Automatic Data Processing - ADP

There isn't anything catchy to say.

Alright, as promised, here is my write-up on Automatic Data Processing (ADP). I’ll give a brief overview of what they do, but if you want a full understanding, read the intro presentation and pages 3–16 of the 10-K. As always, refer to the page number at the bottom of the page, not the page number the PDF reader lists.

Let’s start off with the links:

Intro presentation:

Fiscal Year 2025 Q1 earnings presentation:

https://s23.q4cdn.com/483669984/files/doc_financials/2025/q1/ADP-1Q25-Earnings-Deck.pdf

2024 10-K , ADP’s fiscal year ended months ago.

https://s23.q4cdn.com/483669984/files/doc_financials/2024/ar/adp-fy24-10-k.pdf

The services that ADP provides are mission-critical to their clients. ADP software and cloud solutions process payroll, manage employee leave, benefits, tax compliance, and a multitude of other things. This creates a one-stop shop for employers. Sign up with ADP, and all of the logistics of hiring, paying, and providing employees with benefits are handled, allowing businesses of all sizes to focus on building their business and not worrying about all of these other concerns. Let’s hit some bullet point facts about ADP:

One out of every six workers in the United States is paid through ADP.

ADP is also a licensed insurance agency.

ADP is in 140 countries globally.

Outside of the United States ADP processes payroll for 16 million workers.

Processing all of this data affords ADP the unique ability to, well, collect data. I think a lot of people hear "data collection" and assume it’s this nasty, conspiratorial thing corporations do. In this case, it is fairly innocent. ADP isn’t collecting data in the form of “John Doe from Seattle, WA, earns $104,000 a year.” They’re collecting data in the form of “The average accountant in the United States makes X amount of money a year.” ADP has unique insight into the health of the economy and a wide range of workforce data, which is another way for ADP to provide value to their clients. Are you paying your employees a competitive wage to attract the best talent? ADP can tell you with a high degree of precision.

That is a very boiled-down version of what ADP does. I was going back and forth on how descriptive to be, but the more information I provide, the more it turns into me just restating what’s in the 10-K, but with less detail. Investing involves a crapload of reading. I think perhaps the benefit I provide is that I can tell you exactly where to look, rather than digging through a 100-page 10-K yourself. That, and I find the stocks in the first place—there are thousands and thousands of them out there. Half the battle is digging through them all.

Anyway…

Let’s dig into the financials here, I did find some noteworthy things about ADP. It is always nice when a company’s financial statements aren’t boring.

Questions with Answers.

Page 46 - Income Statement:

Why are their $9 Billion in operating expenses?

Ultimately, not much information is provided on this figure in the 10-k.

Workers compensation and unemployment taxes are included in the figure but no dollar amount was stated.

Page 30 - “Operating expenses increased due to an increase in our PEO Services zero-margin benefits pass-through costs to $3,975.9”

The important part to focus on is “pass-through.” This refers to a cost that ADP incurs, which is passed on to their client with zero markup. Health insurance premiums may be one example of this, although the 10-K never gets very specific about it. The important bit is that it raises expenses and revenue equally. So, it’s more like ADP has $5 billion in operating expenses. I don’t have any more color than that. My gut instinct was that $9 billion seemed high given the nature of ADP’s business. $5 billion sounds more reasonable. Overall, I’m not as concerned as I initially was.

Page 48 - Balance Sheet:

Current Ratio is meaningless since most of ADP’s current assets are funds held for clients.

This is why I use my own metric. ($2.9 Billion in Cash and Short-Term Investments + $3.4 Billion in receivables) > $4.4 Billion in Payables and Accrued Expenses. ADP can easily pay its bills for the next year.

Page 50 - Statement of Cash Flows:

Purchases of corporate and client fund marketable securities. What the hell is that?

This ended up being fairly interesting, starting with client fund obligations. One might assume that when ADP processes payroll, they collect the money directly from the employer and disperse it to employees. That’s not how it works at all. If that were the case, then why would the employer even need ADP?

