I recently increased the size of my stake in Aflac. I noticed that, as the market has been melting down, Aflac has been going up.

Aflac vs. S&P 500 over the last three months:

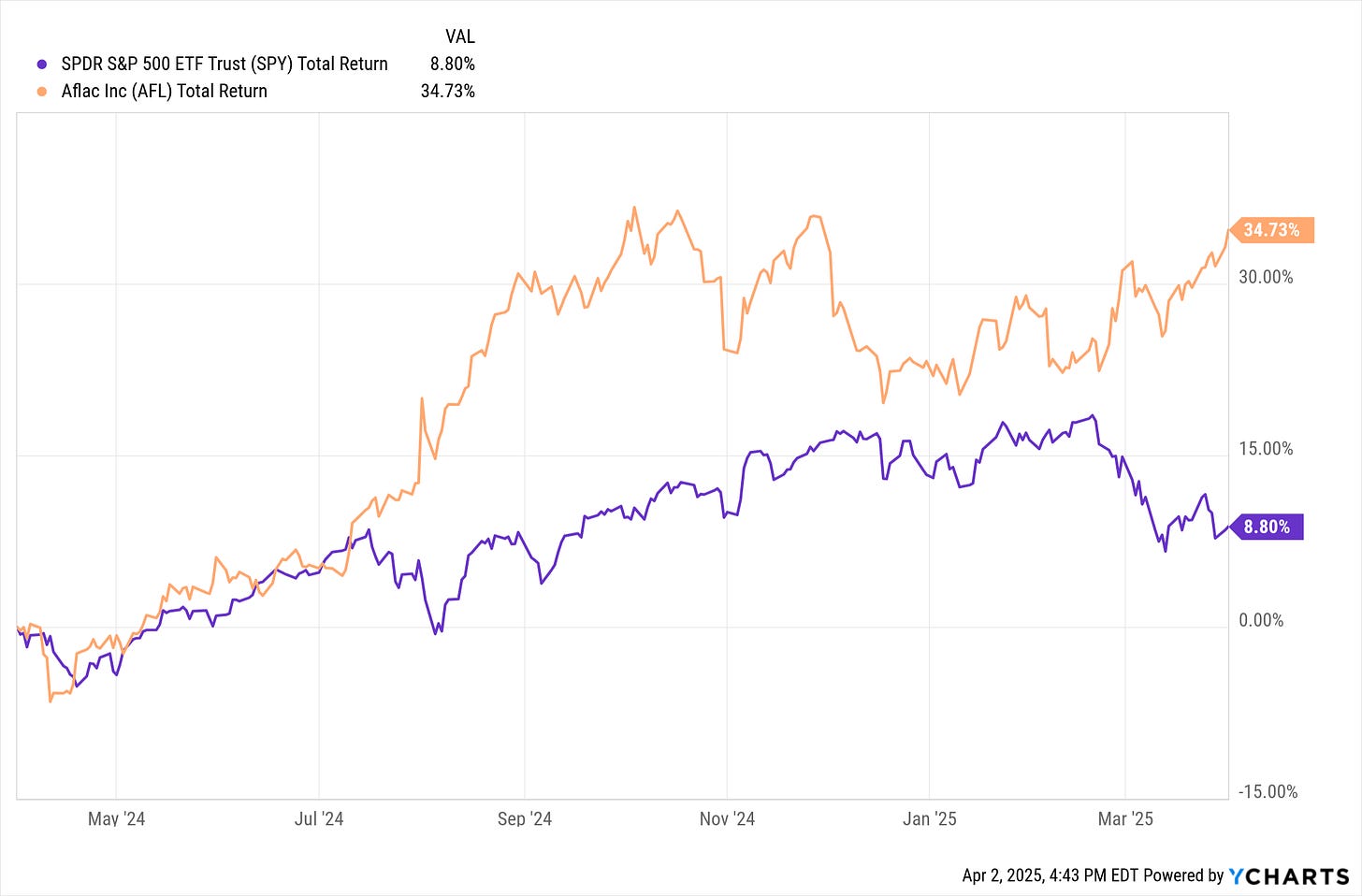

Aflac vs. S&P 500 over the last year:

I’ll link to my write-up on Aflac that I did earlier. The main points are:

Aflac derives about 70% of its revenue from Japan. You’ll notice that, between Aflac and MITSY, I have a fair amount of exposure to Japan.

Aflac has a long, consistent track record of share buybacks. Given Aflac’s low P/E, these buybacks are very effective.

The decrease in Aflac’s cash from operations and free cash flow isn’t concerning to me, since it has nothing to do with Aflac’s business operations and everything to do with the exchange rate between the Yen and the Dollar. If the Yen strengthens against the Dollar, this investment will become even better.

Shares Outstanding since about 1984:

There is a long track record here of Aflac returning value to shareholders in the form of buybacks, which is music to my ears.

This paints a pretty clear picture of how Aflac’s revenue tracks with the Yen-to-Dollar exchange rate. Also, if you compare this chart to the one above, you’ll notice that the drop in the Yen hasn’t impacted Aflac’s commitment to buying back stock.

In fact, buybacks have increased while the Yen was getting weaker. Aflac also issues a dividend on top of this, with a current yield of about 2%.

Now, you will see me criticize other companies for paying out too much money to shareholders, since that can often be a sign of neglect by management—where they are treating the business like an ATM machine and not a company. However, as of December 2024, Aflac was sitting on $6.2 billion in cash, and on their income statement, Aflac only lists $200 million in annual operating expenses.

Insurance isn’t exactly an asset-heavy, capital-intensive business like copper mining is, which is why, in this case, seeing all of this money coming back to shareholders is good in my eyes. Aflac is returning a lot of value without compromising its business. Although, some of the cash they are holding has to be kept as their float.

Trump just announced his tariffs, and it's looking like tomorrow is going to be a bloodbath. NASDAQ futures are down 3.65% right now. Even worse, in my experience, the futures market tends to be a bit more optimistic compared to what actually happens during the next trading session.

Today I increased my stake in Aflac. I find very little to complain about with Aflac, and thus far, it has done well during the current stock market crash. I noticed that my original post reviewed Aflac’s 2023 10-K, so I’ll need to post an update soon reviewing Aflac’s 2024 10-K.

Happy hunting.

My Portfolio:

MCD, MITSY, AFL, META, JPM, MGM

METC $17 Call 6/20/2025

FedEx Bond CUSIP: 313309AP1

12.2% of my portfolio is cash right now.

*Disclaimer*

You can and will lose money in the stock market. You can lose all of your money. I can and will be wrong. I have been wrong in the past. I have lost money in the past. Investing in stocks is risky and should never be considered safe. Invest at your own risk.