ensure the compliance of node operators with honest conduct.

The IPFS is a peer-to-peer file storage network. https://ipfs.tech/ Let’s say I have 20 terabytes of unused storage space online. At the most basic level, I could create a node and rent that space out to the larger Filecoin network. By staking Filecoin—which would be subject to slashing if I don’t provide the service I agreed to—I would be paid in Filecoin for the service I’m providing, and Filecoin has monetary value. In practice, it’s more complex than that, but thinking of it as decentralized cloud storage is an accurate way to conceptualize it.

When you store data in the cloud with OneDrive or iCloud, your data is distributed across multiple servers to protect against hardware failures. However, you are ultimately entrusting a single company, like Microsoft or Apple, with managing and securing your data. In contrast, with IPFS and Filecoin, data is similarly distributed for redundancy, but the key advantage is that no single entity controls your files. Instead, they are stored across a decentralized network of independent nodes, providing greater privacy and reduced reliance on a central authority.

https://filecoin.io/store/#intro

Allow me to paint a picture for you. Let’s say you’re a journalist with the Free Press… How about… Olivia Reingold, and a modern day political scandal of Watergate severity is happening but nobody knows about it yet. She is contacted by Deep Throat with documents proving government corruption. Now the White House is none to happy about this and gets a warrant to seize her laptop and cloud storage accounts with the likes of Google, Microsoft, Apple .etc in order to get those classified but very incriminating documents back.

Let’s imagine a tech-savvy journalist, Reingold, has not stored the sensitive documents on a centralized file system but instead on the Filecoin network. This means the documents don’t exist in any single location. They are fragmented and scattered across various nodes in the storage network. Files can be accessed by anyone with the CID (Content Identifier) for the file on the Filecoin network. Someone could post the CID on X, blasting the incriminating documents out to the entire world, and no single person anywhere would be able to take them down. The government would have to go to every single node on the Filecoin network and force them to stop hosting the documents—a time-consuming and lengthy process.

To reach the highest level of security when storing a file on the Filecoin network, a person would have to create their own node to access the network directly, which would require some technical know-how. If someone used a storage provider, they would need to go to great lengths to conceal which provider they used, such as setting up the files through a VPN, then destroying the SSD or HDD of the computer they used to create the account, and setting up payment via USDC or a prepaid debit card that is not tied to their personal bank account.

While this isn’t an everyday use case for Filecoin—most people aren’t hiding documents that prove a government conspiracy—there are plenty of instances of both individual and organizational cloud storage accounts being hacked. The encrypted and decentralized nature of Filecoin makes such hacks much harder to pull off. This is why there could be future demand for the use of this network. Once the world catches on to what this new technology is capable of.

Filecoin is in use with many businesses offering storage access on the Filecoin via IPFS at this exact moment.

https://destor.com/destor-directory

I want to draw attention to something important here: Filecoin’s price chart looks nothing like Bitcoin’s. As we’ve progressed through this post, you’ll notice a gradual divergence from Bitcoin’s price pattern. In my opinion, from most similar to Bitcoin to least similar, the order goes: Ethereum, Solana, Chainlink, Ripple, and Filecoin.

I think this is significant because the less a token’s price behaves like Bitcoin, the stronger the case that actual use of the token is the driving force behind any rise in its price, rather than out-of-control speculation, which is, above all, the defining feature of Bitcoin.

Again, I want to comment on market cap. Remember how Bitcoin has a $1.12 trillion market cap, and Solana has a $60 billion market cap? Well, Ripple sits at $31 billion, Chainlink at $6.6 billion, and Filecoin at $2.14 billion. It’s important to note that the more real-world application a crypto has, the less money is invested in it. This perfectly describes the average person who puts money into crypto.

I prefer the term crypto over cryptocurrency since the currency part implies the token is the most important aspect of the system, which isn’t the case. The computer systems these tokens are attached to are far more interesting and important to me than the banal idea that hoarding some pointless token is a good long-term investment.

The average person walking around, I think, has no real idea of what crypto is beyond the basic concept that Bitcoin is a digital token. I also don’t think most crypto bros buying Bitcoin, Ethereum, and NFTs don’t have much more than a very basic understanding of how things work. This perfectly explains why crypto market caps fall off a cliff once you get past Bitcoin and Ethereum—it’s largely a matter of shallow name recognition driving speculative buying. That mixed with a heaping of cognitive bias in decision making which leaves people mistakenly thinking that they are investing and not operating under the Greater Fool Theory.