ADP processes payroll in a manner similar to how an insurance company processes claims. An insurance company collects premiums and saves them in order to have money to pay out claims in the future. But insurance companies don’t just put this cash into a savings account and let it sit there—they invest it to earn money off the cash they have collected while waiting for claims to come in. This is called float, and it is how Warren Buffett built his empire.

ADP has float! But instead of premiums, they are collecting fees from employers, and instead of paying out claims, they are paying out people's wages.

An old employer of mine used ADP, and I thought it was interesting that my direct deposit always came from ADP directly. Well, this is why. ADP sucks in a bunch of money from employers to pay their employees. Rather than letting it just sit there, ADP invests it.

Page 60 - Note 4 - Corporate Investments and Funds Held for Clients. It is very important that ADP is responsible here. If it were 2006 and they were buying mortgage-backed securities, well, when the housing market collapsed, ADP would have run the risk of failing to process payroll and give people their paychecks. Imagine if that had happened to one in six American workers. Needless to say, what ADP does is very important.

Overall, it looks like ADP is being responsible. Again, though, I don’t have a lot of detail on their precise bond portfolio. It says how much money is in corporate bonds, but it doesn’t list the bonds. So, there is a limit to the depth of my analysis.

It was a bit tricky to try and pin down exactly how much ADP is profiting off of their, well, I guess I’ll call it float. It is tricky because ADP is constantly adding to the pool of assets as they collect money from clients and constantly paying out funds as they process people’s paychecks. So, this isn’t a fixed number that I can watch grow over time and easily mark a rate of return. But if we go back to the Income Statement on page 46, we get some clarity.

The 10-K breaks out interest earned on this float and pass-through revenue that was used to process payroll. In 2024, the interest ADP earned on the float was $1 billion. But that doesn’t tell me how much ADP has made if the face value of their bonds has gone up, which doesn’t seem to be mentioned anywhere in the 10-K.

But the $1 billion in interest seems to have funded most of the $1.2 billion in common stock repurchases that they did in 2024. I did not expect to find this sneaky benefit baked into their business. Generally, software and cloud service providers don’t have float.

So, that is everything I have to say after reading their presentations and financial statements. Now, let’s get to the visual aids—the charts!

