I was going to write about next ADP but then this caught my eye. As I’ve mentioned before there isn’t a lot that interests me right now in large cap stocks. Given my preference for established business that gush free cash flow like old faithful at Yellowstone. There is an entirely different philosophy out there that I also follow, its the one that led me to CCB. The basic idea is this: It’s hard for a large corporation to double in size but easy for small one. Is Apple going to double it’s iPhone sales anytime soon? Probably not. But could a corporation valued at $250 Million hit $500 Million in a couple years giving a 200% return? That is probably a lot more likely to happen. This stock is moving fast. I started writing this on November 19th, 2024 at about 11 PM PST. The stock closed at $36.56 today after rising 13.5% in a day and the opening ask for tomorrow is $57.33 that is a crazy jump. Which is perhaps the first point to make, Amrep (AXR) has a market cap of $193 Million. That is very small and holding stocks this small can be a complete roller coaster ride. One large institutional investor takes interest and the stock can sky rocket. They decide to sell and it crashes back to earth. Microcaps aren’t for the faint of heart, this stock will move in ways that McDonald’s never will. It can also go to zero in ways that McDonald’s never will.

A great example of how small they are is their home page:

It’s about the most basic thing you will ever see.

The best source of information is their 10-K, you won’t find much written about these guys online.

I’m hustling to write this so I’m just going to quote the 10-K a lot.

Also its a 53 page 10-K, if there was ever a sign that a stock is a micro cap, that’s it.

AMREP Corporation was organized in 1961 as an Oklahoma corporation and, through its subsidiaries, is primarily engaged in two business segments: land development and homebuilding. The Company has no foreign sales or activities outside the United States. The Company conducts a substantial portion of its business in Rio Rancho, New Mexico (“Rio Rancho”) and certain adjoining areas of Sandoval County, New Mexico. Rio Rancho is the third largest city in New Mexico with a population of approximately 111,000.

Land Development

As of April 30, 2024, the Company owned approximately 17,000 acres in Sandoval County, New Mexico. The Company offers for sale both developed and undeveloped real property to national, regional and local homebuilders, commercial and industrial property developers and others. Activities conducted or arranged by the Company include land and site planning, obtaining governmental and environmental approvals (“entitlements”), installing utilities and storm drains, ensuring the availability of water service, building or improving roads necessary for land development and constructing community amenities. The Company develops both residential lots and sites for commercial and industrial use as demand warrants. Engineering work is performed by both the Company’s employees and outside firms, but development work is generally performed by outside contractors. The Company also provides landscaping services primarily to homebuilders.

Not exactly complicated is it? They own land. They sell and develop land. You don’t need a PhD to understand what they do. It’s all in one place too. So, why the hell is this stock going gang busters?

Don’t worry I got you.

As of November 19, 2024, there have been several notable real estate developments announced in Sandoval County, New Mexico:

Lomas Encantadas Expansion: The Lomas Encantadas community in Rio Rancho is undergoing significant expansion, with new homes being constructed by builders such as Pulte Homes and Abrazo Homes. These developments offer a variety of floor plans and modern amenities to cater to diverse homebuyers.

Moderno at Lomas Encantadas: Abrazo Homes has introduced the "Moderno at Lomas Encantadas" project, featuring contemporary designs and energy-efficient homes. This development aims to provide residents with modern living spaces in a growing community.

Mariposa Community Growth: The Mariposa community in Rio Rancho continues to expand, with new construction homes offering access to amenities such as a clubhouse, indoor and outdoor pools, and extensive hiking and biking trails. Builders like Pulte Homes are actively contributing to this growth.

Placitas Custom Homes: In Placitas, custom home developments are on the rise, with builders focusing on integrating modern designs with the natural landscape. These projects aim to offer luxury living with scenic views of the surrounding mountains.

Yeah ChatGPT found that information for me. Okay? I’m sprinting over here. That’s all residential though.

As of November 19, 2024, several significant commercial and industrial real estate projects have been announced in Sandoval County, New Mexico:

Rio Rancho Commerce Center Expansion: The Rio Rancho Commerce Center is undergoing expansion to accommodate new industrial facilities. This development aims to attract businesses seeking modern industrial spaces with convenient access to major transportation routes.

Bernalillo Business Park Development: A new business park is being developed in Bernalillo, offering commercial land parcels suitable for various enterprises. The project focuses on providing flexible lot sizes to meet diverse business needs.

Placitas Mixed-Use Development: In Placitas, a mixed-use development is underway, combining commercial spaces with residential units. This project aims to create a cohesive community environment, integrating retail, office, and living spaces.

Algodones Industrial Park: An industrial park is being established in Algodones, offering industrial land for manufacturing and distribution facilities. The development is strategically located to provide easy access to major highways, facilitating efficient logistics operations.