Why would someone hold Ethereum or Solana but not also hold Chainlink, a critical network that enables useful applications on the blockchain? I’ve always spoken derisively about crypto and those who “invest” in it, and this is why.

There is no investing to be done in commodities only stock and bonds.

"An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative."

- Benjamin Graham

Crypto tokens are commodities, not securities, and therefore don’t have to trade on stock exchanges and are much less regulated. No commodity investment will ever meet the criteria for thorough analysis like a business does. You can analyze a company, understand that it has a strong position in its industry, and reasonably predict its future performance—far better than you can anticipate future commodity prices.

Ray Dalio, in his book Principles, describes getting wiped out multiple times speculating on commodity futures. Just to be clear, while stocks represent fractional ownership in real businesses, commodities are resources. Lumber, pork, oil, lithium, copper, steel, coal, chicken, water, coffee, diamonds, etc., are all commodities.

I think this is what got people started on the whole “Bitcoin is digital gold” nonsense. Crypto are unique to tangible physical resources. First of all they are inherently limited in quantity. That is not the case of typical commodities. Chicken, Pork, Lumber, Coffee .etc are renewable resources. New chickens and pigs are born everyday, new trees are replanted after a clear cut, the supply is not permanently limited to one fixed number. Even with things like oil where we will run out eventually, that is still so far in the future that we aren’t supply constrained. Crypto is unique in how limited the supply of the commodity is and its why there is such extreme volatility in prices. Especially when there is no underlying use for the token like with Bitcoin.

Solana, Chainlink, and Filecoin aren’t mere tokens, they are decentralized computer networks with legitimate uses. As the demand for the service these networks provide increase there will be upward pressure on the price of their tokens. Stemming from real network demand, not wild speculation from people with a poor understanding of both technology and the behavior of financial markets.

Now, this is Pacific Northwest Edge, so what’s the edge here? First off, my edge is being an old-school computer nerd. When I was a kid, my mom had a second phone line for our house so the family computer could use its 56K dial-up internet connection via AOL, while still allowing us to receive phone calls on our usual landline. This kept my internet usage pretty tame, since we had just one family computer with internet, sitting out in the open. Then, when I was 10, we got cable internet, and my older brother set up a Linksys wireless router. For some reason, in 2000, all the adults struggled with configuring one, leaving the job to my brother.

Then my mom put a Compaq computer in my bedroom, gave me completely unsupervised access to the internet, and I was off. Allow me a trip down memory lane:

The Haxor Laser Show:

http://audio.textfiles.com/shows/haxorradio/

This radio show in the spring and summer of 2004 was the coolest thing in the world to me at the time. The show hosts Johnny Hacker, AV1D, and Hairball were my heroes when I was 14. Listening to these guys I learned how to phone phreak right before it became obsolete. It also got me interested in social engineering and I read the Art of Deception by Kevin Mitnick. Whenever I broke into peoples online accounts it was always a social engineering attack and never an act of elite programming skill on my part. Remember back before two factor cell phone authentication when you had to answer security questions? That was the dumbest thing ever, it was a built in backdoor to every user account, if you could get the answer to those questions. Once you had someones email account you could use it reset their passwords on all their other accounts too. That detail largely hasn’t changed to this day. Protect your email account. It’s also disturbingly easy to call tech support and talk them into giving you access to someones account, classic social engineering.

The Haxor Laser Show was a podcast before podcasts even had a name. The term podcast originated from radio shows that were meant to be put on the iPod and the term has stuck ever since. In 2004 Mark Zuckerberg launched “The Facebook” years later going on to name the road to his headquarters “Hacker Way.” Now if I look up people I went to high school with I see a lot of the preppy kids have tech jobs. People that in high school had zero interest in computers. There is an advantage to being someone who has a passion for it vs. someone who does it because it pays well. Mind you I work as a therapist not a programmer and I am very happy with it. Coding and setting up computer systems is a hobby that I love. However, my skill at social engineering was probably a good hint that I would be a talented therapist in the future.

Some proof times have changed:

This old hacking training ground now has a pride flag on its front page, a post urging you to go vote against Trump, and a BLM memorial to George Floyd. If you listen to the first episode of the Haxor Laser show from 2004 they directly state that most hackers at the time were not politically oriented. Again, the subculture was if anything, anarchist. Rather than hyper politically correct and woke. I still think the online criminal under world is more apolitical then anything else. But times have changed and not everything has survived.