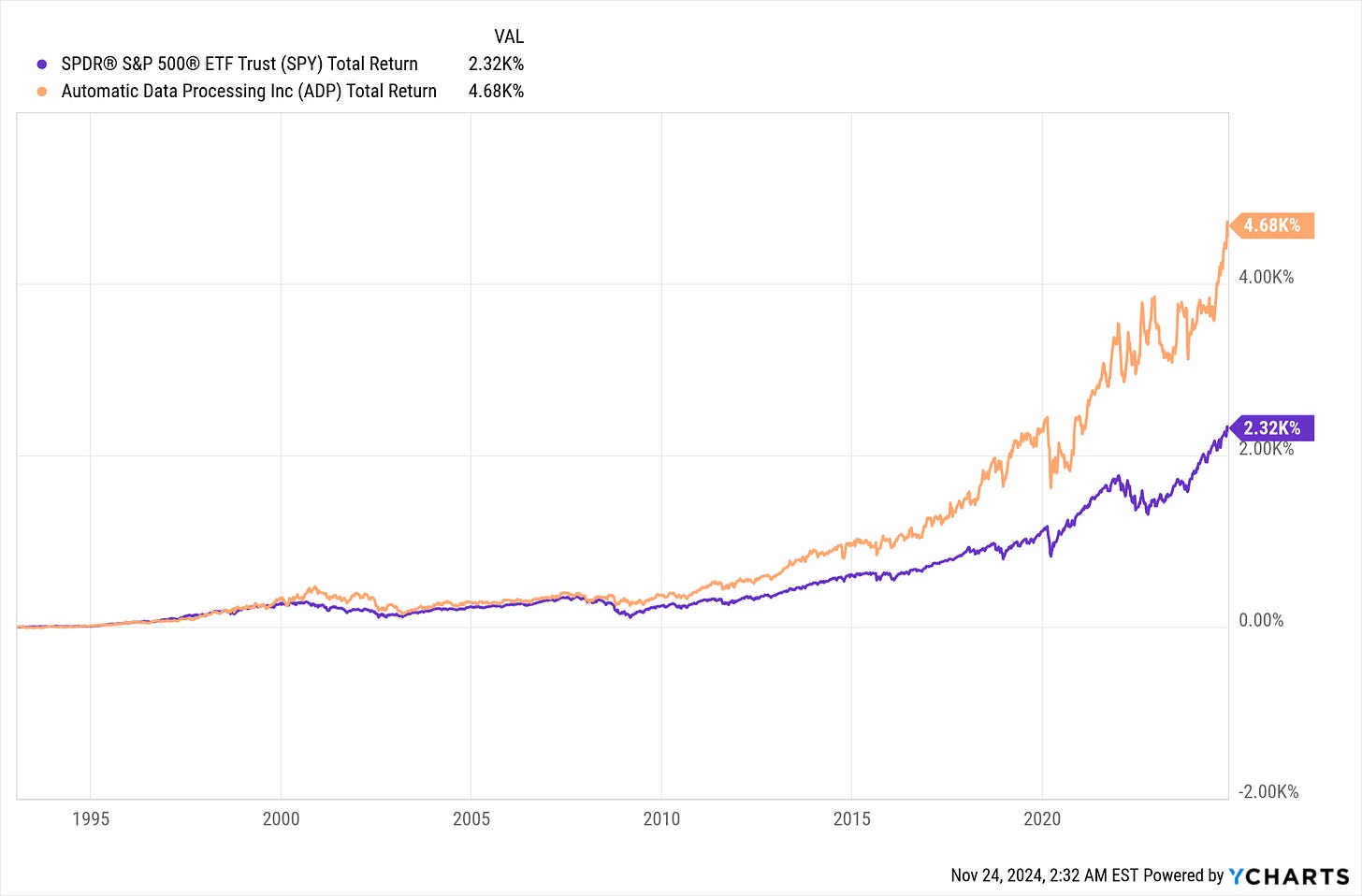

ADP vs. The S&P 500 as far back as I have data:

ADP vs. The S&P 500 in the last 10 years:

ADP vs. The S&P 500 in the last 5 years:

ADP vs. The S&P 500 in the last 3 years:

ADP vs. The S&P 500 over the last year:

The total return charts here aren’t as beautiful as the ones I usually show you. If we go back ten years or more, ADP has crushed the stock market. However, in the last five years, ADP has struggled to beat the S&P 500. Now, worst case, getting a return on par with the overall market isn’t the end of the world. Underperformance is the thing to avoid like the plague. I think the reason for this is that we have been in a prolonged tech bubble, which, as I frequently say, started to pop in 2022. Then ChatGPT came out, and the market started partying like it’s 1999—or 2007.

Since ADP could be viewed as a tech company, I think it’s caught much of the same upward pressure, keeping it on track with the stock market as the world has gone crazy—first over the FAANGs and now over the Magnificent 7. FAANG refers to Facebook, Apple, Amazon, Netflix, and Google. However, ADP is not some overvalued tech company, and we can see that it outperformed by a wide margin in 2022 as the air came out of the balloon. Let’s also be clear: a market return over the last 365 days has been 32.85%, which is insane. The historical average return of the S&P 500 is about 9.6%. 32.85% over a year is extremely hard to beat. It’s not fair to measure one’s performance against the stock market mid-huge investment mania. The proper measuring stick is the performance of an investment over the course of the entire market cycle. We got a glimpse of that in 2022, where ADP did very well.

So, for the near term, expect a market return—which, right now, is completely nuts—knowing that when the bubble pops, you aren’t holding some overly hyped piece of crap tech stock but one with real quality, steady profits, and reliable growth for years. None of this relies on wild expectations about AI. One last thought, ADP lagged the market after the COVID crash, which makes a lot of sense. The government forced millions of people out of work with lock downs and ADP processes payroll.