These projects reflect the ongoing growth and diversification of Sandoval County's commercial and industrial sectors, providing new opportunities for businesses and contributing to the region's economic development.

Thank you ChatGPT 4o.

Check out Sandoval County, New Mexico specifically the area to the west of Bernalillo, NE on Google Maps in a satellite view, you can see where they have traced out roads they have yet to pave in the desert. There is a huge amount of expansion going on here and somebody with a lot of money knows it and is buying up stock. I still feel like i’m missing something here….

Why is this suburb of Albuquerque going to quadruple in size? Well the plot thickens….

Intel Corporation: Intel has been a cornerstone of Sandoval County's economy since 1980, with its facility in Rio Rancho. In January 2024, Intel opened Fab 9, a state-of-the-art semiconductor fabrication plant, as part of a $3.5 billion investment to enhance advanced semiconductor packaging technologies. This expansion underscores Intel's long-term commitment to the region and has generated thousands of jobs, reinforcing New Mexico's role in domestic manufacturing and innovation.

In addition to Intel Corporation's longstanding presence, Sandoval County, New Mexico, has attracted several other major corporations and witnessed significant expansions in recent years:

Geobrugg North America: In August 2023, Geobrugg, a global leader in safety protection solutions, announced an $8.8 million expansion of its manufacturing operations in Sandoval County. This development includes the addition of 60 jobs and the creation of a North American manufacturing hub at their Algodones location.

BlueHalo: In 2021, BlueHalo, an integrated national security and technology company, selected Albuquerque, adjacent to Sandoval County, for a new 200,000-square-foot campus. This facility focuses on space technologies, directed energy, and air and missile defense, contributing to the region's growing tech industry.

MTX Group Inc.: Also in 2021, MTX Group Inc., a global technology consulting firm, announced plans to establish a Southwest regional office in New Mexico, aiming to create 250 high-tech jobs over five years. This expansion underscores the state's appeal to tech companies seeking growth opportunities.

It really is amazing how much information can be gained so quickly these days if you can just figure out the right questions to ask an AI.

I was once talking to someone who worked for the county government in Douglas County WA. A similar rural and empty place. They said that big tech companies were moving in because there was cheap land and cheap electricity for their data centers. I suspect a similar effect is at work here and AXR is sitting on a real estate gold mine that probably was worth a lot more than it was ten years ago.

Okay here are some charts:

The negative correlation that I like:

AXR vs S&P 500 10 years:

AXR vs S&P 500 5 years:

AXR vs S&P 500 3 years:

AXR vs S&P 500 1 year:

AXR Technical Chart:

The rise has been sharp recently but also has been going on since 2021. Note that 2022 was a horrid year for the entire market.

Revenue:

PE Ratio:

A PE of 20 isn’t bad for a dominate position in a very hot real estate market.

EV to EBIT:

Debt To Equity:

Yeah, they basically don’t have debt. $123 Million in total assets which are very likely undervalued and on $4.5 Million in Total Liabilities.

Operating Cash flow and Free Cash Flow:

Now ain’t that beautiful?

But what are they doing with all that cash?

Well none of the charts or spreadsheets on Ycharts give me a good answer, so back to the 10-K:

Page 18 - Balance Sheet:

Cash has increased by about $10 Million since last year a 52% increase.

Page 19 - Income Statement:

If you have never read financial statements before this is perhaps the easiest place to start. There is nothing fancy here.

Page 22 - Statement of Cash Flows:

This is what I was looking for. So where is all that free cash flow going? Also, they are listing cash in Thousands not Millions. I mean isn’t that just adorable? I love a good Microcap.

The answer is no where. The cash is going no where. It is simply sitting on their books waiting to be given back to shareholders. As of their most recent quarter they are sitting on $40 Million in cash. If that was paid out to shareholders it would jump the share price by 20.7%.

One final point about as to why the I think the value of the real estate on their books is undervalued.

This is the rate at which the value of their assets have increased in the last five years:

There also haven’t been any major purchases during this time.