Discord is basically the dumbed down version of Internet Relay Chat (IRC) which is not what it used to be. Back in the day IRC was hopping, it was where I got a leaked high definition copy of Star Wars Episode III: Revenge of the Sith before it even came out in theaters. But the computer underworld has since moved on to Telegram and other places like it that. Places I won’t discuss and if you want to know what they are go find them yourself. “Don’t ask me, figure it out yourself” is certainly an old school computer nerd attitude, which only changed once you had a sufficiently complex programming question to ask.

I’m writing this post off of a computer running the Ubuntu, a Linux distro. I probably shouldn’t brag about that since its kind of the n00b version of Linux. Fun fact you can get decent computers right now very cheap. Windows 11 doesn’t support 7th generation Intel CPU’s and older, it also doesn’t’ support Zen 1 AMD CPU’s and older. I got an old Dell office computer with an i5-7500, 16 GB of Ram, and a 500 GB HDD for $75 including shipping on eBay. Microsoft might refuse to support the hardware but Linux still runs it just fine. The fact that Windows doesn’t support the CPU anymore makes the hardware useless to about 98% of people and caused the price to drop massively. Funnily enough when I checked the SMART data on the HDD its only been turned on for a total of one year and nine months. Which means this old Dell Optiplex built in 2017 must have largely sat unused in some corporate office or school somewhere before hitting eBay. I also added two 10 TB HDD’s configured in RAID 1 connected via a dock through the USB 3.0 ports and added an adapter to connect a GPU to the PCI-E slot from outside the computer case since it won’t fit on the inside. Dell was nice enough to stick the PCI-E slot directly up against the PSU.

Why I mention any of this is to say my edge is that I understand computer systems a helluva a lot better then most people and loops back to the question that should sit at the end of this long post.

Do I own crypto?

The answer is yes. I own some USDC, Solana, Chainlink, and Filecoin. Solana is the superior computer network to Ethereum. Ethereum has been trying to get its act together for years and still can only manage a 30 TPS throughput. Chainlink is a critical puzzle piece that allows programs on the blockchain to do things that are relevant in the world. It makes no sense to own Ethereum or Solana and not Chainlink. There is also a legitimate appeal for decentralized cloud file storage.

Part of the reason for my personal anecdotes was to point out that most of these things sound like little known nerd ideas today. But many of the little known nerd things of 2004 are mainstream today. The first time I ever heard about an ebook was from Av1d on the Haxor Laser Show. Reading a PDF file of a book on your computer was a brand new thing back then and now look where its at. Everyone has heard of the Kindle. These three crypto are legitimate technological innovations that a person could profit off of by owning their tokens if network use increases in the future.

I spoke a lot about crime during this post. That doesn’t concern me at all. You know what a huge driving force behind the mainstream adaptation of the internet was during the 1990’s? Porn. The internet eliminated the awkward experience of walking into a sex shop and picking some VHS with a god awful name like “Asshole Demolishers 4” on it and having to look another person in eye when you paid for it. The internet stuck around because it was useful for many more things then watching porn. But that certainly got the ball rolling. It is the same with crypto and the criminal uses for the technology.

The internet, USDC, Solana, Chainlink, and Filecoin are distinct from Bitcoin. The first four all have illicit use cases but they also have very legitimate ones. Bitcoin does nothing but serve a means to facilitate payments between criminals or as a conduit for the speculative fever dreams of naive people.

I view my crypto purchases as gambling and you should too. It is not investing by any sense of the word. So, if you are interested in crypto, and have an amount of money you wouldn’t mind putting into a slot machine and never seeing again. Consider Solana, Chainlink, and Filecoin. Again, the logic behind purchasing these tokens is that increasing use of their networks will create a lasting sustainable demand for their tokens making them more valuable in the future than today. I currently have less than 1% of my money in crypto.

If you have need to transact outside of the traditional financial system or don’t like examples in recent history of western democracies freezing peoples bank accounts then consider USDC.

**Disclaimer**

As I literally just said buying crypto is gambling. You will very likely lose all of your money and never see it again. Act accordingly when making your choices. It is also quite possible I provide inaccurate information at some point in the post. Double check everything I say, don’t trust strangers on the internet.