Now more charts…

Cash from Operations and Free Cash Flow:

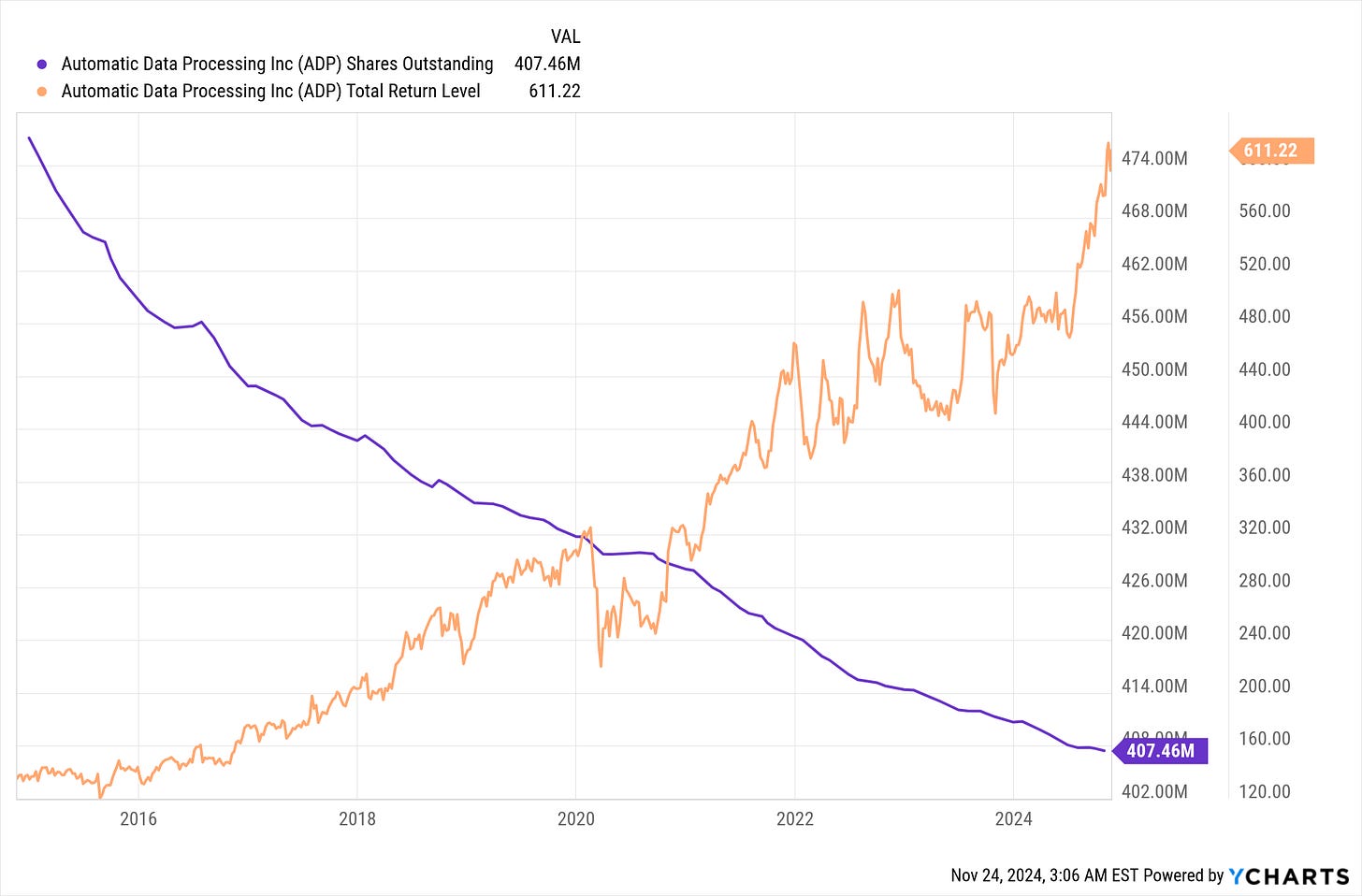

Total Return and Shares Outstanding:

If you don’t pay attention to the scale the shares outstanding can be visually deceiving. Here is shares outstanding as a percentage:

I love to see total return go up and share outstanding go down. ADP has rising revenue and throws off cash. Whats not to like?