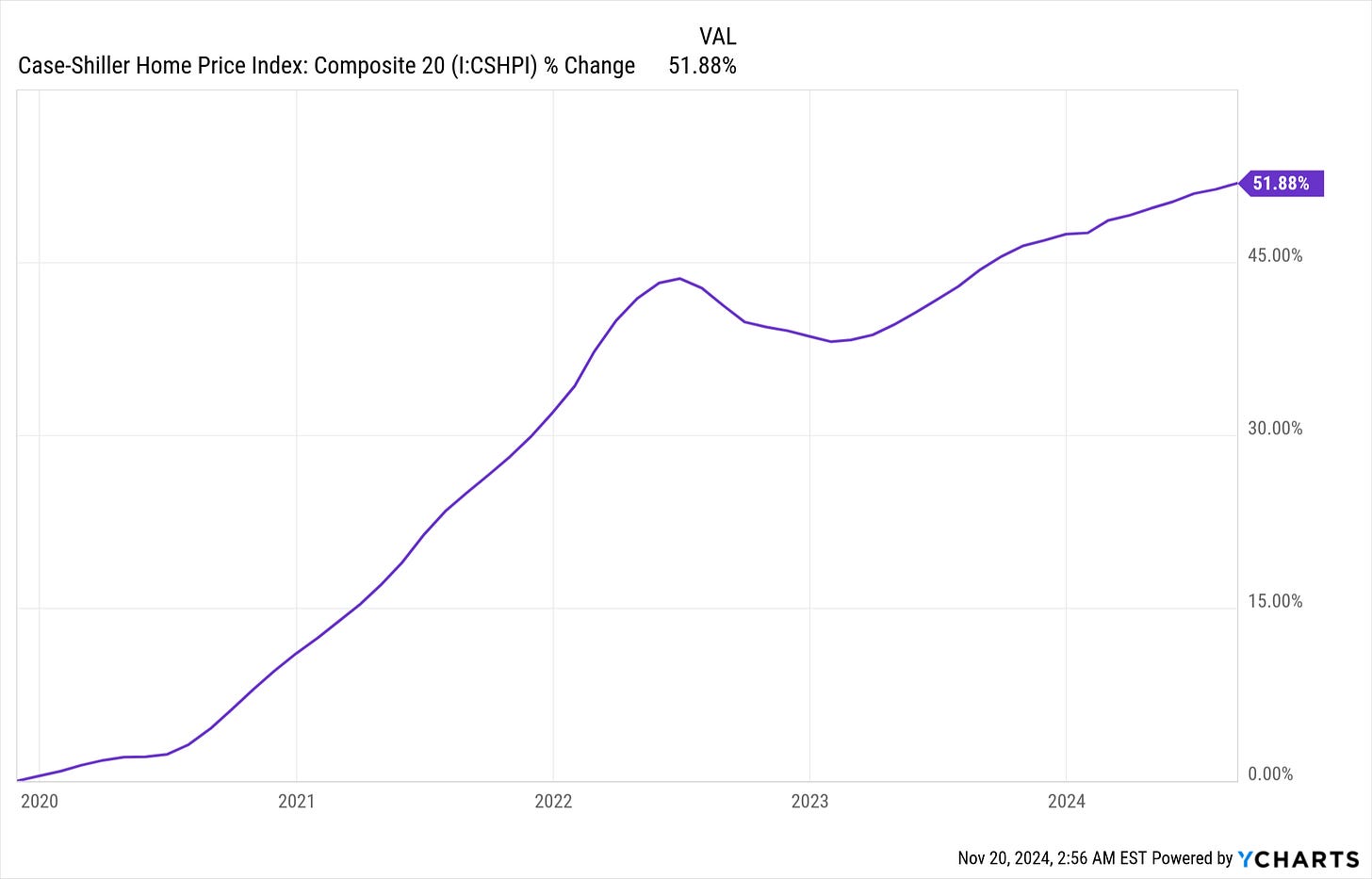

Here is the rate at which the value of real estate in the United States has increased:

Zillow shows a rise of 59.7% of the price of a home in Albuquerque, NE over the last five years which is in line with the national average.

https://www.zillow.com/home-values/23429/albuquerque-nm/

It seems probable that the market value of AXR’s assets are higher then what they list on their balance sheet and will grow further in the future.

This is certainly an investment that isn’t for the faint of heart. If something doesn’t go according to plan in the one very specific real estate market. Well, there goes your money. Bye-bye. If you want a safe investment read what I wrote on McDonald’s.

One final thought…

Growth in Rio Rancho, NE:

https://www.koat.com/article/rio-rancho-new-mexico-growing-city/46891233

If you plug Rio Rancho, NE into Google Maps with the Satellite view on it will outline the city for you and there is quite a staggering amount that is still waiting for development.

Anyway, this is what I am doing tomorrow when the market opens. Between AXR and ITB I’ll have a fair amount of money banking on the United States housing market. Again, this is a risky investment but one that I am very interested in and I don’t think the ship has sailed on it yet. But with how quickly the market is moving I think the future growth is getting priced in as we speak.

I wrote this very quickly, I apologize for the lower than usual quality and any typos I missed. ADP is up next though.

My Portfolio:

FI, ADP, MCD, AFL, VLO, AXR, ITB, PPA

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.