PE Ratio:

As I have said before, this would be where most value investors would stop. They’re stuck in the Great Depression-era Benjamin Graham thinking that a value investment can only be in the neighborhood of a PE of 15. The problem is how readily available information is these days. Mispricings still happen in major ways, but insane undervaluations are rare. I follow the Munger approach of wonderful companies at fair prices. Given the future in front of ADP, making one large move into the stock now and holding is a strong value proposition. Give it a couple of years, and ADP will be at a PE of 15—not relative to the market price years from now but relative to what you paid for it today compared to the future market price.

Revenue growth:

Now lets round this off with Hamilton Helmer’s 7 powers:

Scale Economies

Achieving cost advantages by spreading fixed costs over a large output or network. Larger companies can produce goods or services at a lower cost per unit.I don’t think ADP has a scale economy. Software and digital services don’t have the same cost per unit calculation as a business that produces tangible goods. I also don’t think ADP can avoid scaling up server capacity as their business grows.

Network Economies

The value of a product or service increases as more people use it, creating a self-reinforcing competitive advantage (e.g., social media platforms).I don’t see a network effect either. Does ADP’s popularity make the service better for other customers? The best example of a network effect is Facebook, it only works because everyone else has a Facebook profile. That sort of effect just isn’t present here.

Counter-Positioning

A new entrant adopts a superior business model that incumbents cannot emulate without harming their existing operations or customer base.I think ADP is the incumbent here and they are the benchmark by which others are compared to. So, no this one isn’t present either.

Switching Costs

The effort, cost, or inconvenience required for a customer to switch to a competitor's product or service locks them in, creating loyalty.Oh yes, big time. ADP processes employee pay and can handle all of their benefits. These are all mission-critical services for a business. This makes ADP fairly sticky. Businesses can’t afford to have a payroll screw-up where workers don’t get their money. ADP’s business definitely falls into the “if it ain’t broke, don’t fix it” category. Why risk it with a new startup? All the other services ADP provides further lock in clients for the long haul.

Switching costs is a huge source of moat for ADP.

Branding

Building a strong, positive perception in customers’ minds that creates a preference for the company's offerings over competitors.A think brand is a small source of moat for ADP. They are the industry leader in their field. If a business goes with ADP they know they are getting a service that is reliable and will work. If a business owner likes to play it safe, well that is ADP. They are the tried and true option.

Cornered Resource

Exclusive control of a valuable resource (e.g., intellectual property, talent, or partnerships) that competitors cannot easily replicate or access.I think some of their data collection is a cornered resource. But it’s unclear exactly how much money they are earning from that. The sheer number of businesses ADP works with gives them access to information on a scale that other people just don’t have.

Process Power

Unique processes or organizational capabilities that deliver consistent advantages and are difficult for competitors to copy.Nope. One could say Toyota has process power from their consistent ability to produce the most reliable cars on the market. Does ADP create something that is impossible to duplicate? I don’t think so. ADP’s advantages lie elsewhere.

ADP has some immense sources of sustainable competitive advantage. That being said, what's my edge here? What do I think I understand that other people are missing? Probably not a lot, except for my ability to find boring things attractive. Right now, everyone likes what is shiny. Bitcoin is going nuts, NVIDIA is driving the market bubble, and here I am buying stock in a business that does a lot of the grunt work of running a business for employers.

Ok, bye bye now.

My Portfolio:

FI, ADP, MCD, AFL, AXR, VLO, ITB, PPA

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.